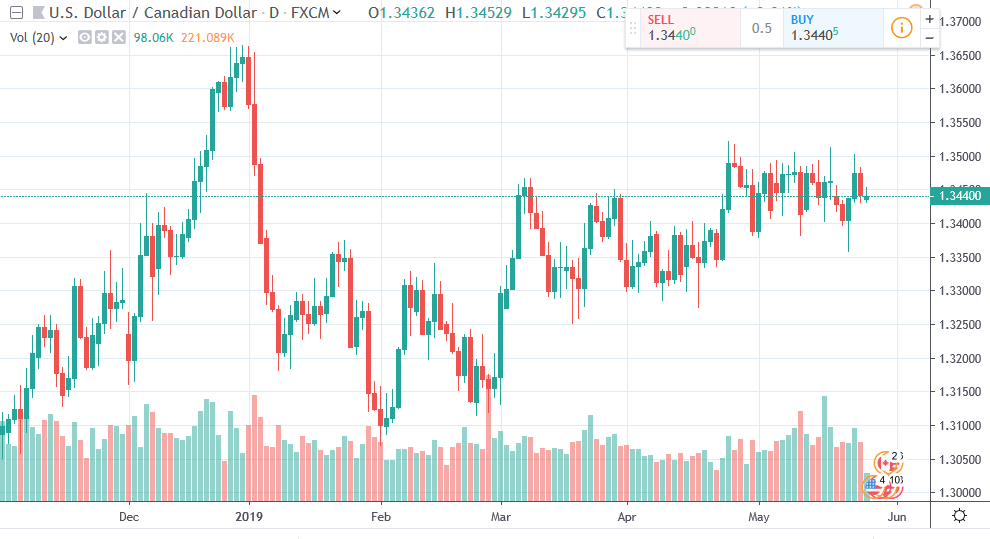

US dollar testing major resistance against Canadian dollar

The US dollar has rallied a bit during the trading session on Friday in a bit of a “risk off” move as financial markets deal with a multitude of concerns. Because of this, we are approaching the 1.35 level, an area that has been significant resistance recently. That being said, it’s likely that we are going to eventually break through this level as it has been tested so much.

USD/CAD Chart

Trade war concerns

Obviously, one of the biggest concerns out there is the trade war situation and with the US treasury markets getting a huge boost from fear, it makes sense that the US dollar should strengthened. This is true across the board, and therefore it looks like Canada will suffer the same fate as many other countries as far as the currency markets are concerned. Beyond that, the Canadian dollar is a bit of a proxy for crude oil and as a result it could get a bit of a bad feeling over the next couple of trading sessions until things settle down.

Canadian economy

The Canadian economy isn’t exactly running on all cylinders either. Because of this, there is a lot of concern about various sectors, not the least of which is the housing market. Unfortunately for Canada, lenders didn’t pay attention to what happens south of the border 10 years ago, and therefore we have a huge housing bubble in places like Vancouver and Toronto. If that continues to burst as it has, that of course will be a drag upon GDP as well.

Add to that the global concerns and the fact that so much of the Canadian economy is driven by crude oil, you have a recipe for trouble. Canadian crude has been trading at lower levels for quite some time, especially the grades that come from the western part of the country. This of course also hurts the entire situation. With that being the case, it’s difficult to imagine a scenario where this market suddenly rolls over and takes off to the downside. It certainly is going to need help from exterior forces, perhaps the US/China trade relation negotiations working out, because it would drive up demand for crude in general.

The main take away

Simply put, this is a market that is trying to break out and very well could. Once we clear the 1.3520 level, it is very likely that the market will go looking towards 1.36 handle next as it was the scene of a significant selloff. Alternately, if we do pull back from here I think there’s a ton of support down at the 1.34 handle as shown during the Thursday session and many others before it. As I write this article, we are making a fresh, new high for the last couple of weeks, so it certainly looks as if we are trying to resolve this consolidation rectangle, and therefore should manage to get roughly the same distance as the rectangle, giving us that tidy target of 1.36. If we break above there, then it becomes more of a “buy-and-hold” scenario.