Swedish Krona Continues to Face Pressure

- Swedish krona at historic lows

- US dollar continues to strengthen against “risk currencies”

- Long-term uptrend

The Swedish krona continues to face an onslaught of pressure as market participants continue the selling of anything risk-related. As a general rule, Sweden is considered to be a proxy for technology, which is heavily related to risk. Quite often, traders will sell the krona any time there are a lot of fears about global growth around the world.

Long-term uptrend intact

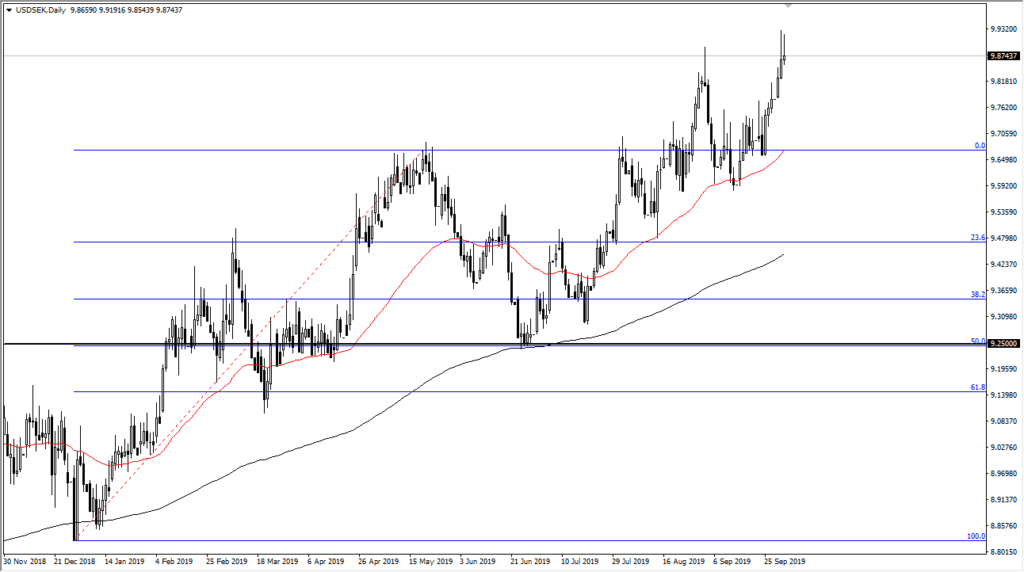

USD/SEK chart

As can be seen on the chart, this pair has been in an uptrend for some time. In fact, the market has started to accelerate the momentum to the upside over the last several days, showing a renewed weakness when it comes to “riskier currencies”. There is a general dynamic around the world right now, as the US dollar has strengthened against several other “risk-on currencies” such as the South African rand, the Mexican peso, and the Hungarian forint.

As a general rule, these currencies all tend to move in the same direction as risk appetite either increases or decreases. It appears that a lot of the money initially earmarked for Sweden may be going into the US Treasury markets.

Technical analysis

The technical analysis for this pair is quite straightforward, as the 50-day EMA has recently offered massive support at the 9.65 SEK level. It is starting to turn to the upside as well, so it should be supportive going forward, as it has been lately. Beyond that, the 200-day EMA is all the way down at the 9.45 SEK level and trying to catch up. Ultimately, it looks as if the 9.70 SEK level will offer support on any pullback, which is possible considering that the daily candlestick is starting to form a shooting star. This should be the “pause that refreshes”, rather than some type of major breakdown.

The trade going forward

The trade going forward is rather straightforward: buying on pullbacks makes quite a bit of sense. Somewhere near the 9.75 SEK level, there should be a ton of support just waiting to jump in and push the market higher. The alternate scenario could be a break above the wicks of the last couple of trading sessions, making a fresh, new high and almost certainly opening the door to the 10.0 SEK level above, which has a lot of psychological importance attached to it.

If the 9.75 SEK level does not offer support, then the next support level is going to be either the 9.7 SEK level or the 5- day EMA. As far as a complete turnaround is concerned, this trend should be intact until something changes drastically when it comes to growth in Europe. That’s because Sweden is highly levered to the European Union. Beyond that, there are still trade tensions everywhere that continue to favor bonds being bought in the United States, as well as United States stocks – in other words, all assets that need the US dollar to be purchased.