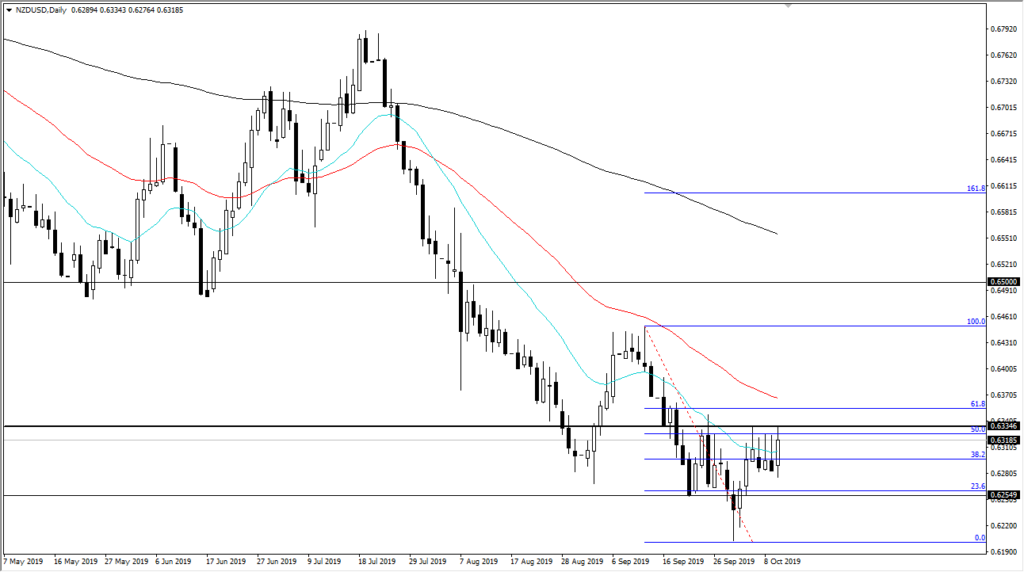

Kiwi Dollar Struggling to Break Out

- New Zealand dollar testing resistance

- Multiple long wicks

- 20-day EMA slicing through candlesticks

The New Zealand dollar rallied a bit during the trading session after initially falling on Thursday, showing signs of confusion yet again. The market rallied towards the crucial 0.6335 handle again, only to fail. That being said, as the Americans pick up the ball, we started to see a bit of “risk-on” as the stock markets opened. The problem here is that it only takes a tweet or headline to throw things into disarray again.

Trade headlines

The trade headlines coming out of the United States may cause some nausea when it comes to trading the forex markets. Plus, with the New Zealand dollar being so highly levered to the Chinese and Asian economy in general, it will be one of the first places traders will look to once the rumors start flying. At this point, it’s very difficult to imagine a scenario where the Americans and the Chinese come together with any type of clarity, so it’s likely at this point that we will see traders short this pair yet again.

Unfortunately, we have already seen the beginning of the rumor mill move the markets. With that being the case, it’s very likely that we will see a lot of choppy volatility. So it’s worth looking at the charts for small moves, not large ones.

Obvious resistance

NZD/USD chart

The market sees obvious resistance just above at that 0.6335 handle, as the market simply has not been able to break above there. Beyond that, the 50-day EMA is just above and more than likely going to cause some issues, as it does tend to attract a certain amount of attention. Ultimately, the market will be paying attention to the risk appetite of traders around the world, as the US/China trade talks take front and center. New Zealand, unfortunately, will be a likely victim of headlines.

To the downside, the 0.63 level is very likely to be a target, but a break down below probably opens the door to the 0.6250 level. At this point, a range is more than likely going to be the trade going forward, especially over the last couple of days as the talks continue. In fact, the results of the talks won’t probably be known until late Friday, meaning that the true larger-term trade is going to be on Monday.

The trade going forward

Once the market breaks out of these levels though, you can start to put a little bit more money to work for a longer-term move.