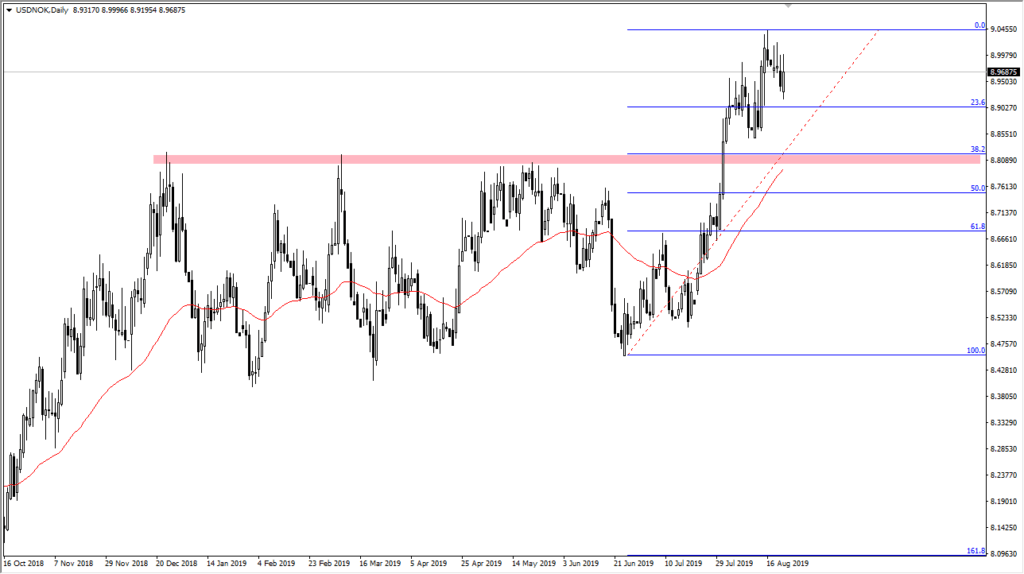

US dollar pulling back toward support against Norwegian krona

- Norwegian krona proxy for crude oil

- USD/NOK at extended highs

- Massive support below

The US dollar has rallied against the Norwegian krona for some time as you would expect, as a Norwegian krona is such a huge proxy for crude oil. Most of those rigs in the North Sea? Norwegian owned. Because of this, the Norwegian krona is quite often traded as a proxy for what’s going on in the crude market, and as the oil markets had suffered so drastically, it makes sense that the US dollar would gain. By proxy, this market needs to rally because of course oil is priced in those greenbacks.

Technical analysis for the Norwegian krona

USD/NOK

The technical analysis for the USD/NOK pair features several different things going on at once. We have the 50 day EMA tilting higher and reaching towards the massive support level that I have drawn on the chart. That support level, at the 8.80 NOK level, also features the 38.2% Fibonacci retracement level which of course will attract a lot of attention. It was where we had seen quite a bit of resistance previously as it was the top of the previous range. A simple pull back to this area would make quite a bit of sense as it hasn’t quite been retested yet. A pullback to that area should attract a lot of buying pressure.

With all of that in mind, I like the idea of buying pullbacks as they represent value, and of course the US dollar has been strong for so long. If we were to break down below the 8.80 NOK level, then the next major support level will be at the 61.8% Fibonacci retracement level which is closer to the 8.70 NOK level. As things stand now, technical analysis doesn’t suggest that selling is a possibility.

Pay attention to other markets

If you have been trading for more than about 10 minutes, you recognize that there are a lot of crosscurrents when it comes to any financial market in your trading. In this case, you not only have to pay attention to the crude oil market, which rising prices will help the Norwegian krona and of course vice versa, but you have to pay attention to the bond markets in the United States. This is because recently we have seen a lot of money flowing into the US Treasury markets, and that has placed a lot of demand for the US dollar. At this point, that has abated slightly, but the longer-term trend is most certainly positive for the Treasury market, so at this point there’s at least half of the equation that suggests we should go higher.

For further fundamental analysis, you can simply look at economic conditions around the world. For example, transportation indices that show signs of weakness suggest that there will be a lower demand for crude oil. All things being equal, nothing operates in a vacuum so make sure that you line up as many reasons as you can right along with the technical analysis. At this point, it seems to be a matter of “when and not if” we can buy this pair.