GBP Starting to Roll Over During a Torrid Session

- British pound kicked off the week dropping

- Sterling faces massive resistance above the current level

- Continued Brexit noise not helping the market

The British pound initially tried to rally during the Monday session but turned around and broke down substantially. This was more than likely going to happen, as the last several days have been choppy after a massive move higher had placed pressure on the market. Because of that, a bit of exhaustion may have crept back into this marketplace.

Resistance

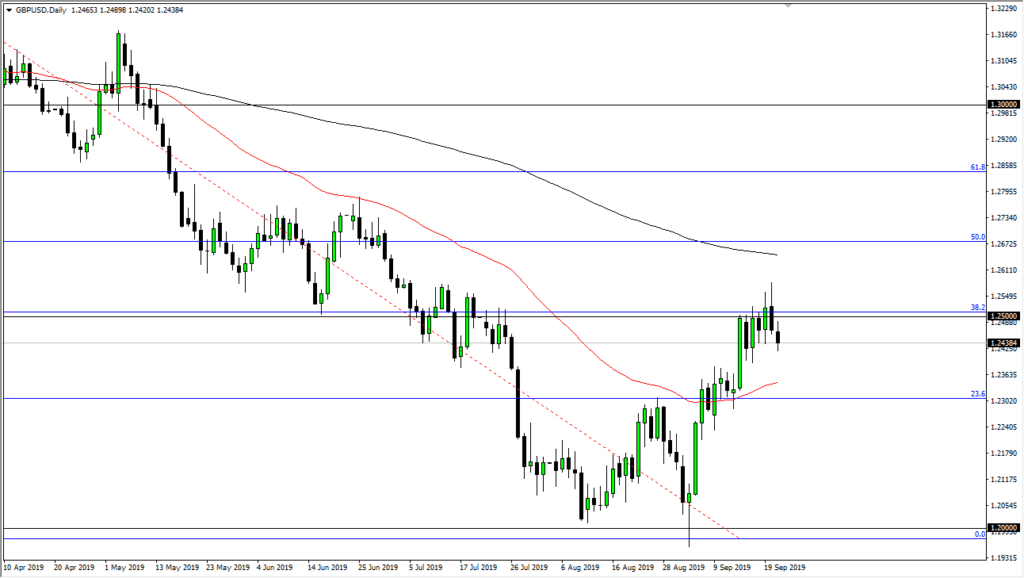

The 1.25 level will be a significant area of psychological resistance as it is a large, round, significant figure that is sure to attract a lot of order flow. There are also a couple of other reasons to suspect that the sellers will be waiting in the wings, including the fact that the 38.2% Fibonacci retracement level has been placed there from the most recent breakdown.

Beyond that, the 1.25 GBP level has been supported in the past, and the concept of “market memory” dictates there should be plenty of order flow in that area, offering a natural barrier. The market is most decidedly in a downtrend as seen by the 200-day EMA on the chart, pictured in black. With that being the case, even with the nice rally that we have seen as of late, the reality is that the market has only bounced a bit after a major sell-off. With that in mind, it’s very likely that the sellers will come back in force, as the longer-term money will flow most decidedly to the downside.

GBP/USD technical chart

Brexit noise

The headlines involving the Brexit scenario continue to be erratic at best. That, of course, will have a major influence on whether or not people are comfortable owning that currency. After all, at any moment there could be a headline that throws this market around and brings even more volatility. Markets absolutely hate uncertainty, and this is a perfect example of that scenario.

The trade that has worked for several years has involved waiting for signs of optimism to then start selling again. It is perhaps at this point that we find ourselves now. To the upside, the 200-day EMA defines the downtrend, so if we can break above there, it’s likely that could change a lot of the analysis. Currently, though, the market is nowhere near that level, so it’s difficult to be optimistic for any significant amount of time. That being said, this is a market that could very well find itself reaching towards the lows again, which are closer to the 1.20 GBP handle.

The negativity seen on Monday tested the bottom of the neutral candle for the previous week, and breaking through the bottom of that could show renewed negativity in the market. Therefore, it’s very likely that the market will continue to drift lower from here, waiting for some type of reason to own the sterling – something that traders just don’t have quite yet.