British pound trying to form a base against the Japanese yen

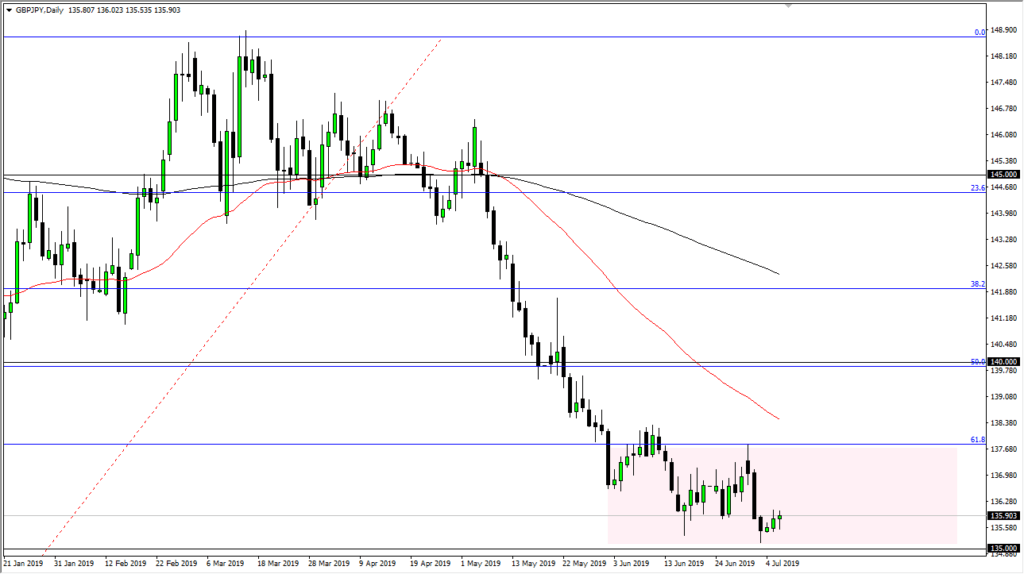

The British pound initially fell during the trading session on Monday, turning around to show signs of support again. We ended up forming a bit of a hammer early in the day and that of course is a good sign. The ¥135 level underneath is going to continue to show signs of support so it’s likely that we could get a bit of a bounce from here.

Looking at the chart, it’s easy to see from the light pink rectangle that I have drawn that we are in an area that could cause a bit of consolidation. It makes sense, because the ¥135 level is a large, round, psychologically significant figure. Beyond that, the ¥138 level above should be resistance. Ultimately, this is a market that is driven quite often by risk sentiment more than anything else, so keep in mind that the other parts of the global markets can have a great influence here.

Hammer

GBP/JPY

The hammer that formed from a couple of days ago and seems to be forming during the trading session on Monday is assigned that there are plenty of buyers, but there’s also the possibility that we turn around and break through the ¥135 level. By breaking through hammers, that shows an exhaustive market and one that will more than likely break down pretty significantly. At that point I would anticipate that we could go to the ¥132.50 level, and with a quickness. It would probably accompany some type of ugliness when it comes to risk appetite around the world, so keep that in mind.

However, all things being equal…

That being said, if all things are equal we should see the bounce. That bounce offers an opportunity for us to go back and forth and perhaps take advantage of a short-term countertrend rally. If we were to break above the 50 day EMA, which is drawn in red on the chart, then I think the longer-term move probably signals of this market goes to the ¥140 level. A break above there then unleashes the market to the upside. At this point, that could be a longer-term move, but at this point it’s going to be a lot of little back and forth.

The play going forward

The market going forward looks to be choppy, and I do think that fading short-term rallies may work. In fact, it’s probably the safer play but keep an eye on the S&P 500 and other indices around the world as to where we may go here. This marketplace will be very sensitive to all of that, plus the Brexit nonsense that seems to be never ending. I feel that it’s much easier to short this market than by it, but we need to see some type of exhaustive candle above the do so. In the short term you can probably take advantage of a small pop, but I would bail out of any long positions at the first sign of trouble, as the market has been beaten down with good reason.