New Zealand Dollar Continues to Struggle After No Rate Cut

- Royal Bank of New Zealand keeps rate steady

- “Risk-off” continues

- US dollar getting bid

- Asian economy still an issue

The New Zealand dollar initially tried to rally on the back of a “no rate cut” decision overnight by the Royal Bank of New Zealand, which was less dovish than some people may have anticipated. The statement suggested they are willing to step in and support the markets, as well as the economy, however they need to. In other words, it’s very likely they will step in and do something eventually. As a result of this, and the fact that markets are forward-looking, it is understandable that the New Zealand dollar lost value.

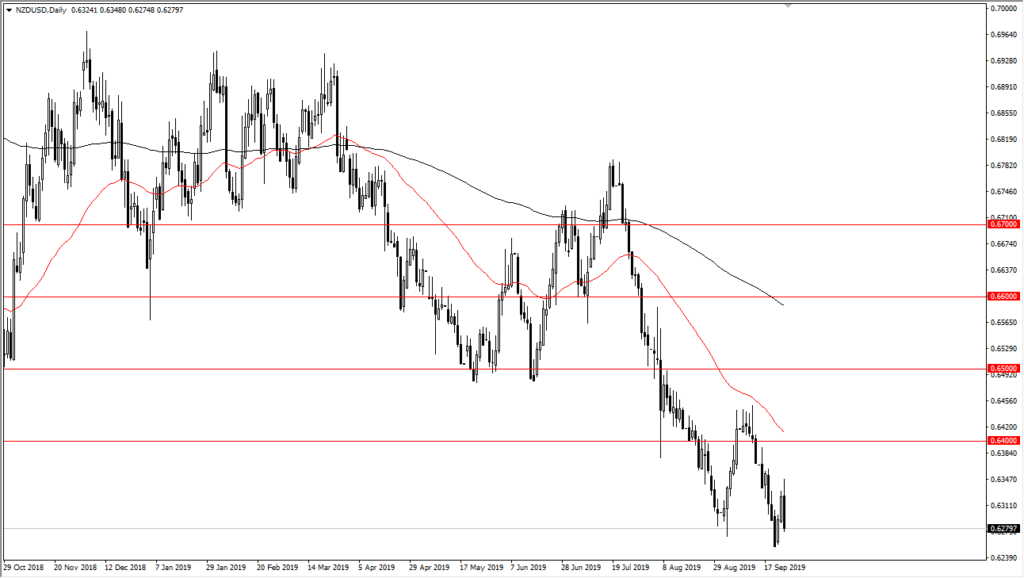

Continued downtrend

NZD/USD daily chart

There is most certainly a continued downtrend in this market, and any other market that is risk-related at this point. Because of this, it makes quite a bit of sense that the forex community has shunned riskier commodity currencies such as the New Zealand dollar in favor of treasuries and the like. After all, there are a whole host of issues that could come into play when it comes to this market. Ultimately, this is a market that should continue to show signs of negativity and offer selling opportunities on short-term bounces.

“Risk-off” issues everywhere

During the overnight session, it was announced that the US Congress is starting the impeachment investigation of US President Donald Trump. This suggested a “risk-off” attitude straight away, but it should be noted that impeachment is a longer-term process and takes quite some time to actually occur. As such, it’s likely that we will continue to see buyers stepping in for the US dollar, based on the US Treasury markets rallying. We have seen a nice pop in bonds lately, and that raises demand for US dollars.

We also have the US/China trade war going on, and that has its own effect on the markets. Granted, China has decided to start buying pork again, but it has more to do with the current epidemic going through the barnyards of mainland China. This isn’t so much consolatory as it is a necessity.

The trade going forward

The trade going forward in the New Zealand dollar is more of the same. In other words, we will be looking for opportunities to short this market every time it rallies. The 50-day EMA is approaching the 0.64 handle, so we’ll probably continue to see sellers in that vicinity. A fresh, new low is also a sell signal, perhaps sending this market down to the 0.60 level. This area has not been seen for ages, but at this point, there seems to be very little stopping that from happening over the next several weeks.

The one wildcard would be if the Americans and the Chinese came together in some type of trade agreement. However, that seems to be a highly unlikely scenario to occur between now and the election in 2020.