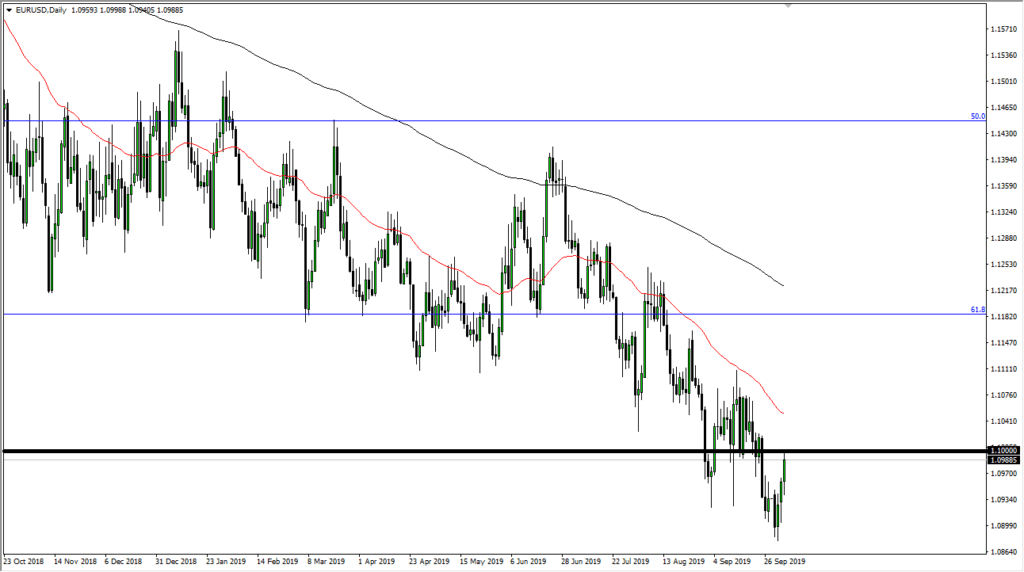

Euro Likely to Continue Downtrend Going Forward

- 10 level looms large

- 50-day EMA drifting lower

- Jobs number to cause volatility

The euro has enjoyed a rally during the trading session on Thursday, as the ISM non-manufacturing numbers in the United States came out much weaker than anticipated. Because of this, the market has seen a lot of movement to the upside, but as the headlines cooled off, so did the euro. The 1.10 level looks to be very resistive, as it is a large, round, psychologically significant figure. That being the case, it will be interesting to see whether the price can sustain any type of advance above that level.

Large, round, psychologically significant figure

EUR/USD chart

The currency markets like these large candles, such as the 1.10 level. Because of this, a lot of order flow is likely to appear. You can see that the most recent breakdown candlestick from this level was rather significant and long. If the market can break above the highs from that session, which is substantively the 1.1020 level, it will clear the way for a break towards the 50-day EMA, where you would expect to see even more resistance. Beyond that, there is a lot of choppiness between here and there, so it makes sense that sellers would step into this marketplace somewhere in between.

Jobs number

the jobs number coming out of the United States will have a massive influence on what happens next with the US dollar, which is half of the equation here. Keep in mind that the US stock market continues to attract inflow as global growth everywhere else is slowing down drastically. Yes, the last couple of figures in the United States have been less than stellar, but they are still better than the rest. In an environment where there are negative yields in multiple places, it makes sense that traders are looking for both bond yields that are positive, and stocks that are in the “safer economy”.

The trade going forward

With the jobs number coming out during the day on Friday, you can be assured that there will be volatility. A close above the 50-day EMA on the daily chart could change a lot in this currency pair. However, with the poor economic fundamentals coming out of the European Union, mostly due to concerns about Brexit, it’s difficult to imagine a scenario where the euro should outperform the greenback as a favored trading vehicle. Because of this, selling near the 1.10 level on signs of weakness is probably going to be the easiest way to trade this market.

To the downside, the 1.0750 level is the scene of a large gap which has yet to be filled. With that in mind, it makes sense that this market will continue to drift to the downside. Europe has far too many issues, and the move would go with the overall trend.