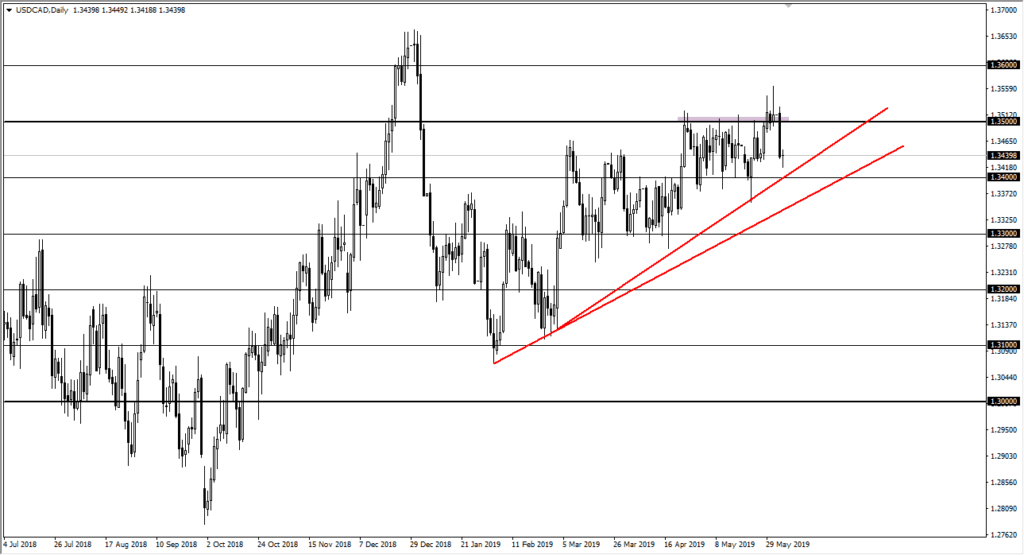

USD/CAD looking to test major area again

The United States dollar has initially fallen against the Canadian dollar during trading session on Tuesday but turned around to form a bit of a hammer midday. This is a pretty good sign, considering that we have been grinding higher over the longer-term, and as you can see on the chart I have a couple of trendlines marked. Because of this, we could see a continuation to the upside as it would simply be more of the same.

Uptrend

USD/CAD

This is a market that’s been in and uptrend for some time, and as you can see by the trendlines, it looks likely to continue to go further. The uptrend line that we are following is higher than the one before, so at this point it’s likely that the acceleration could send this market finally breaking through the 1.35 level significantly. That’s an area that of course is a lot of resistance, because it is not only structurally resistant, but it is also a large, round, psychologically significant figure.

At this point, it looks like pullbacks continue to offer value, and as we have an uptrend line just below that runs through the 1.34 handle, there will be a lot of buying pressure in that region. Beyond that, there is also another uptrend line just below the 1.34 level as well. Because of this, I think it’s much easier to buy this pair or that it is to sell it. I also recognize that a breakout above the 1.35 level that sticks would be a good move for the longer-term trend.

Crude oil

The crude oil markets of course have been very volatile and negative, so it makes sense that we would see the Canadian dollar suffer as it is a proxy for the oil markets that currency traders will use occasionally. That being said, it is only one of many factors as the Americans are actually larger producers of crude oil than Canada now. If you are going to use the CAD for a proxy to trade oil, typically you are better off trading something like the CAD/JPY pair.

Canada

Canada currently has a lot of concerns bubbling just underneath the surface when it comes to its economy. Because of this, I think that this may have more to do with underlying structural problems when it comes to housing and banking in the Great White North. Ultimately, there are too many reasons stacking up against the Loonie to think that Canada is going to show strength in the currency markets.

The main take away

The main take away of course is that we still have plenty of bullish pressure underneath. However, there is a significant amount of resistance near the 1.35 handle, so short-term pullbacks are buying opportunities that should eventually shoot to the upside. Once it does, I suspect that the market will probably go looking towards the 1.36 level, and more than likely beyond as it will be a longer-term move. At this point, selling is extraordinarily difficult.