GBP/NZD Facing Headwinds

The British pound rallied again to kick off the trading session on Wednesday, as seen against almost all currencies. However, in this article we will be focusing on how Sterling is ferrying against the New Zealand dollar.

Serious headwinds just above

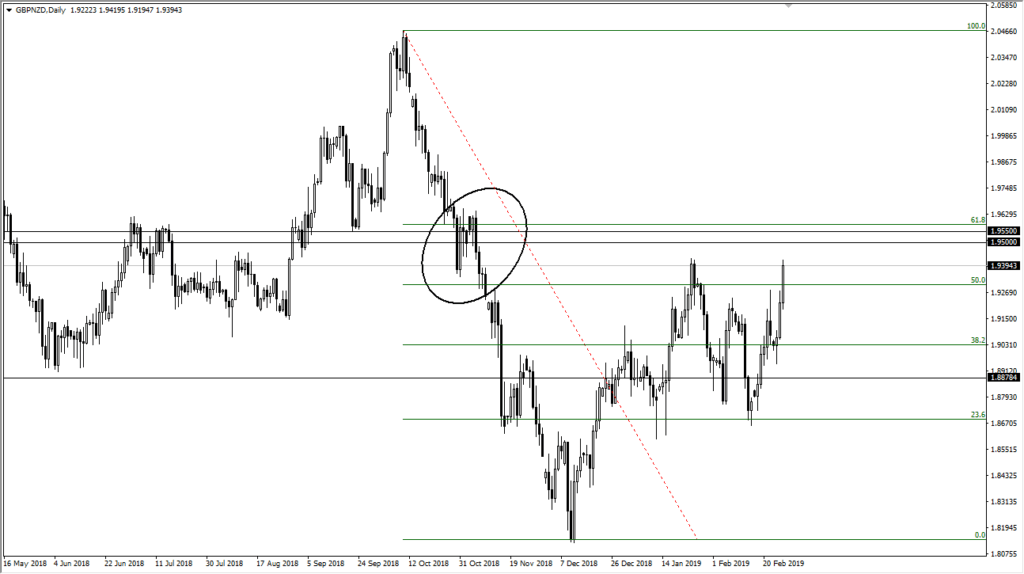

While this has been an impressive candle early during trading on Wednesday, we are starting to get close to significant resistance just above. We have the 1.94 level, which is the beginning of a significant resistance barrier overall. This is because not only do we have the round figure, but we also have a cluster that we have circled on the chart from previous trading. That typically will signify order flow, which of course can mean that there are a lot of sellers there waiting.

Beyond that, we also have the 1.95 level, which of course is an even bigger round figure, and will attract a lot of attention. The 61.8% Fibonacci retracement level is of course right there as well, and that obviously is a major Fibonacci retracement level to pay attention to. That being said, we have also had a very strong rally to the upside over the last couple of weeks. This means that we probably will see the British pound ran into a little bit of trouble.

The pause that refreshes?

At this point, we suspect that this is probably more of a pullback than anything else, and it’s likely that the pullback is a simple sign of exhaustion more than anything else, but not necessarily the beginning of a major short trend. Quite frankly, the British pound of course has a lot of headwinds above based upon noise and Brexit headlines, so it makes sense that some traders might be a bit cautious about going long here. However, this brings up the fact that we are probably going to be looking at a market that sees prices below here as value more than anything else. After all, despite the negative headlines, the United Kingdom will in fact exist after the Brexit.

Remember, one of the best ways to make money is to buy things when they are “cheap.” Recently, the British pound has been sold off so drastically that it is most certainly cheap by historical norms, and if we get some semblance of normalcy in the future, those who can hold onto the British pound for the longer-term will make a killing. In fact, it’s very likely that the larger funds are starting to add on the dips, and it’s also very possible that we may have bottomed longer-term. Quite frankly, unless we get a “no deal Brexit”, it seems very unlikely that the British pound will go below the previous lows that we had seen several months back.

Not willing to sell

Keep in mind that although the Americans and the Chinese are starting to make progress in the trade deal, the reality is that New Zealand is far too highly levered to China to trade on its own. On the other hand, any good news out of the United Kingdom Wilson the Pound much higher. You are essentially looking for an in balance between the future of the United Kingdom and China. Has China become too expensive? There are a lot of things out there starting to suggest this, not the least of which is debt. New Zealand loses its largest customer or at the very least the largest customer starts buying less, guess what happens next? Obviously this is a longer-term argument, but at the end of the day the British pound is undervalued from a longer-term perspective and is far from reaching a normal price. That is closer to 1.50 against the US dollar at the very minimum, so as we are far from there, longer-term we will have British pound prices rising.

There seems to be significant support at the 1.92 level, and most certainly at the 1.90 level on a pullback.