EUR/USD marches along

ISM manufacturing PMI miss

During the trading session on Friday, the United States reported 54.2 for the ISM Manufacturing PMI figures, expected to be 55.6 previously. Beyond that, the University of Michigan Consumer Sentiment numbers came out at 93.8, as opposed to the 95.8 expected figures. All of this of course has put some bearish pressure on the US dollar, driving this pair higher.

Fair value

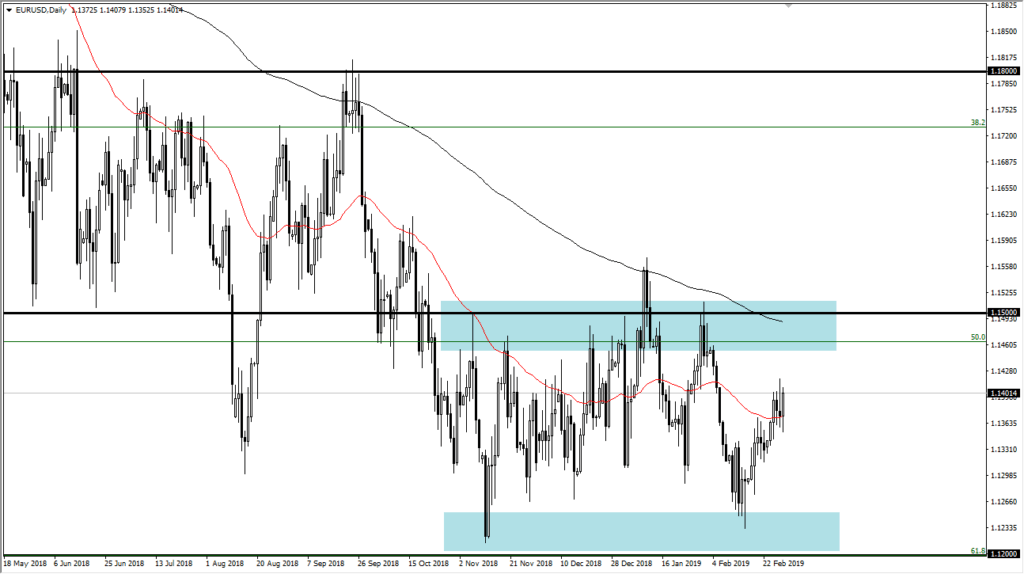

All things being equal, as we dance around in this market between these two major levels, we are essentially at fair value. This is the midway point between two major levels, and therefore you would expect to see somewhat equal pressure in both directions. However, there are some things to take away from the longer-term charts that you should be paying attention to.

While we are at the fair value region, the reality is that we are at extremely low levels after a massive pullback, with the lot of support and buying pressure underneath. It is because of this that I look at fair value is something to pay attention to, but only a minor resistance point. I like the idea of buying pullbacks as they occur. This is simply because we have not completed the move to the top of the range, which also coincides quite nicely with the 200 day moving average which is just below 1.15. I would expect a significant amount of resistance and that area, but we still have a way to go.

Central banks

Central banks around the world have suddenly become quite a bit more dovish, and perhaps the biggest surprise of course has been the Federal Reserve. While the European Union numbers haven’t exactly given much hope to the Euro, is very easy to imagine a scenario where the Euro is perhaps underpriced. With this being the case, most pundits believe that the US dollar will lose a bit of value this year, and I think that what we are looking at right now is a reflection of the attitude shift in the Federal Reserve. We are essentially basing for a bigger move.

Look for value

In a situation like this, you should be looking for value. Simply put, you should buy the Euro when it becomes too cheap, just as you should be buying the US dollar when it does. The great thing about massive consolidations like we see right now is that they are obvious, and there will be plenty of players willing to jump on both sides of the trade at the outer edges. However, someday we will break out of this and make a significant move. When you go into this type of trading environment you assume that it lasts until it doesn’t. You also recognize that someday you will have a losing trade playing these ranges. That’s okay, because once we break out significantly, we know where the next move is and can measure based upon the previous consolidation. It is because of this that I believe someday we will break above the 1.15 level and go looking towards 1.18 level. In the meantime, enjoy the well-defined range.

It should be said though that by the longer-term outlook, it certainly seems as if this market does favor of move to the upside. It would be quite surprising if we break down below the 1.12 level, and would probably be some type of major financial event that has people buying the US dollar worldwide.