US Dollar to Find Value Against Swedish Krona

- US dollar pulls back to find buyers

- Swedish krona historically low

- 50-day EMA approaching

The US dollar has been on its back foot for a few days as the “risk-on” trade has come back into favor. This favors smaller currencies, and the Swedish krona falls into that purview. It’s very likely that the market will eventually find buyers, as it is already starting to see signs of buying in the middle of the day. We can expect to see a continuation of the uptrend based on this very fact.

Long-term uptrend

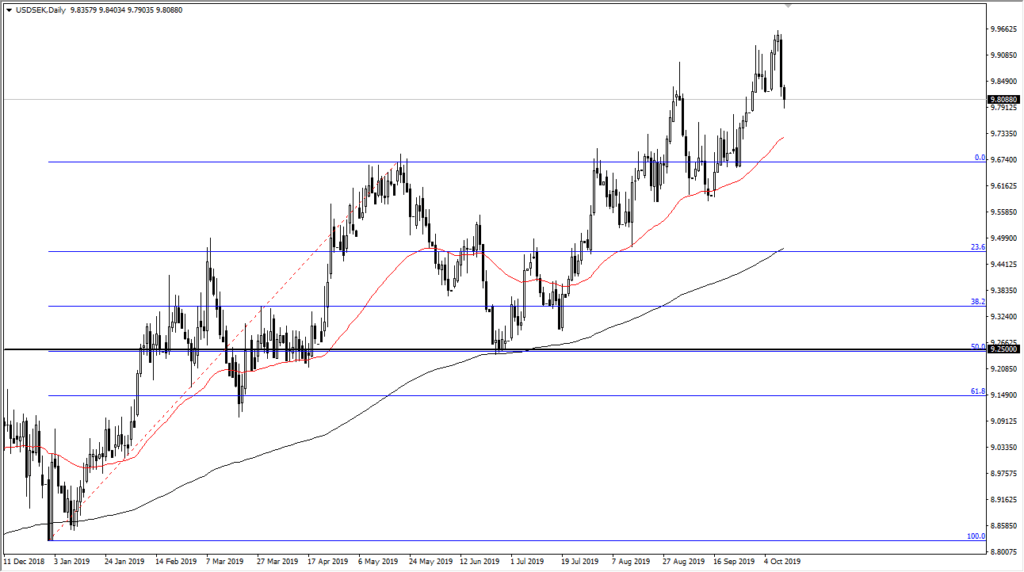

USD/SEK chart

The trend in the USD/SEK pair has been rather relentless, as buyers have come back into the market to pick up value every time it is presented. Looking at the chart, the 50-day EMA is underneath and should continue to offer support, as it typically will do on longer-term trends. The market has been testing the 9.80 SEK level during the trading session on Friday, heading into a weekend of uncertainty when it comes to the global economy. Plus, with the US/China trade situation in flux during the talks, it will be interesting to see how risk appetite is influenced.

The beginning of the latest leg higher was all the way down at the 9.25 SEK level, an area that has attracted a lot of attention. We have seen the market break to fresh new highs repeatedly, which is a reflection on risk appetite, as Sweden is so highly levered to technological companies.

Thinner markets offer larger rewards

While the Swedish krona is part of the US Dollar Index, it is only slightly above the 2% level. As a result of this, although the leverage is typical for major currency pairs, it does tend to move in impulsive waves as the volume is lower than other pairs such as GBP/USD and USD/JPY. As such, larger rewards are offered, but also your risk is going to be a bit higher. This is why trading this pair needs to be looked at through the prism of longer-term trends and simply held on to. The Swedish krona is less a trade and more of an investment.

The trade going forward

The trade going forward for this pair is to simply buy dips as they are offered. It makes sense that the market did pull back slightly as we approached the 10 SEK level, which is a major round figure. This will cause a certain amount of psychological resistance. However, that is simply a psychological barrier and won’t typically hold over the longer-term against what has been such a strong and reliable trend. Just below, the 50-day EMA is at the 9.73 SEK level, and reaching towards the market level. With this, short-term pullbacks should continue to offer an opportunity to build up a larger core position for the break out above the 10 SEK level.