New Zealand Dollar Heading Towards Gap Against Loonie

- New Zealand dollar bouncing from extended drop

- Gap above should offer significant resistance

- Gap just below the 50-day EMA

- Strong downtrend

The New Zealand dollar has been hammered recently, as the world runs from overall risk appetite in general. Even with that, the last couple of days have been kind to the New Zealand dollar, which displayed a “dead-cat bounce”. Markets cannot go in one direction forever, so it makes sense that there has been a bounce. The prudent trader, though, will be waiting for an opportunity to trade with the larger move. After all, forex pairs tend to trend for two to three years at a time, so professionals will take advantage of that.

Dead-cat bounce

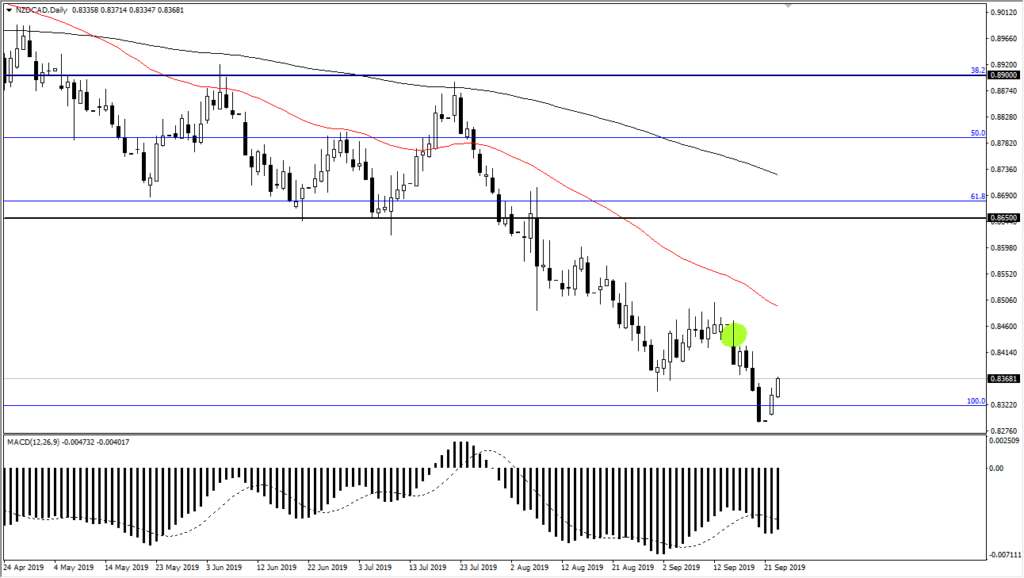

NZD/CAD daily chart

Although this has been an impressive rally for the last couple of days, the reality is that it is a bit of a “dead-cat bounce” because the market has fallen to such extreme lows. We have recently made a “lower low”, which is the very epitome of a downtrend. That being said, there is a gap above current pricing at roughly 0.8450 CAD, and that area should continue to offer resistance although it has been filled recently.

Technical analysis

The technical analysis in this pair is relatively straightforward in the sense that we are most decidedly in a longer-term downtrend, which can be spotted quite easily. The gap will have a bit of a market memory attached to it, and therefore the market should offer quite a bit of selling pressure in that area. Beyond that, the New Zealand dollar is highly leveraged to the Asian economy, which is under attack due to tariffs between the United States and China. Being so overexposed to Asia at this point is probably not a good thing.

In the chart there is the 50-day EMA, which is currently just below the 0.85 CAD level. That should also offer quite a bit of resistance. It is very likely at this point that the sellers will come in at that level, as this is a widely followed technical indicator. Longer-term traders will continue to add to their short positions when the 50-day EMA is touched, and the same can be said for the 200-day EMA, which is currently far above.

To the downside, the market is very likely to look for the next “large, round, psychologically significant figure”, which would be the 0.80 CAD level underneath. As a result of this, on a turnaround it’s very likely that people will be adding aggressively to their positions, especially if it’s a breakdown of the recent lows made at the end of trading on Friday of last week. At this point, it’s very difficult to be a buyer of this pair, and it simply looks like we are more than likely going to see some short-covering.