US dollar continues to find support against Canadian dollar

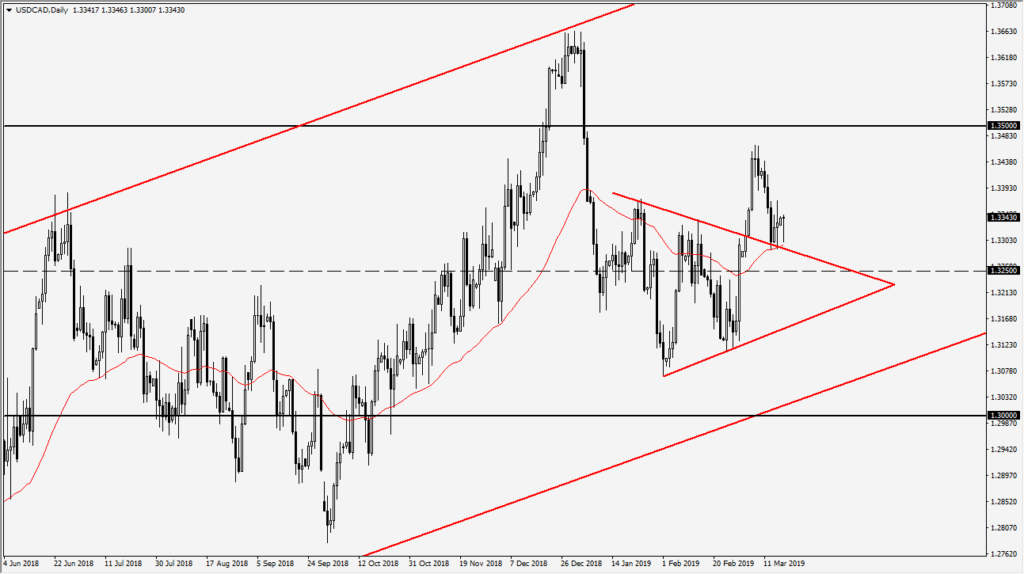

The US dollar fell a bit during the trading session on Monday but found support at the technically important 50 day EMA. At this point, we can also point to the triangle that we have recently broken out above as a potential supportive level as well. The market has respected this technical set up, so course it’s worth paying attention to.

The triangle

The recent triangle was rather obvious, and the fact that we have tested it for support after breaking out of course is a good sign as well. The 50 day EMA is crossing through the downtrend line, and it looks as if we are trying to form a hammer. This of course is a very bullish sign, so if you can break above the top of the candle stick from Friday, that would be yet another bullish signal that could send the US dollar higher. While this is typically thought of as a “risk off signal”, keep in mind that there are a lot of other things going on. For what it’s worth, the triangle measures for a move of roughly 200 pips.

Canadian economy and oil

Recently, we have seen the oil markets strengthened, but beyond that we are witnessing the Canadian economy struggle in general, as we have interns seen the Canadian dollar suffer a bit. With that in mind, remember that this is the main measuring stick of a currency, how it does against the greenback. In other words, if you are trading the Canadian dollar and all you should be paying attention to this chart. Beyond that, if we do get some type of major “risk off” market event, then we could see this market get turbocharged as the greenback will naturally receive a lot of attention.

The Bank of Canada has recently suggested that there are a lot of headwinds to the Canadian economy, so all things being equal that should be thought of as a major influence.

The importance of 1.3250

Looking at the charts, the 1.3250 level has been important more than once, as it was both support and resistance over the longer-term. Overall, it looks as if the market is going to try to go to higher based upon the support level as well, so it’s yet another piece of the puzzle as to which direction we should be trading. Beyond that, we also were in a down trending channel longer-term, so keep that in mind as well.

We also have the 1.3250 level being essentially the 61.8% Fibonacci retracement level from the initial push higher, so that will also offer a lot of support. We are currently trading at the roughly 50% Fibonacci retracement level, so it that’s yet another reason to think that the buyers are probably going to be in control overall.

The alternate scenario

One thing that could cause some issues is if oil suddenly spiked higher, as that could send the Canadian dollar higher in general. However, it appears that we are focusing more on the internal Canadian economy and the fact that the Bank of Canada seems very likely to remain soft and cautious in the foreseeable future, so with that in mind it’s very likely that the Loonie continues to be on its back foot. That being said, you should keep in mind that oil can change things if it suddenly gets wildly bullish.