The Euro Showing Signs of Strength Against the British Pound

- 61.8% Fibonacci retracement level is key

- Approaching the 200-day EMA

- Bullish candlestick reaching towards wicks

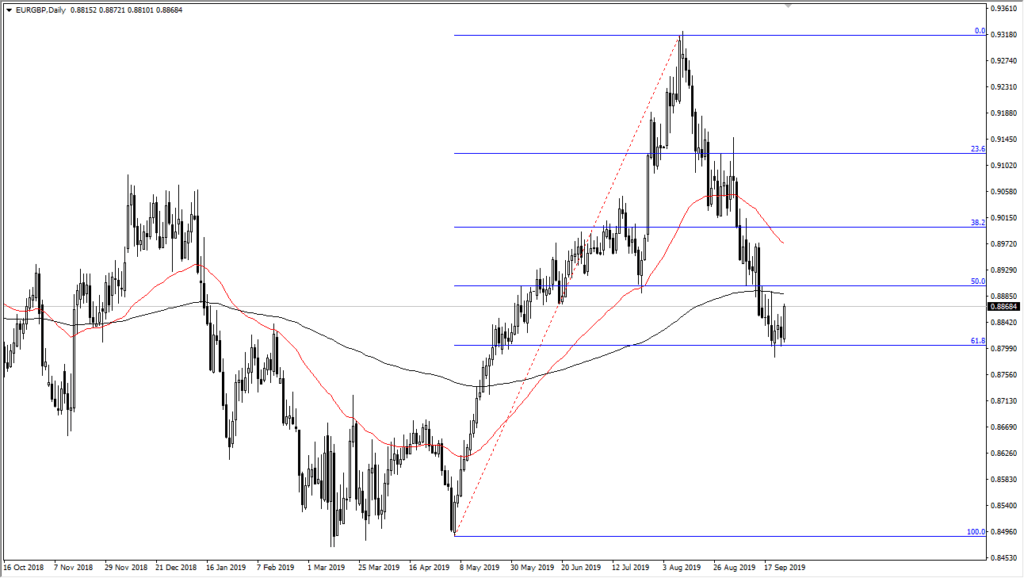

The euro rallied a bit during the trading session on Wednesday, showing a significant amount of bullish euro action. There are several wicks just above from the last several trading days, so it does suggest that perhaps there is a lot of resistance. However, the one thing that does stand out on this chart is the fact that there have been several attempts to break out to the upside, and there was just more of the same during the Wednesday session. In other words, this is a market that has shown an extreme amount of bullish pressure and, more importantly, conviction.

Fibonacci retracement and more

EUR/GBP daily chart

The Fibonacci retracement level of 61.8% is crucial when it comes to longer-term trading. It is known as the “golden mean”, and the market has in fact found a lot of buyers in this area. Beyond that, the 200-day EMA is just above those wicks from the last week or so. At this point, a move above there would be a very bullish turn of events and might bring in quite a bit of order flow.

This makes a bit of sense as the British pound is starting to sell off against just about everything. Plus, even though the euro has been very soft, it appears that more pressure is being applied to the British pound in general. It should be noted that the currency pair features both sides of the Brexit issue, so there is still going to be a lot of headline risk out there.

The trade going forward

The trade going forward is going to be a difficult one. The headlines will continue to cause a lot of issues, and therefore it will be difficult to hang on to any position, regardless of directionality. However, a break above the 200-day EMA and the 0.89 level should lead to a continued grind higher, reaching towards the 0.90 level and followed by a move towards the 0.9150 level.

The alternate scenario is a break down below the Friday candlestick, which could open up the door to a move back down towards the 100% Fibonacci retracement level. This currently sits at the psychologically significant 0.85 handle, which of course would attract a lot of order flow by larger institutions, as these big numbers do.

Regardless of which trade you take, this is a pair that demands a certain amount of caution when it comes to position size. This is because the sudden Twitter posts and headlines on newswires can throw this market in one direction or the other rapidly. It could be an explosive move higher or lower, so at this point it’s very likely that putting a small position with tight stops probably works out best.

This is going to be the “center of the universe” when it comes to Brexit. So, while the risk-to-reward ratio could be all over the place, the move could be explosive and extraordinarily profitable for longer-term traders once there is some type of certainty.