EUR/JPY at a major crossroads

The EUR/JPY pair rallied a bit during the trading session on Wednesday again, as we continue to see more of a “risk on” attitude around the world. Typically, this pair will move right along with risk appetite, which has been rising as of late. Ironically, it more than likely has very little to do with either Europe or Japan.

Federal Reserve, world’s central bank

The main reason risk appetite seems to be climbing can be summed up in two points: the first is the US/China trade talks seem as if they are moving along a bit to a conciliatory tone, but at the end of the day it’s almost impossible to imagine a scenario where some of the structural problems will suddenly disappear. After all, one of the mainstays of the Chinese technical revolution has been the theft of intellectual property, one of the main issues that the Americans bring to the table. Simply put, the Chinese have not been playing by the rest of the world’s rules, and President Trump seems more than willing to call them out on it. With that in mind, the upward momentum from the trade talks is probably somewhat limited.

The second point, and more than likely the most important one, is that the Federal Reserve is stepping away from its hawkish stance. It may be a bit counter intuitive to think of the EUR/JPY pair because of that, but keep in mind that the Federal Reserve will raise and lower interest rates, and that they will have a far-reaching effect into a lot of emerging economies. Where do investors look for growth? That’s right, emerging markets. If the emerging markets are starting to do well, then the Japanese yen typically get sold off.

Don’t forget the EUR/USD

Again, this is probably a bit counter intuitive for some people but keep in mind that the true measurement of a currency strength is how it is performing against the world’s reserve currency, the US dollar. Currently, the Euro is at the bottom of a major consolidation area, so a bounce is very likely. That should put upward pressure on the Euro against many other currencies. This is one that you can put in the positive column for the market.

And then there is the USD/JPY pair…

The USD/JPY pair is the biggest measurement of Japanese yen strength. It is currently consolidating, so while there isn’t necessarily weakness in the Japanese yen, there isn’t necessarily strength either. Because of this, it does put more focus on the EUR/USD pair. Most new traders forget that when they trade a pair like the EUR/JPY pair, it works something like this:

If you are going long EUR/JPY, you are essentially buying EUR/USD, and selling USD/JPY. If you are shorting EUR/JPY, you are essentially selling EUR/USD and buying USD/JPY. It’s a bit confusing, at least at first.

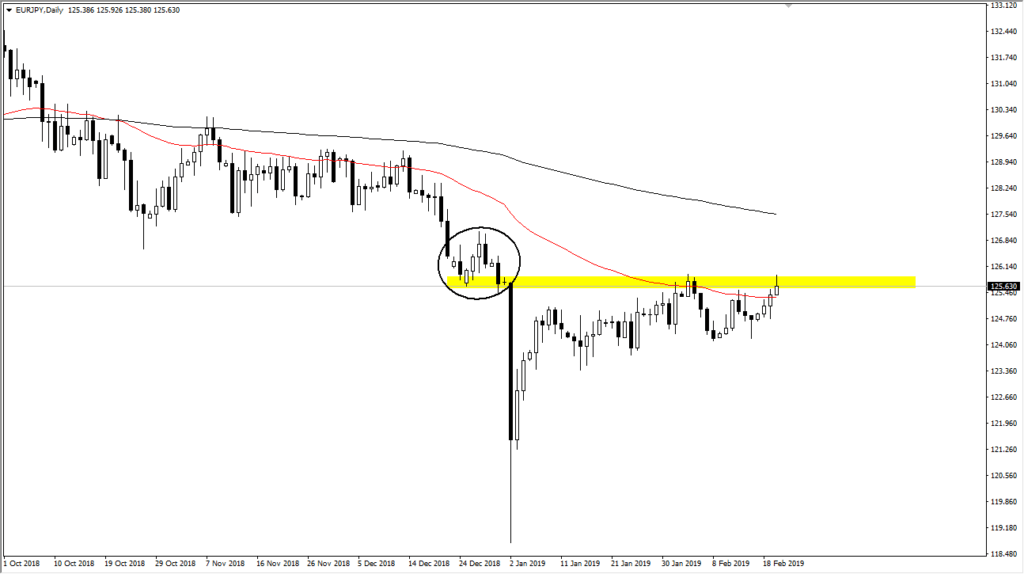

The technical layout

having said all of that, you can see on the chart that I have a couple of moving averages. This is one of the reasons I believe we are at a crossroads. We have broken above the 50 day EMA and are approaching an area that I believe should be somewhat resistive. It was the beginning of the “yen flash crash” that we had seen recently, so therefore there is probably going to be significant order flow in this area. Beyond that, there was a cluster right before this happened, and that cluster should offer resistance as well. This isn’t to say that we can’t break out to the upside, just that you should expect a lot of volatility in this area.

Again, you should keep in mind the other two currency pairs mentioned in this article. In order to get a gauge as to whether or not we can continue to break out in the EUR/JPY pair, you are probably going to need to pay attention to those pair simultaneously. That’s typically the case, but even more so when you are at a major inflection point on the chart like we are now.

While things do look bullish so far, and you could even make an argument for a pseudo-ascending triangle, be advised that there is a lot of noise just above.