Canadian dollar is struggling against Japanese yen

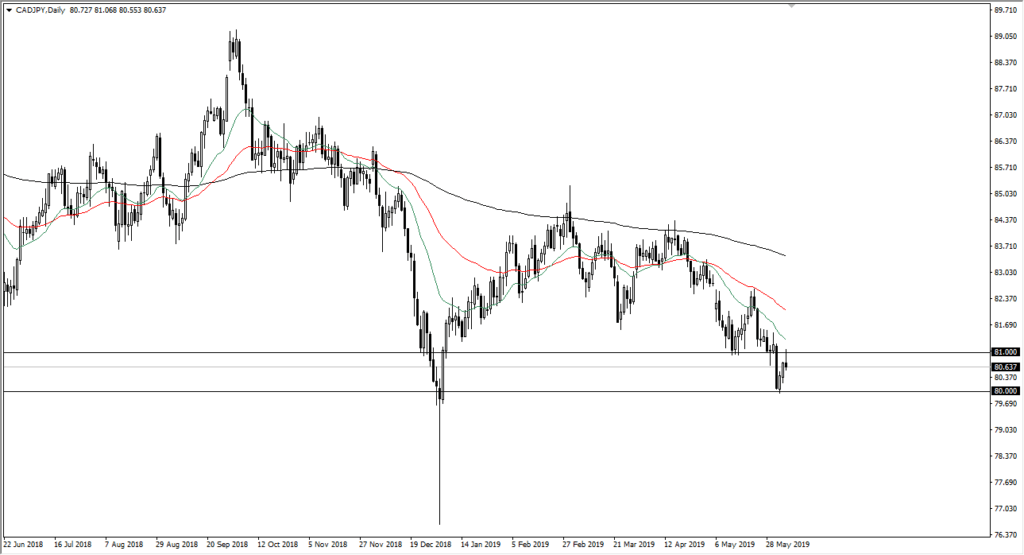

The Canadian dollar initially tried to rally against the Japanese yen on Wednesday, which of course is a bit of a “risk on” move. We reached the ¥81 level, which of course is an area that previously had been support as you can see on the daily chart. At that point, the market had something of a decision to make, and as the Americans came on board it may have become a little bit more obvious.

Failure of momentum

CAD/JPY Chart

The market trying to break above the ¥81 level but failed to continue the upward momentum. Because of this, it looks as if the previous support has acted as major resistance. The fact that we turned around the way we did suggest that the Canadian dollar is going to continue to drop. Underneath, the ¥80 level underneath is massive support and of course a major round figure that traders will pay attention to. With this failure of momentum, it’s very likely that the relief rally may be over.

Looking at the moving averages, they are all turning lower, as I have the 20, 50, and the 200 daily EMA marked on the chart. Ultimately, it looks as if this lack of momentum is probably going to have us testing 80 and yet again. A breakdown below that level of course would be a continuation of the bearish pressure that we had seen.

Crude oil

What most people won’t tell you is that the attitude of the USD/CAD pair isn’t driven by crude oil the way it once was. However, when comparing the Canadian dollar against Japanese yen, it’s a completely different scenario. This is because while the Americans are now the world’s largest producer of crude oil, it skews the attitude of the USD/CAD pair. However, Japan imports 100% of its crude oil, while Canada exports massive amounts. This is essentially a play on crude oil in general. Beyond that, it’s also a risk barometer and therefore it’s likely that we can continue to go lower as long as crude oil continues to look soft and of course we have concerns about global growth, which weighs upon demand for crude oil as well.

The main take away

The main take away with this market is that we have had a little bit of a relief rally, but the breakdown bar that happened from Friday was tested, and it held the negative pressure. Ultimately, this is a market that will probably continue to see negative pressure, and a break down below the ¥80 level opens up the possibility of a move all the way down to the ¥77 level. With this, I believe that the pair continues to see plenty of selling pressure, and there’s no reason to think that anything is going to change in the short term, at least not until we get good economic news or figures. Until we get a reason to be excited about life in this market, I suspect that we are going to continue to rollover.