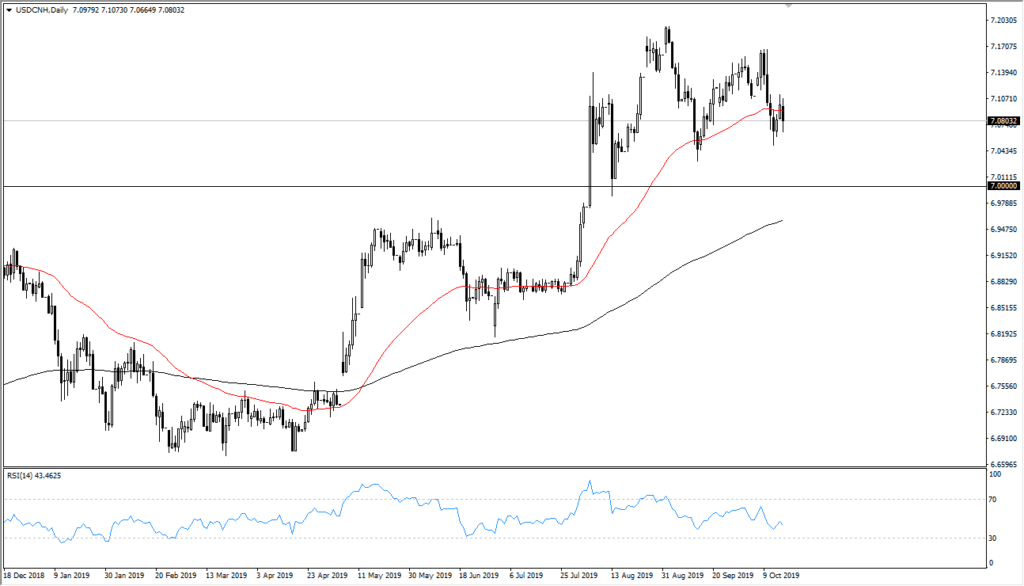

US Dollar Still Strong Against Chinese Yuan

- USD/CNH still above seven

- 50-day EMA at current level

- 200-day EMA still sloping higher

The US dollar has fallen a bit against the Chinese yuan over the last week or so, but this pair is still relatively strong. After all, the 7.00 CNH level was an area that had attracted a lot of attention. These large, round, psychologically significant levels tend to give rise to a lot of headlines on the news, which in turn attracts a lot of attention by traders around the world.

USD/CNH chart

What do the Chinese want?

The Chinese have quite a bit of a handle on their own currency, and there is a lot of rhetoric around the world as to what the yuan is doing. That being said, despite what many people around the world think, the weaker yuan doesn’t help the Chinese economy like it once did. Yes, there is still a huge export factor to their economy, but they also have massive amounts of debt denominated in US dollars.

In other words, if they borrow $1 billion in the open market, the last thing the Chinese want to do is have that US dollar strengthen, driving the amount needed to pay back the loans in the local currency higher. As your currency gets weaker, you need to pay more to get the other one.

That being said, they don’t want the yuan to get too expensive either. This is why the PBOC, the Chinese central bank, is so heavily involved in the currency rate. They have enough in the way of exports when it comes to their economy that they don’t want their goods becoming too expensive – it is quite an interesting balancing act.

High demand for the greenback worldwide

There has been high demand for the US dollar worldwide anyway, so this isn’t just a Chinese phenomenon. Looking at the chart, it’s very likely that we are simply consolidating and getting used to the idea of being above the 7.00 CNH level, which was a major barrier psychologically speaking. Now that we are above there, the longer the market can chop around, the more likely it is to be comfortable at this level.

With that being said, and the US-China trade situation going nowhere, it’s very likely that we will see this pair go higher as demand for US Treasuries increases. After all, Chinese economic numbers have been worse lately, and an extension of the stalemate with the US and China can only exacerbate that situation. In fact, this market is bullish as long as we can stay above the 7.00 CNH level. Buying on pullbacks should continue to work.