Japanese Yen Under Pressure

- Renewed trade hopes

- US dollar pressing major resistance barrier

- “Risk-on” trading for Thursday

In yet another round of trade optimism, the trading community shunned the Japanese yen, the safe-haven asset, during the trading session on Thursday. Ultimately, this is due to the Chinese stating overnight that the Americans were looking to push back and even repeal some of the tariffs going forward. While this hasn’t been confirmed at the time of writing, it is suggestive that talks are moving forward, and that perhaps more hope can enter the picture. As hope grows, so does the USD/JPY pair.

Correlations forming

One of the biggest correlations that you will see in this pair is with the S&P 500, which looks poised to break out to the upside yet again. The S&P 500 has been rather relentless in its march higher, and this should continue to put upward pressure on the USD/JPY pair, which is the benchmark for Japanese yen strength or weakness.

Ultimately, it’s a bit of a “perfect storm”, as money runs away from Japan and starts looking for more risk. The best-performing stock market at this moment is the American stock market. that, of course, means that people will need the US dollar.

Technical analysis

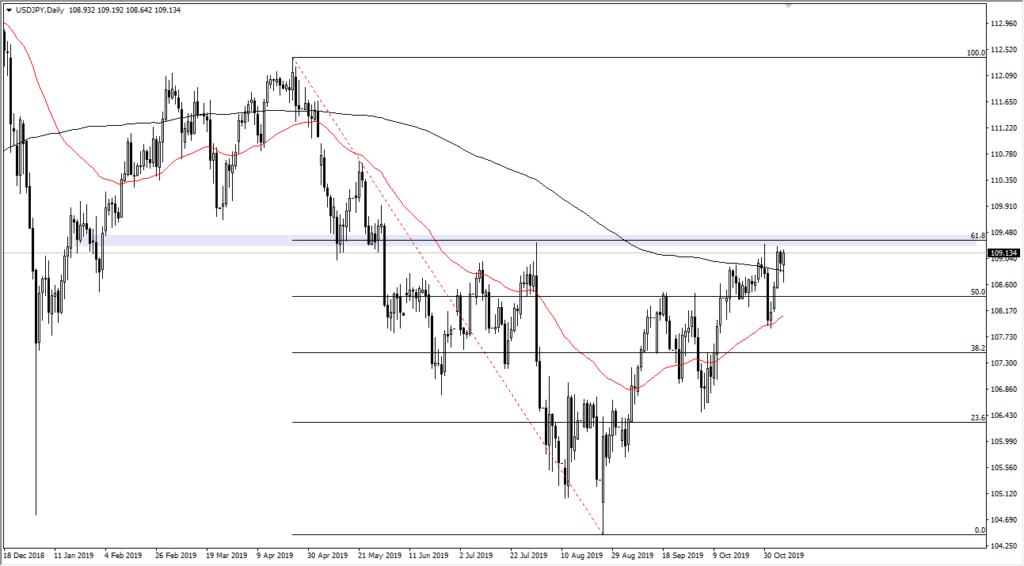

USD/JPY yearly chart

The technical analysis for the pair is rather easy to read, as the market has been smashing up against the crucial 61.8% Fibonacci retracement level. This area will continue to offer a bit of resistance, but it does now look as if it’s only a matter of time before the market breaks out.

The 200-day EMA is sitting just below current trading action, and early in the day, we have already seen a complete turnaround in any selling pressure. Having said that, there is an enormous amount of noise between ¥109.5 and ¥110, the latter of which is a large, round, psychologically significant figure.

That being said, there is a gap that is closer to the ¥111 level that will be a bit of a resistance barrier between here and there.

As far as selling is concerned, the 50-day EMA would have to be broken to the downside, meaning a move below the ¥108 level. That seems a bit unlikely at the moment, considering the momentum that we have seen and the tenacity of the buyers to pick up any type of value.

As long as the stock markets in America continue to attract money, the US dollar will continue to be relatively strong. This has money flowing away from other currencies such as the Japanese yen and the Swiss franc, looking for returns on Wall Street.

This also has a slight “knock-on effect” in other Japanese yen-related pairs. At this point, the Japanese yen looks as if it’s on its back foot.