Mexican Peso Under Pressure

- Emerging market currency

- US dollar continues to find bid

- Major Fibonacci retracement level tested

The Mexican peso is one of the foremost emerging market currencies to be traded in the world. It is representative of Latin America, but it also acts as a proxy for the crude oil market as many of the rigs in the Gulf of Mexico are Mexican owned. Beyond that, as it is one of the more liquid Emerging Market (EM) currencies, it attracts a lot of flow for anything south of the border.

Emerging market concerns

There are plenty of reasons to be concerned about emerging markets, as global growth seems to be slowing down. As the risk appetite of traders starts to fade, money will go running away from some of the more higher-yielding currencies. The US dollar is where the money goes to when emerging markets get hammered, simply because the most liquid market to hide in will be the US Treasury market. Remember, a lot of the big moves in the currency markets are based on billions of dollars, and there may be few opportunities to park your capital. Simply put, the market has to be liquid enough to absorb your orders and not move against you.

Greenback strength

The US dollar continues to get a little stronger against many other currencies in the world, not just the Mexican peso. The euro, the British pound, the Canadian dollar, and many other currencies have all fallen against the US dollar during the trading session on Monday. As such, it’s not a stretch to consider that the US dollar would pick up momentum against some of the less liquid and stable currencies, such as the Mexican peso. Beyond that, the crude oil markets have fallen over the last several days, so it makes sense that the fundamental attachment of the peso to the crude oil market continues to put upward pressure on this pair.

Technical analysis

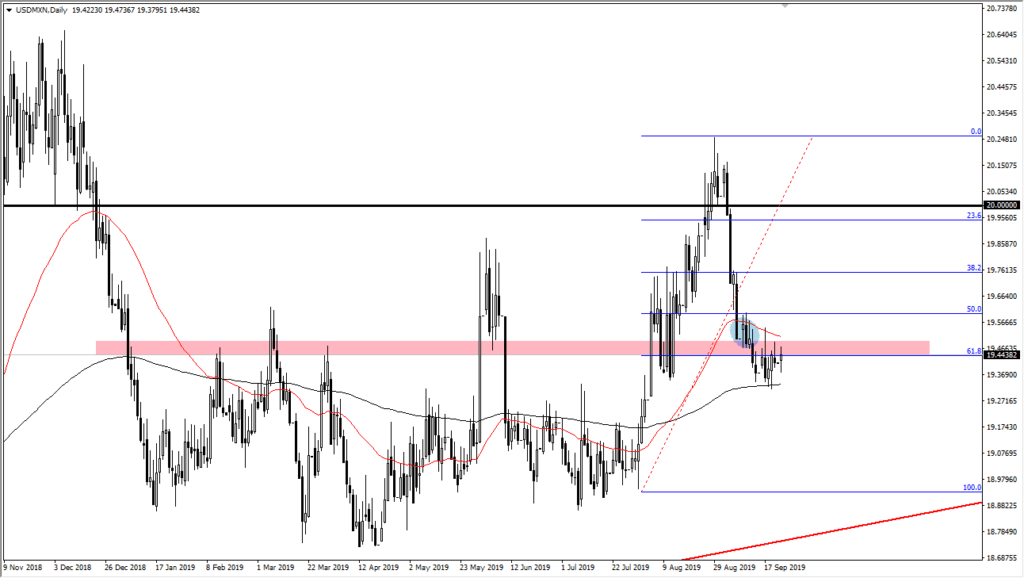

USD/MXN daily chart

The technical analysis for this pair is relatively straightforward, as the market is dancing around the crucial 61.8% Fibonacci retracement level. Further compounding the possibility of support here is the fact that we are in an uptrend, and the black 200-day EMA underneath has offered support over the last couple of days. With all of that in mind, it makes sense that longer-term money is starting to flow into this market.

Buying on the dips has worked for quite some time, and that should continue to be the case here. However, if there was a daily close below the 200-day EMA, one would have to start thinking about the market falling down towards the 100% Fibonacci retracement level near the 18.95 pesos level. As there are a lot of concerns around the world when it comes to the economy, it makes sense that the greenback will remain favored over the Mexican peso.