Canadian dollar gets hammered as oil falls

The Canadian dollar got absolutely pummeled during the trading session against the greenback as crude oil markets got hit hard. At the time of writing, the West Texas Intermediate market is down almost 5%, and it looks as if markets are pricing in a severe lack of demand for the commodity. This makes quite a bit of sense, because just 24 hours previously the market had gotten way ahead of itself with the idea of the Americans pulling back on some of the impending tariffs on the Chinese.

Global economics

The global economic situation of course is very soft at this point therefore it makes sense that the crude oil markets could get hammered. At this point, it’s very likely that the market will continue to price in lower crude oil markets, and as a result it should weigh upon the Canadian dollar as it is a proxy for currency traders to express their opinion on oil. At this point, with global markets slowing down and the economy struggling, it’s likely that the lack of demand should continue to be a major issue for crude. This hurts Canadian exports drastically, and therefore it makes sense that we continue to rally.

Looking at the bond markets, you can see that the yields are starting to invert in the United States which suggests that we are going to head into recession relatively soon, so that of course will cause a significant amount of trouble. Ultimately, this is a US dollar is getting a bit of a bid due to strengthening treasuries. If that’s going to be the case, then it makes sense that the US dollar also will be a beneficiary against most commodity and “risky currencies.”

Technical analysis

USD/CAD

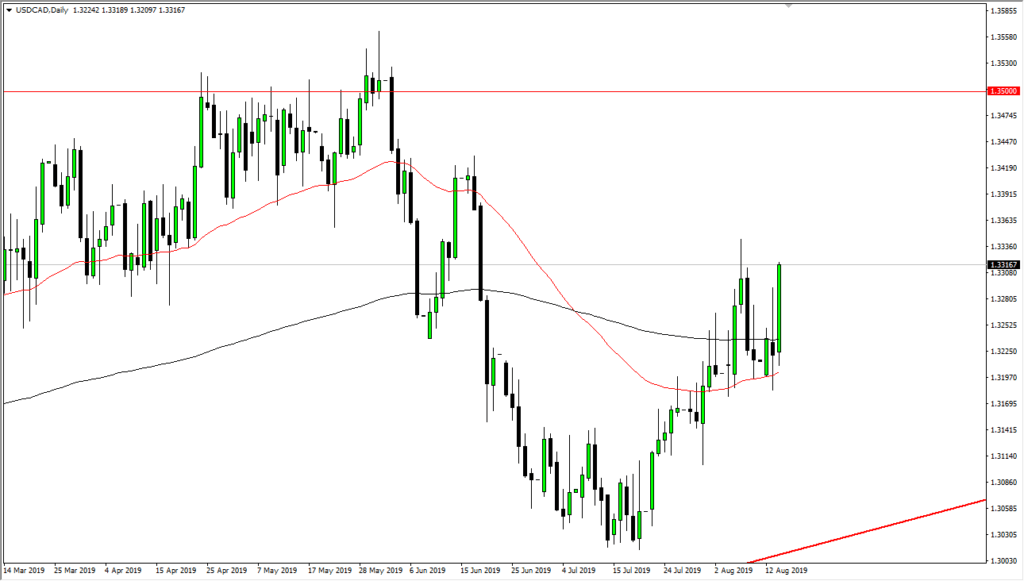

The technical analysis for this pair is relatively straightforward, as we have broken above the top of a couple of shooting stars which means a lot of short-sellers are trapped in this market. At this point, they will have to start buying the US dollar to cover their short positions. Beyond that, we also have the 50 day EMA tilting higher and getting ready to cross above the 200 day EMA which we are well above as well. This is essentially a “golden cross”, which is a major technical signal for longer-term traders. Ultimately, it looks as if we are going to make a play for the 1.35 handle to the upside, which of course is a large, round, psychologically significant figure.

The trade going forward

The trade going forward of course is to buy short-term dips in this market as it looks so strong. As crude oil has broken down and of course treasury markets continue to get a bit of a bid, this is a bit of a “perfect storm” to send this market higher. We had recently bounced from a major uptrend line, so it makes sense that we continue to see this type of momentum built up, so look for short-term pullbacks to take advantage of the overall trend.