Japanese Yen Continues to Attract Order Flow

- Japanese yen is a safety currency

- The world is a dangerous place

- Preservation of trading capital crucial

- Multiple reasons fear could enter the markets

As you may or may not know, the Japanese yen is considered to be one of the “safety currencies” in the world. This is because a lot of money is borrowed in Japanese yen to speculate in the markets. For years, the so-called “carry trade” has functioned by borrowing huge amounts of cash in Japanese yen, and then seeking out yield in other markets that offer more. Granted, most interest rates are rather low these days, so the “carry trade” doesn’t quite work as well as it once did. However, markets do flood back to the Japanese yen in times of concern.

Recently, the Japanese yen has been selling off

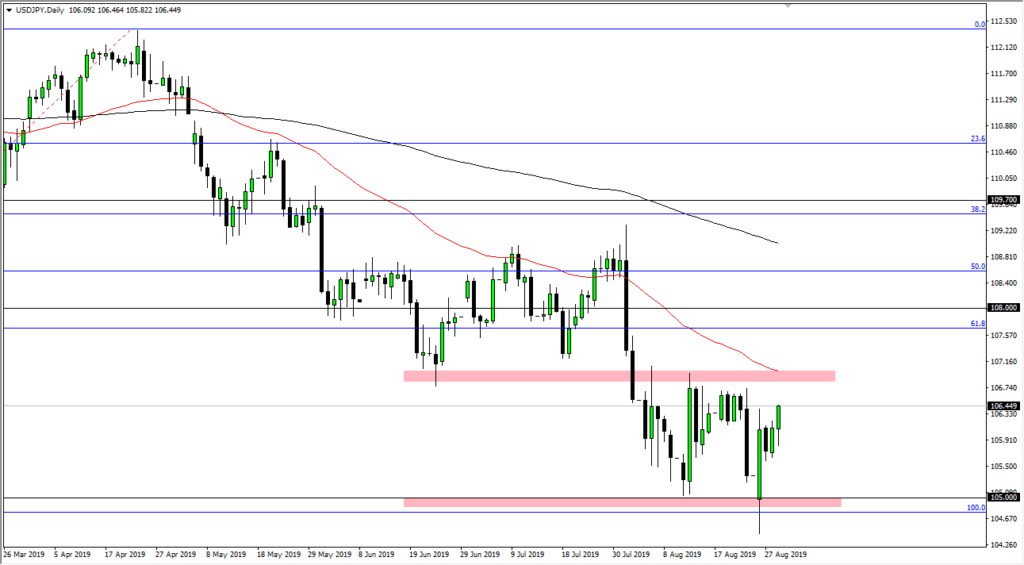

USD/JPY Daily Chart

Over the last several days, we have seen the Japanese yen lose some footing. This was further exacerbated on Thursday as the Chinese have suggested that they aren’t going to escalate the trade war, at least in the short term. This makes sense, because they have all kinds of problems with Hong Kong right now. Beyond that, most Chinese debt is denominated in US dollars, and as the Chinese yuan continues to get hammered, that causes a major problem for the Chinese economy.

With that, we have seen a bit more “risk-taking” in the form of selling Japanese yen. The USD/JPY pair is the place that most people look to for trying to short the yen. We have seen that over the last couple of days, but we are starting to reach towards the ¥107 level above. That is an area that should continue to cause a bit of resistance. Not only has it been resistant recently, and not only do we have the 50 day EMA right there, but we also have other charts that we can look at to facilitate this analysis.

Japanese yen futures

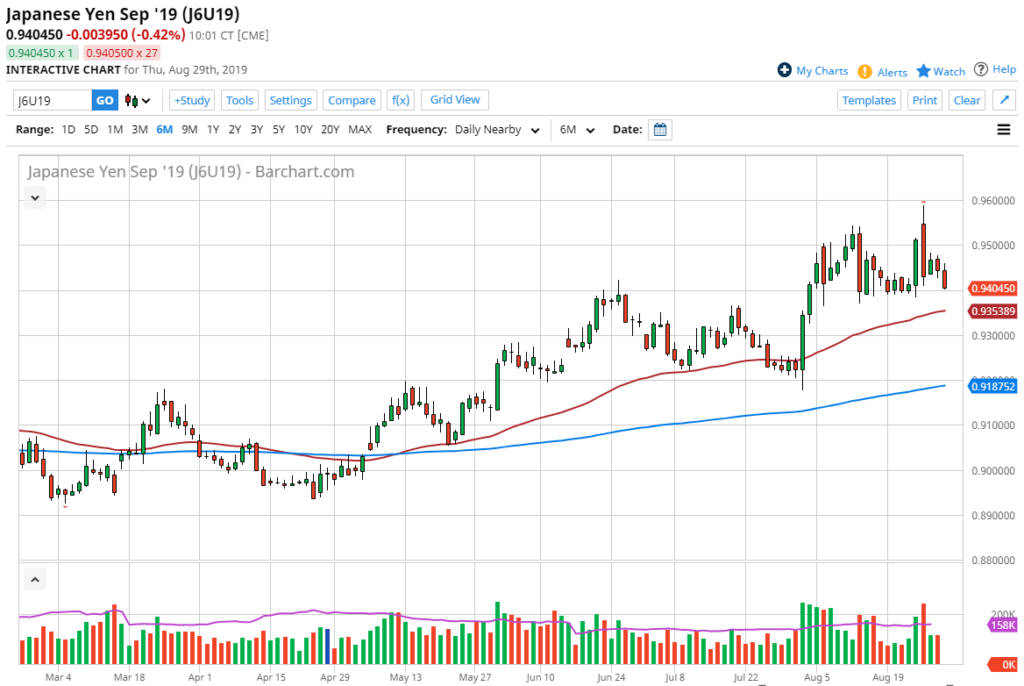

Yen Futures Sept 2019 (keep in mind price is inverse.)

What most of you may not pay attention to – possibly to your detriment – is that there is the futures market for currencies. The Japanese yen futures market is based on where the Japanese yen should go, going forward. When you look at the chart, it’s obvious that the 0.94 USD level has offered both support and resistance lately. This doubles the analysis, and you can see that, clearly, there are buyers in that area. At this point in time, it looks like we may get a little bit more negativity before we bounce again at this level that has been so reliable.

The takeaway

The takeaway is quite simple. After all, the Japanese yen is considered a safety currency. And while the US/China trade war may calm down for the next few days, it’s only a matter of time before something kicks it off again. Brexit also has people nervous and, of course, global growth is slowing down. The Japanese yen will continue to attract order flow.