New Zealand dollar likely to find buyers against Canadian dollar

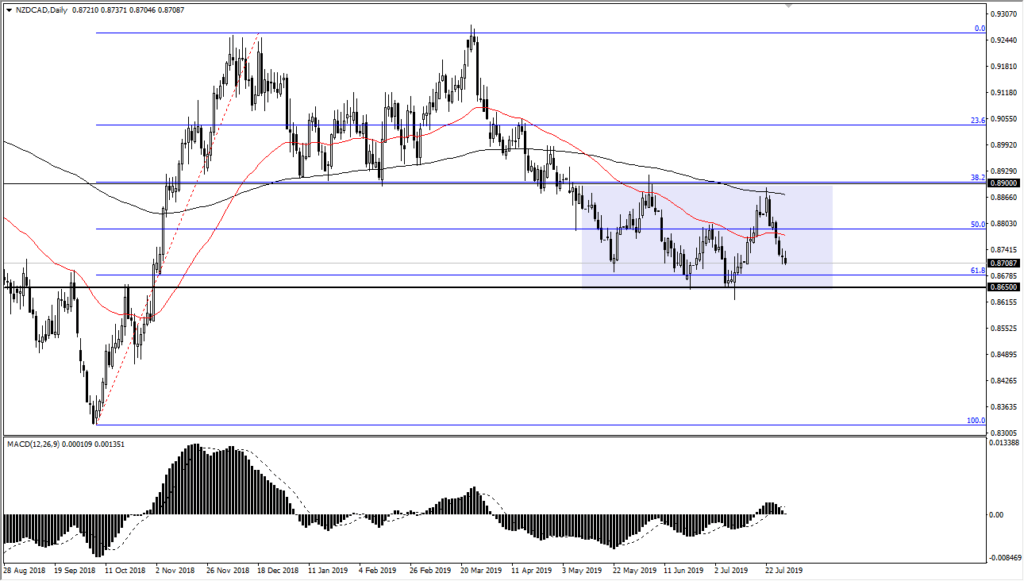

The New Zealand dollar is likely to find buyers against the Canadian dollar rather soon, not necessarily in some type of major revelation, but just simply because the market has found so much support at levels just below. There are a multitude of reasons to think that this market to bounce, not the least of which of course is that the fundamentals in Canada are weakening, and of course oil hasn’t exactly been on fire as of late, which works against the Canadian dollar itself.

Technical factors

NZD/CAD

There are a multitude of technical factors as to why I expect to see buyers come into this market relatively soon. The first thing that I would say is that the next 24 hours will be dominated by the Federal Reserve so it makes sense that people are trying to avoid the greenback in general. That makes this pair a very interesting place to be.

One of the most important things that I can point out is that we have been consolidating in a 250 pip range as of late, and we are getting close to the bottom of it. The 61.8% Fibonacci retracement level is towards the bottom of this range, close to the 0.8650 level as well. That obviously will attract a lot of attention, as traders pay attention to the “golden ratio” quite often. That being said, there is also a massively supportive candle stick that had formed at the 0.8650 level that started the most recent rally, so I would anticipate there is going to be some stringent defense in that area.

The Moving Average Convergence Divergence indicator, or the MACD, measures strength and weakness, and you will notice that the histogram underneath is starting to rise as price is starting to fall. That is what is known as divergence, and quite often can signal a potential turnaround. In other words, a bounce from this level.

The trade going forward

The trade going forward from what I see is to play the first signs of a bounce at the 0.8650 region. The trade wouldn’t necessarily be a guaranteed A+ set up, but it does have a high likelihood of reaching towards the 50 day EMA, which is pictured in red on the chart. Ultimately though, if we were to break down below the 0.86 handle, then it gives you a clear move down to the 100% Fibonacci retracement level. In other words, even if you do lose initially, it sets up a large move to the downside and the risk to reward ratio is great.

In other words, it’s very likely that we have some type of tradable action in the next 24 or perhaps 48 hours. While there might be a bit of a “knock on effect” from the Federal Reserve announcement, it’s very unlikely that it will be pronounced over here in this pair, as we can hide from that volatility and trade a much more stable marketplace.