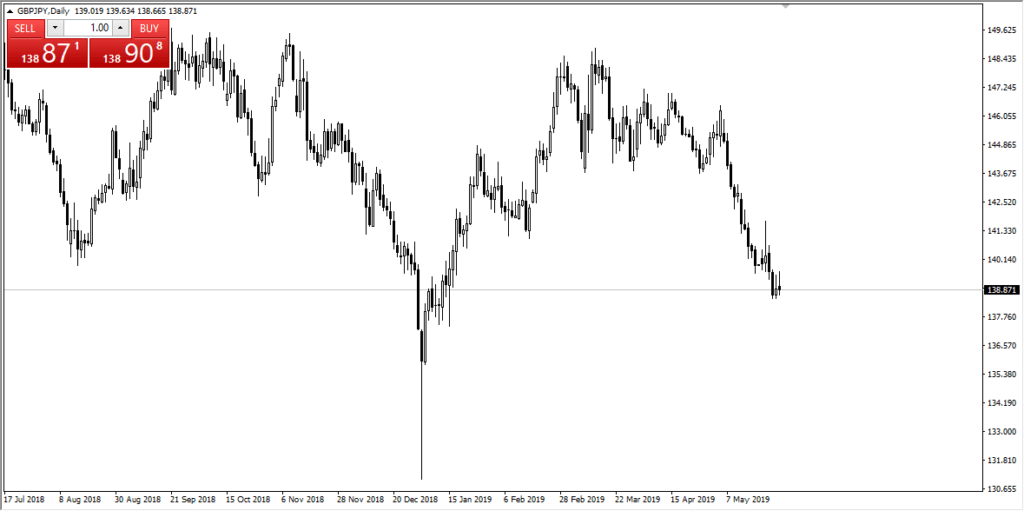

GBP/JPY still looks sickly

After the results of the election and the United Kingdom, it’s not much surprise that the British pound has sold off again. We have seen this against the US dollar, several other currencies, and of course here against the Japanese yen. Keep in mind that this pair is highly sensitive to risk appetite which makes a lot of sense that we would see negativity here as well.

Inverted hammer

Looking at this chart, I could see an inverted hammer forming again for the second day in a row. If that is in fact the way this plans outcome it’s very likely that we will eventually break down. At this point I think that the market breaking below the ¥138 level would be very negative. Ultimately, this is a pair that will move right along with other markets around the world, so we start to see stock markets fall off, that will also present negativity for this market as well.

GBP/JPY

However, if we break above the top of the candlesticks for both of the past two days, that would be a very positive sign includes in this market towards the ¥142.50 level, as it would be break in the top of a couple of resistive candlesticks. Keep in mind that we need some type of “risk on” for that to happen, but anything’s possible with as volatile as the markets have been the last several months.

All things being equal though I do believe that the markets probably going to break down so therefore it’s easier to sell rallies as they happen. Short-term charts can be used for this, or a simple break of the support from the last couple of sessions.

The Dragon

This pair is known as “The Dragon” for good reason, mainly because it’s so volatile. In times of panic, this is a great pair to short because you can find yourself 300 or 400 pips in profit rather quickly. Obviously, it works in both directions so you need to be cautious.

The reality is that marketplaces are very skittish right now so this pair will probably continue to fall on. It’s not until we start see the British pound stabilize against the greenback that I would consider buying this parentless of course would break that resistance I mentioned previously. If that happens, then one would have to think that the GBP/USD pair would also be going higher.

The main take away

Selling short-term rallies continues to work, and at this point I don’t expect that to change anytime soon. However, we must do with the charts tell us so that breakout to the upside would lead to much bigger games I suspect. All things being equal, this is a pair that will probably find itself at ¥135 rather soon, and quite frankly one has to think that we are only one headline away from that happening. As usual with this pair though, you need to keep your position size correct or it will hurt you.