Euro continues to drift lower against Sterling

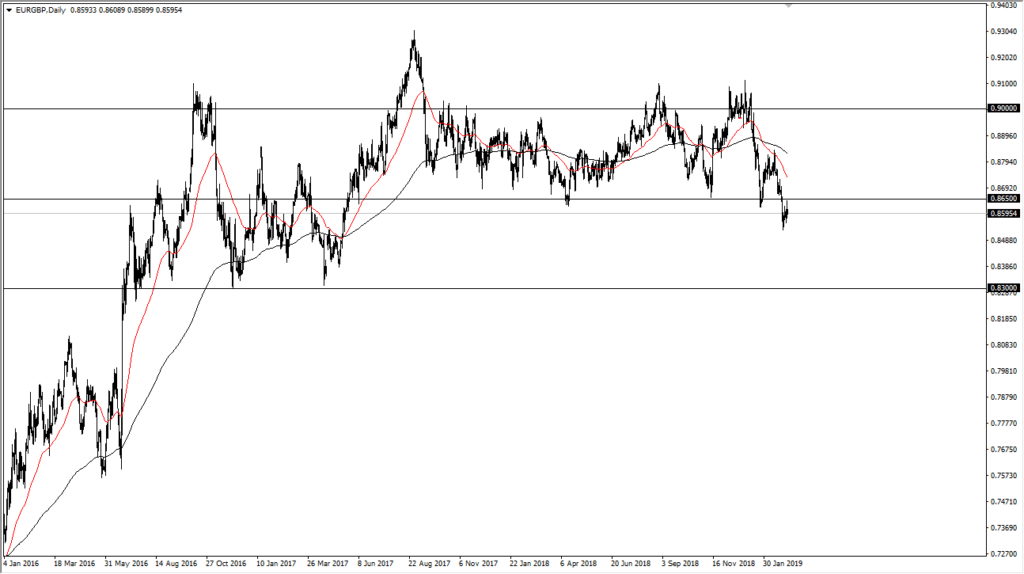

The Euro was trading at 0.8593 GBP early in New York trading on Wednesday. This is the result of a break down from major support at the 0.8650 level, an area that had held for well over year. By doing so, and then bouncing to test that area over the last couple of days, Euro has shown that it is definitely suffering at the hands of the British pound.

All things Brexit

Obviously, the British pound is moving based upon Brexit headlines and of course concerns about whether or not there is going to be a deal, a delay, or somewhere in between. That being said, it does look like the odds of resolution or at least trying to turn in the right way, and as markets are a forward looking mechanism, traders are starting to bet on the British pound.

Since the Brexit boat, the British pound has been at historically cheap levels, so it makes sense that value hunters continue to come in and look to pick up the currency “on the cheap.” This can be measured a little easier against the US dollar, as it has continued to rally quite significantly.

European Union issues

While the death of the United Kingdom has been prematurely announced, across the English Channel we have the European Union which is starting to show serious economic issues. Anytime you have Germany barely escaping a technical recession, the European Union is going to be in trouble. Italy already is in a recession, and quite frankly could be another candidate to leave the European Union under the right circumstances. All things being equal, the European Central Bank is probably going to have to talk down the Euro for a while and suggest that quantitative easing will continue as the economy simply cannot handle higher interest rates.

The technical picture

Recently we have seen the “death cross” in this pair, which is when the 50 day EMA crosses below the 200 day EMA. That’s a technical indicator that perhaps we are getting ready to enter a bearish market. Beyond that, the moving averages are starting to slope lower, and of course we have already broken through that support level. Anytime a support level has been in effect for over year, you should be paying attention. Looking at the chart, it’s easy to see that we could have further to go to the downside.

The 0.83 level looks to be massive support from historical charts, and therefore that should be the target. However, if we were to turn around and break above the 0.87 level, that would negate the entire trade and make it more of a mess than anything else.

You should never forget to pay attention to how these currencies perform against the greenback, because that is the “measuring stick” of strength. The British pound is breaking out to the upside while the Euro is somewhat stagnant. That should tell you everything you need to know about which one of these currencies you should be owning currently. Whether or not we can break down below the 0.83 level is a completely different story, but it certainly looks as if we are going to try to find out sometime in the future.