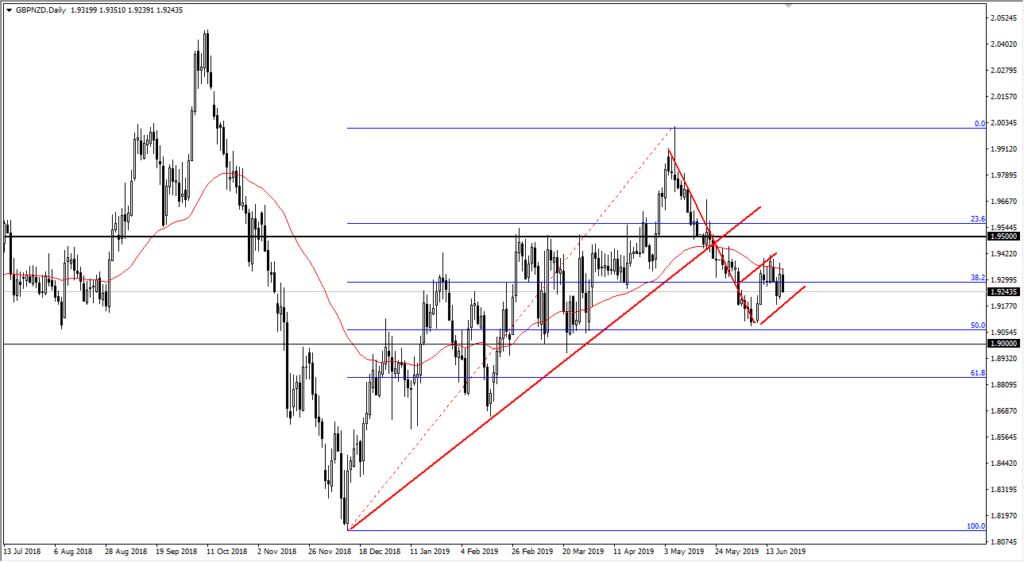

GBP NZD forming a bearish flag

The British pound continues to suffer at the hands of other currencies, and at this point it looks like we are trying to form a bit of a bearish flag. That being the case, it’s very likely that we could continue to drift lower, and there are a couple of support areas that still need to be tested. Because of this, we will probably look for reasons to start shorting again.

Bearish flag

GBP/NZD

Looking at the chart, you can see that I have a bearish flag marked out, as we had recently reached towards the 1.9075 level, bounced a bit, but found a lot of resistance at the 50 day EMA. We are now pulling back from that level again, so at this point it’s likely that we go down to the lows again, at the very least. However, if the bearish flag is in fact true, we could see this market go down to the 1.83 level as a target. This doesn’t mean that we will get there overnight, but it would jive quite well with the British pound having a lot of issues, and of course if we can get some type of deal between the United States and China, that would also be a huge boon for the New Zealand economy.

Broken trend

Looking at the chart again, you can see that there was an uptrend line that had been broken through several weeks ago. When zoomed out, it shows clearly that we had pulled back towards the 50% Fibonacci retracement level before bouncing. However, as we are starting to roll over at the 50 day EMA, I suspect that we are going to test that 50% Fibonacci retracement level again. If we can break down below the 1.90 level, the market will then test the 61.8% Fibonacci retracement level but then continue to go even lower.

Never forget the Brexit

As usual, we have to worry about the Brexit as well, which of course will continue to weigh upon the British pound. Quite frankly, things are lining up for a push much lower against the Kiwi dollar. With more quantitative easing coming out of both the ECB and the Federal Reserve, it makes sense that commodity start to rally, and of course that helps the Kiwi as well.

With the never ending drama surrounding the Brexit, it’s going to simply be safer to think of the British pound as something that you can’t buy quite yet, and in this case it becomes even more obvious.

The alternate scenario

The alternate scenario of course is that this bearish flag gets blown out, but I would not be comfortable buying this pair until we break above the 1.95 level on a daily close. If that happens, then we could very well go looking towards the 2.00 level above. However, I give that about a 15% chance of happening, and probably only if there is significant progress made in the Brexit, something that seems to be allusive to say the very least.