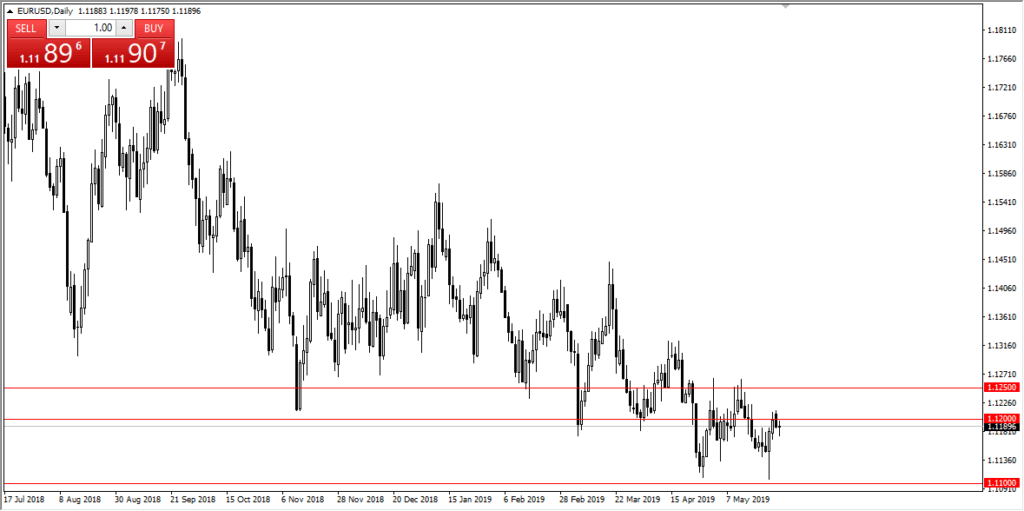

EUR/USD slams into resistance

The Euro rallied significantly during the trading session on Monday, reaching above the 1.1250 level, which of course was a very bullish sign. This was perhaps in reaction to the Chinese adding tariffs against US goods, and perhaps an attempt to get away from the US stock markets as they melted down early and trading. However, as the day starts to play out we are seeing a bit of a change when it comes to the attitude.

Major resistance

EUR/USD

There is significant resistance just above at the 1.1250 level as we have pulled back from there. We are starting to form a bit of a shooting star which of course is a negative sign, and we have the 50 day EMA in the same neighborhood. If this candlestick continues to look just as bearish as it does as I write this article, it’s very likely that we will roll over and go looking towards 1.12 level underneath. That’s an area that is a large, round, psychologically significant figure, so it’s likely there will be some type of reaction to that level but quite frankly it will probably be somewhat muted.

This could be the beginning of the next leg down, as we had recently broken through major support at the 1.12 level, something that was quite surprising for a lot of traders. We are still very much in a downtrend, and unless we can clear the 1.13 level that will not have changed. Yes, it was a bit of a bounce during the day and of course the previous couple of sessions, but when looked at in the aspect of the longer-term, it’s just a blip on the radar.

The US dollar

The biggest problem with this pair is that if you believe the United States is going to be hurt by the trade war, the Euro isn’t necessarily the safest place to put your money to work. After all, a lot of institutional money will go flowing into US bonds, which of course require US dollars. Because of this, it may be a bit counterintuitive to the new trader, but when there is trouble out there, even when it involves United States, it almost always means US dollar strength. There is the initial job like we had seen during the Monday session, but eventually the treasury markets attract enough money that things roll back over.

The main take away

The main take away of course is that we need to pay attention to the longer-term trend. Yes, the last couple of days have been difficult for those who are trying to short the market, but the reality is that nothing has actually changed. We have simply bounced slightly, and definitely slightly in the scheme of the bigger picture. The 1.11 level underneath will more than likely be retested, so the very least I think that’s probably where we go looking.

If we break down below there then the market could go down to the 1.10 level underneath which is even more crucial on longer-term charts.