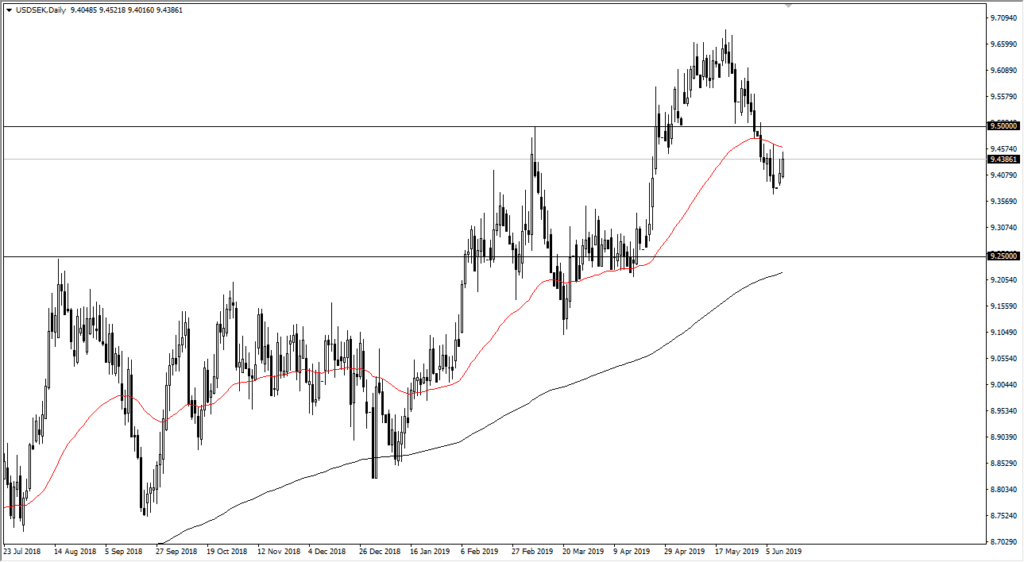

US dollar trying to base against Swedish krona

Many of you probably don’t trade the USD/SEK market, but you should. After all, it is part of the US Dollar Index, so therefore it allows for strong leverage, and does tend to move in reasonable mannerisms. That being said, another thing that we need to pay attention to is what drives this market.

Risk appetite

One of the big drivers of the USD/SEK pair is whether or not there is risk appetite. After all, Sweden is highly levered to the technology sector, so therefore if you see a lot of bullish pressure in markets that favor technology and of course risk appetite in general, this pair tends to fall, as more money flows into Sweden and away from the treasury markets which of course are based in the US dollar.

That being said, you can see that as the last couple of weeks have been rather strong for stock markets around the world in general, the US dollar has fallen against the Krona. Ultimately, we even broke down below the 50 day EMA on the chart, but now find ourselves turning right back around to reach towards that level.

Beyond that, the Riksbank in Sweden has recently announced its dovish intent, so that works against the Krona as well.

Uptrend

USD/SEK

You do have to keep in mind that there is a certain amount of strength in the overall uptrend, and we may have simply gotten ahead of ourselves. This makes sense as we had reached the top of the overall channel at the 9.70 level. That being said, we are now starting to see a bit of a bounce over the last couple of days, near the 9.40 level. If we can break above the 50 day EMA, then we can continue to test the 9.50 level above there, and then perhaps reaching towards the 9.65 level above, which has seen pretty significant selling. Longer-term though, if we continue to see a lot of trouble in the financial markets and concerns around the world, it wouldn’t surprise me at all to see this uptrend continue and have this market going towards the 10.0 SEK level above.

The main take away

One of the greatest things about the Forex markets is that they tend to trend for long periods of time, and therefore it’s best to simply trade with the trend. As we are bouncing from here, I’m going to use the 50 day EMA as an entry point above, reaching towards the 10.0 SEK level in general. However, there is also the possibility that everything turns around if we get some type of saving move for risk appetite.

All things being equal, it looks as if the US dollar should continue to show signs of strength against the Swedish krona, but that doesn’t necessarily mean that it’s going to be a straight shot out. It looks as if we are in a good entry point now, especially for longer-term traders you’d like to take advantage of huge trends.