Australian dollar making case for a reversal

The Australian dollar is a currency that can be influenced by several external factors. It not the least of which of course is China, which has recently released relatively anemic (by Chinese standards) economic numbers, but better than anticipated. Beyond that, gold has its influence on the Australian dollar, and of course the other half of the equation revolves around the US dollar which has its own fundamentals.

In this environment, the Australian dollar typically ends up being a “risk barometer” of the global markets. The idea of course is that if global growth continues, then the hard commodities in Australia will be in demand. This should drive up demand for the Australian dollar, and therefore send this pair higher. Obviously, the exact opposite can be true as well.

Potential break out

AUD/USD

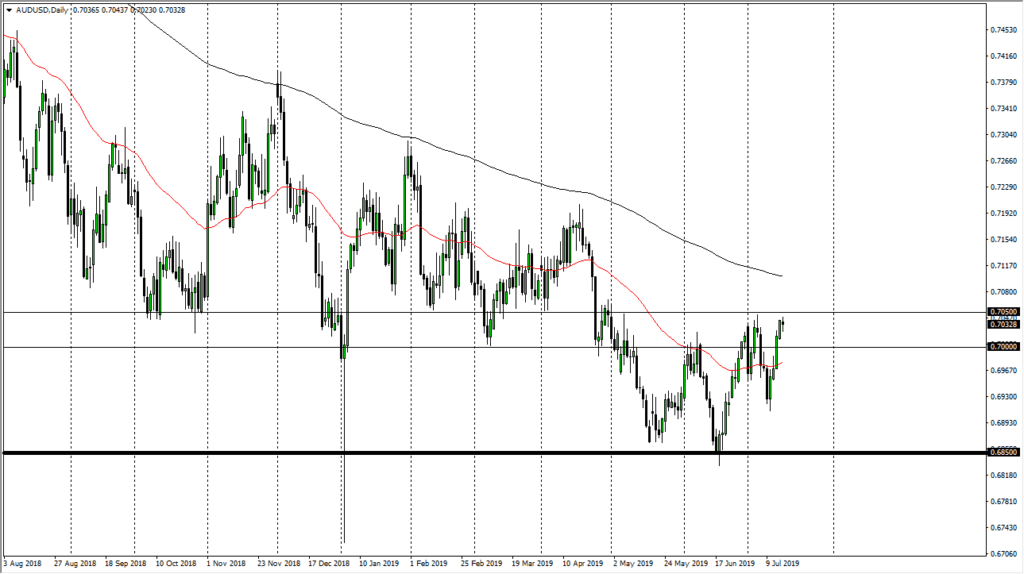

The market looks as if it is setting up for a potential break out right now. I would direct your attention to a couple of weeks ago at the 0.7050 level where we had formed a shooting star. That shooting star represents a significant amount of resistance at an area that also represents a horizontal resistance barrier. If we can break above there, that would of course be a change in attitude and a “higher high.” We arty have a “lower low”, so that could be the beginning of something rather special. All things being equal though, it’s not until we get a daily close above that level that you can start to assert some type of confidence.

US/China

Obviously, one of the biggest factors is going to be the US/China trade talks, which seem to be dragging on forever. There are signs of consolatory tones as of late, so that could help this market rally a bit. That being said, we also have headlined danger when it comes to the US/China trade talks, so keep that in mind as well. Nonetheless, we are at historically cheap levels so it would make sense to see this market find buyers based upon valuation alone.

Federal Reserve

The Federal Reserve is going to be cutting interest rates in July. The question isn’t so much whether or not they will do it, but whether or not they will hint at further rate cuts. If they release very dovish statement, it’s more than likely going to send this pair higher, as when the Federal Reserve starts cutting rates, the US dollar gets hammered. That should send commodities higher, and of course the Australian dollar right along with it. However, if the Federal Reserve sounds like they are “one and done”, we could see the market role right back over.

The trade going forward

The trade going forward of course is waiting for the breakout. If we get a daily close above the 0.7050 level, it’s very likely that this market will then start to accelerate to the upside. The 0.72 level would be one of the initial target, followed by the 0.7250 level. If and when we break above that level, the trend change will not only be confirmed, but be obvious.