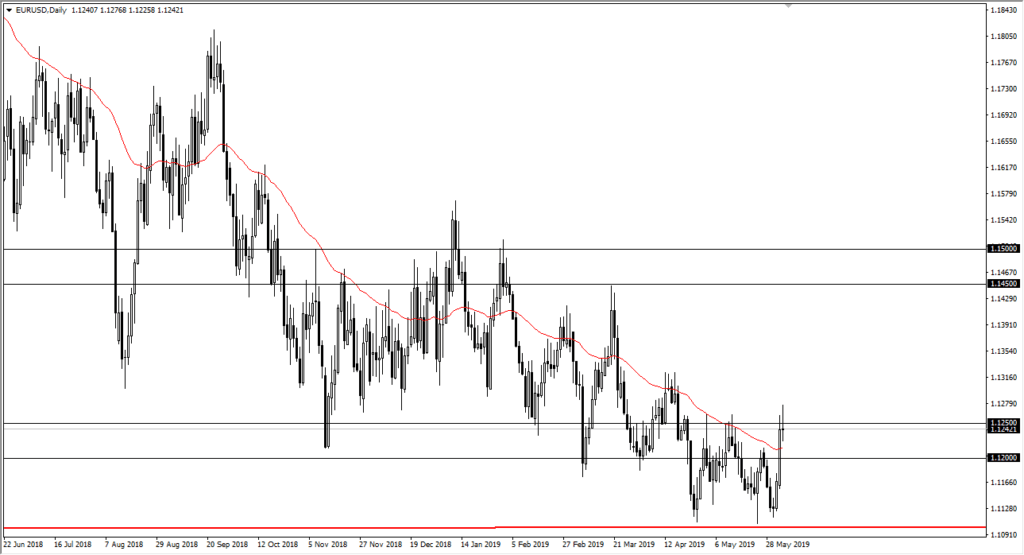

EUR/USD runs into major resistance

The Euro initially shot higher during trading on Tuesday but then ran into quite a bit of selling pressure above. The 1.1250 level has been an area of contention for a while, so it’s not a huge surprise to see that the market has struggled. At this point in time, it looks as if we are trying to form some type of resistor candle, perhaps a shooting star. With that being the case, it’s likely that if we continue to go a little bit lower, the market probably rolls over.

Summertime trading

As we are at the beginning of summer in the northern hemisphere, most traders are worrying more about the beach and less about the currency markets. That being the case though, we do have to worry about all of the noise that we see in the economic conditions that make up the markets are now. We have a lot of concerns about global growth, concerns about Europe, concerns about trade wars, and a whole plethora of different things.

Typically, this is a market that slows down as it is so highly liquid and highly traded, and therefore it tends to go nowhere. The summertime makes this pair miserable, so therefore I don’t think it’s very likely that we break out significantly. However, there are enough headlines out there to make things risky.

The most likely scenario

EUR/USD

The most likely scenario at this point is that we see a lot of noisy trading, and I do believe that we are at the top of the current range. The 1.1250 level probably gets to be a bit expensive, just as the 1.11 level underneath is too cheap. I think we go back and forth for the next couple of months, but longer-term it is probably going to be the beginning of some type of platform for this market to bounce. The Euro has been oversold for some time and it does appear that Europe is trying to get its act together economically.

Beyond that, the treasury market is overbought so we will get the occasional pop in the Euro as the US dollar loses strength. All things being equal it’s likely that we go back and forth in the short term and then eventually find those buyers. I anticipate sometime in September we will get the breakout.

Other scenarios

Other scenarios in this market include some type of meltdown below the 1.11 level, sending this market down to the 1.10 level underneath. That area is even more supportive, and not only from a structural standpoint but obviously a psychological standpoint.

Another possibility, although I think it is a little less likely, is that we finally break above the 1.13 level, and then go looking towards 1.1450 level above which is the beginning of significant resistance. Ultimately though, I think that the market breaking above there is going to take a significant amount of work and would obviously be a major trend change. In the short term, I stick with the most likely scenario.