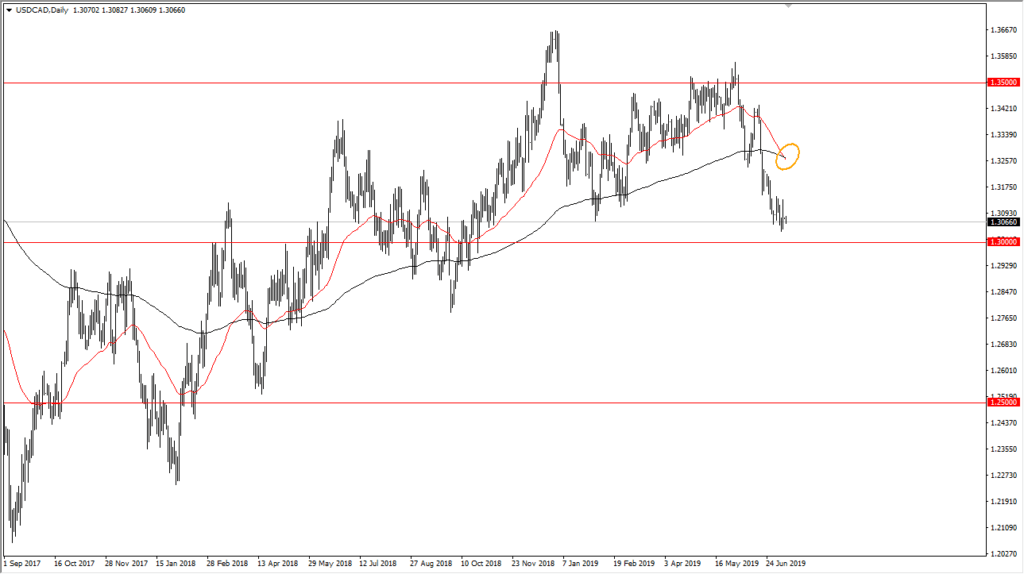

US dollar forms death cross against Loonie

One of the more ominous technical signals out there is the so-called “death cross.” This is when the 50 day EMA starts to cross below the 200 day EMA, signaling a longer-term downtrend. Having said that, it should be taken with a certain amount of levity, as it is such a lagging indicator. That being said, if we do continue to see the downside in this pair, it could really start to move to the downside.

Support just below

USD/CAD chart

Looking at the chart, it’s easy to see that the 1.30 level underneath should offer a bit of support. Beyond the fact that it is structurally important it is also the psychologically important. That being said, if we can break down below the 1.30 level, coupled with the “death cross”, the market should really start to pick up the downward momentum. With that in mind, we could see the beginning of a larger move to the downside.

Granted, we have recently seen an acceleration of the selling, but we could very well consolidate a bit near the 1.30 level. Even if we bounce from this region, it’s very unlikely that this is a market that can be bought anytime soon, at least not until we were to clear the 1.32 handle. In the short term, it looks like we may start to try to find buyers in this area.

However, if we were to get a daily close below the 1.30 level, it’s very likely that the next target will be closer to the 1.2750 level, which could be exacerbated if we get a move in the crude oil market. In general, this is a market that tends to be very choppy with sudden moves, as the two economies are so highly intertwined.

The play going forward

There are a couple different ways to play this market. Having said that, it’s not until we get above the 1.32 level that buying would be easy to do. If we get a little bit of a bounce and show signs of exhaustion, then it could be an opportunity to start selling again, as we could build enough momentum to finally start reaching below the 1.30 level. Alternately, if we close below the 1.30 level then we should see a couple handles worth of downward pressure.

If we were to break above the 1.32 level on a daily close, then it’s very likely that we will go looking towards the 1.34 level, possibly even higher. While crude oil does have a significant effect on the Canadian dollar, it’s a little bit more muted against the US dollar as the United States produces almost 13 million barrels of crude oil a day. However, the Federal Reserve is expected to do interest rate cuts in July, so by all means this market should continue to drift lower overall. All things being equal we should see plenty of negativity going forward. It doesn’t necessarily mean we are going to see a major collapse, just that the downtrend seems to be ensconced pretty well.