British pound looking for trouble above

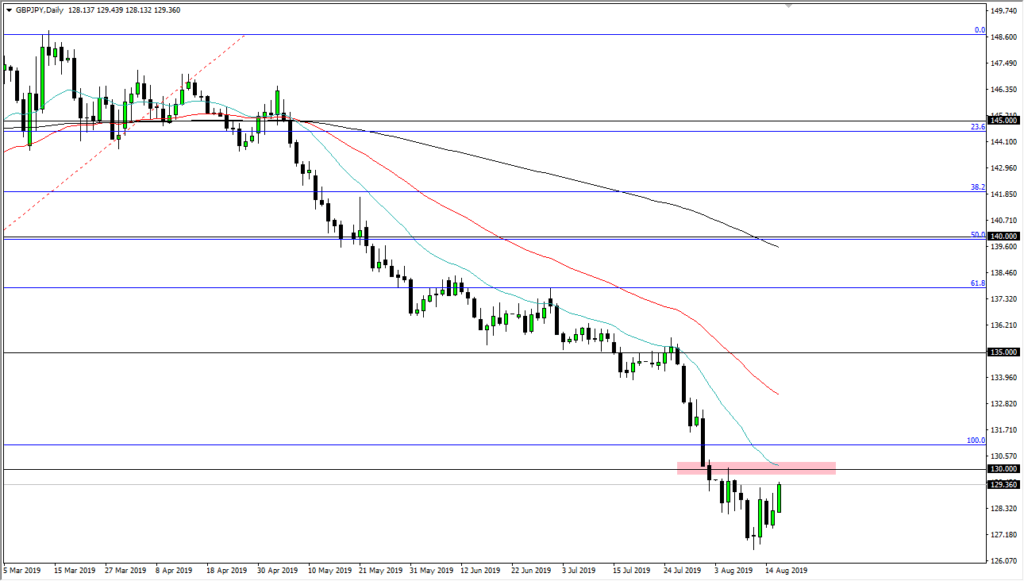

The British pound has been rallying during early hours on Friday. It looks though as if it’s heading towards a significant resistance against a multitude of currencies. Here, I will be paying attention to the British pound against the Japanese yen. We are currently trading just below the ¥130 level. This is an area that I do believe will continue to cause a lot of issues when it comes to this market as I have marked on the chart.

Resistance barrier

The resistance barrier is, of course, the ¥130 level as it is a large, round, psychologically significant figure. Beyond that, we have seen a bit of resistance there previously and although this has been a nice little bounce, the reality is that we should continue to favor the downside for the British pound even though we are a bit overextended to the downside. After all, we have a lot of concerns when it comes to the Brexit, which of course hasn’t gotten any better. There’s been a nice rally on Friday, which quite frankly should be a nice opportunity to start shorting this market relatively soon again.

Confluence of troubles

The Japanese yen is a “safety currency.” While we are getting more of a “risk on” move in the markets overall on Friday, it makes sense that the Japanese yen has been sold. After all, we are a bit oversold when it comes to the stock markets, as well as other risk parameters. That being said though, it’s very unlikely that rallies will last for the long term as there is still a dearth of negativity and negative factors out there. It’s very possible that what we are seeing on Friday is going to be a bit of a short-covering rally with risk appetite based financial instruments.

All that being said, the ¥130 level is a large, round, psychologically significant number that of course will attract flow into the market. Beyond that, we also have the 20 day EMA reaching in that area as well, and it will attract a certain amount of attention. At the first signs of exhaustion, I anticipate that a lot of traders will jump into this market at that level as well.

How I will be trading this pair

I will be trading this market to the downside, and simply waiting for signs of exhaustion on short-term charts to start selling again. At this point, the Brexit hasn’t changed and hasn’t gotten any better so I don’t think that the British pound will hold gains for a significant amount of time. As a more or less tertiary indicator, I will be paying attention to the stock markets as well, as they are an excellent barometer on risk appetite. With that, I’m a seller but I am patiently waiting to take advantage of long wicks to the upside and then look to other markets to start selling again as we are most certainly in a downtrend, and I do believe that eventually, we will go looking towards the lows again.