Euro shows resiliency to kick off week

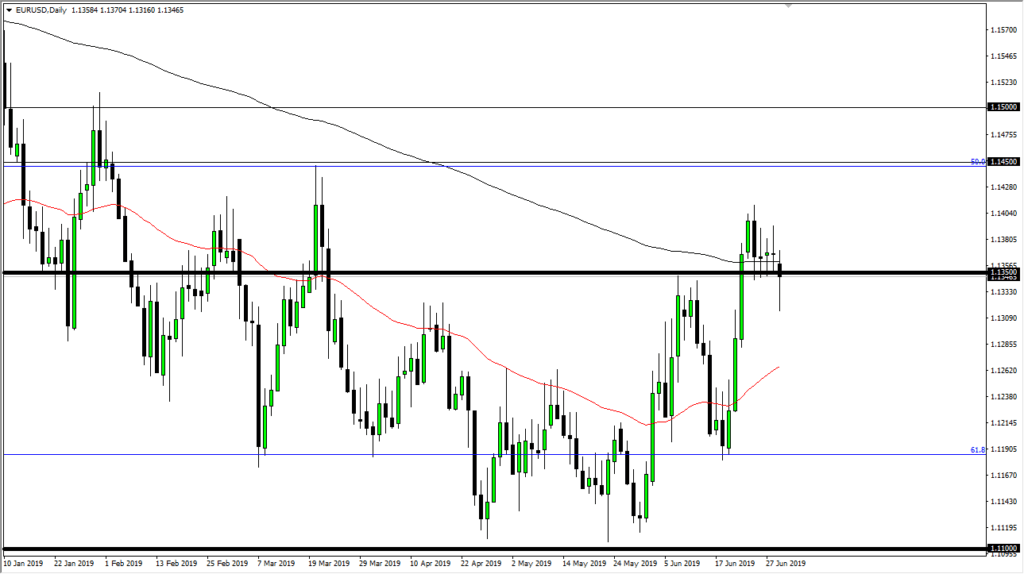

The Euro initially fell during the trading session on Monday to kick off the week but has turned around to show signs of resiliency. We continue to consolidate in the same general area, as it appears the market is trying to build up enough momentum to finally go higher.

200 day moving average

EUR/USD Chart

The 200 day EMA sits just above current pricing, and slices through several of the last few candles. Because of this, I suspect that there are a lot of traders trying to take advantage of a potential trend change. The 200 day moving average quite often will attract a lot of order flow, and that looks as if what’s going on right now. Even though we had broken down a bit early in the session, we are reverting to the mean.

Federal Reserve

The Federal Reserve of course is looking to cut interest rates and that will attract a lot of attention by the currency markets. Because of this I do believe that the US dollar should soften over the longer-term. By extension, the Euro should get a bit of a boost from that as a natural reaction. That being said, it doesn’t mean that it’s going to be an easy ride higher. Ultimately, the US dollar has been overvalued for quite some time, but nothing happens in a straight line. I believe that the Federal Reserve stepping in and looking to cut interest rates will more than likely continue to give this market a bit of a floor underneath.

Buying the dips

At this point, buying the dips seems to be the best way to trade this market. While I’m not a huge believer in the Euro, the reality is that if the US dollar sells off by extension the Euro must rise over the longer-term. I also recognize the 1.1450 level above is significant resistance that extends to the 1.15 level. I do think that we are trying to get there, but it isn’t necessarily going to be easy. That being said you should probably look for value, and other words dips, to short the US dollar. It isn’t necessarily that I love the euro, it’s just that the US dollar will continue to be sold against many currencies around the world.

If we do break down from here, the 50 day EMA, pictured in red on the chart, should be rather significant. That could be where the buyers come back in, creating a “higher low” that signifies that we are perhaps trying to form a longer-term bottom, which of course would also be longer-term bullish. I think this is more of a longer-term trade setting up or perhaps even an investment as opposed to a short-term scalp. With that in mind, many professionals that I speak to have been building up positions over the last several weeks, as you can see denoted by the zigzag pattern to the upside that we have formed. While it may be a quiet summer, it should continue to favor the bulls in general.