British pound continues to face headwinds

As you know, the Brexit has captured most of the headlines around the world when it comes to the Forex markets. This has put an inordinate amount of pressure on the British pound in both directions, slicing back and forth on innuendo and random bits and pieces on twitter. Recently, we have seen a pop in the British pound Ben and as soon as we ran into technical difficulties, it’s true colors start to show again.

The cause

As the Labour Party suggested that could back a second referendum under the right circumstances, the British pound got a bit of a boost earlier in the week. However, that is highly unlikely considering the social chaos it could cause. Quite frankly, overturning an election isn’t exactly a recipe for stability. If it were to happen, it could initially because the British pound to go much higher, followed by a significant break down. After all, if they are going to overturn elections, that will undermine a lot of confidence when it comes to the rule of law.

That being said, be on the lookout for headlines involving the Brexit and any escapist plans. After all, there is a significant amount of financial fear when it comes to leaving the European Union, which is somewhat ironic considering how poorly the European Union is doing currently. However, the fear is out there so be aware of it.

Technical barriers

GBP/USD chart

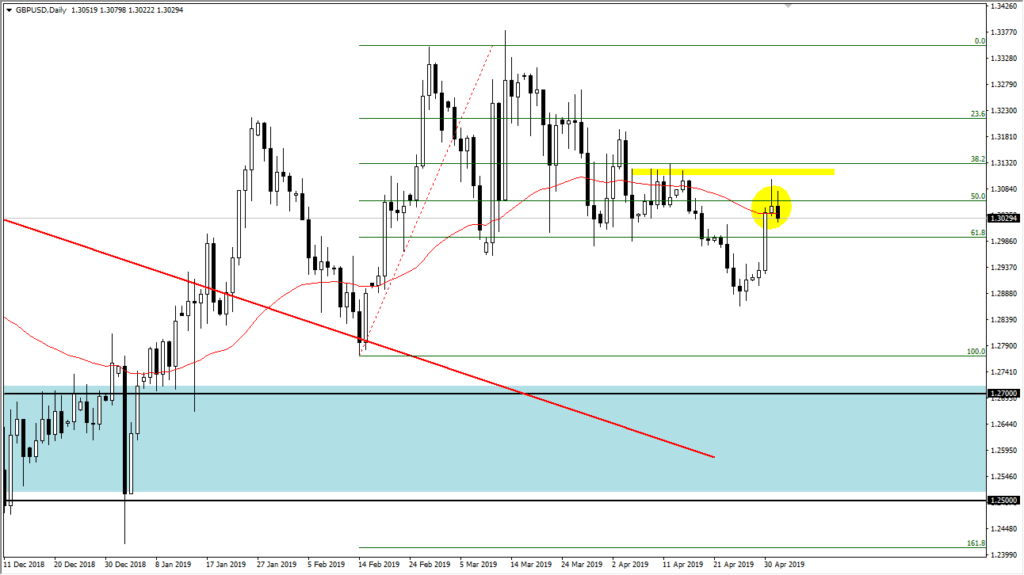

When you look at technical analysis, you must look at the technicals. There is a significant amount of resistance built in right here because of the shooting star on Wednesday, and of course the 50 day EMA slicing through the candle stick. Is very likely that we will continue to drift lower from here into the arms of the greenback, because of not only what’s going on with the Brexit, which of course is anybody’s guess at this point, but the fact that the Federal Reserve didn’t exactly sound dovish during its Wednesday press conference. In fact, that’s where most of the losses came from, after that statement and conference. Above current trading there is significant resistance to be seen at the yellow rectangle which coincides with the 1.31 range.

To the downside, it looks very likely that we would test the 1.29 level, an area that has been significant in the past. It’s a large round number, so course that will attract a lot of attention as well. After that, it’s very likely that we go looking for the 100% Fibonacci retracement level which is closer to the 1.28 handle.

The main take away

The main take away is that we’ve had a nice rally in a currency that has a lot of headwinds. These should be thought of as value areas for the US dollar which of course is favored. Beyond that, if the Federal Reserve isn’t going to cut rates anytime soon, it makes it a bit of an outlier when it comes to central banks. With that, I expect this pair to fall but I’m not necessarily looking for a meltdown, rather more of a grind.