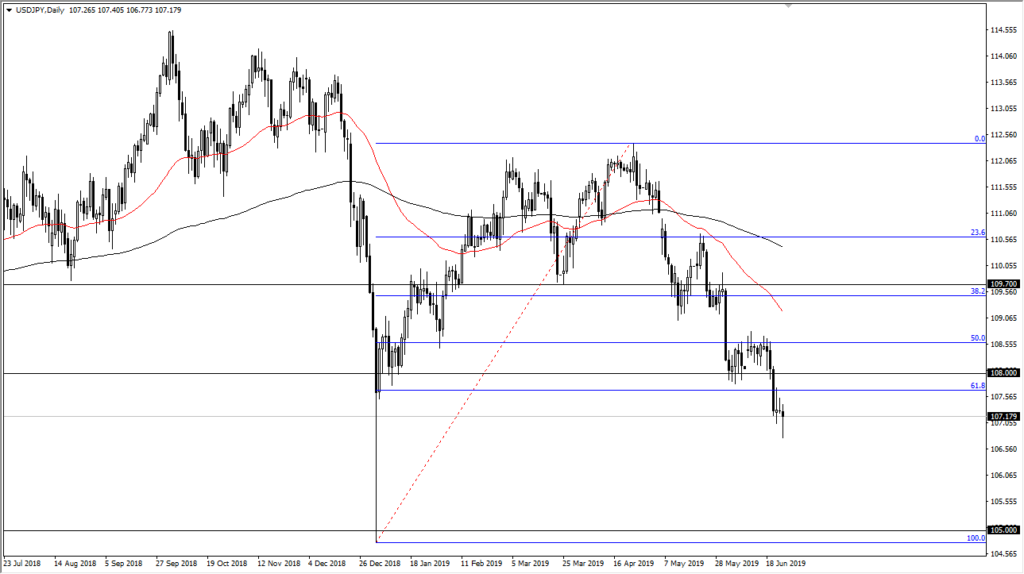

USD/JPY bounces after falling on Tuesday

The USD/JPY pair fell during the session on Tuesday but has found a bit of support later in the day. This was against the backdrop of several Fed speakers, which as usual confused the markets. The markets are going between positive and negative, but overall the situation continues to be an issue.

61.8 % percent Fibonacci

USD/JPY

The market continues to stay below the 61.8% Fibonacci retracement level, and as a result this market should be considered bearish at this point. It is quite common to see a market break down to the 100% level after a move like this, and even if we get a bounce like we have had during the session on Tuesday, it is very likely that the sellers will return given a chance. The breaking of the 108 level has also thrown more bearish attitude in the pair, as the markets simply are running from a dovish Fed.

Federal Reserve

The Federal Reserve has shifted its stance on monetary policy, and therefore looks to be cutting rates this year at least two times. This should send the value of the greenback lower against most currencies, but especially the Yen in this case, as there are a lot of geopolitical concerns around the world. The Yen is a safety currency, and one of the few places traders will run to when leaving the greenback in fear as it were. It is because of this that the pair should be particularly interesting as the dynamics of the trading environment work in favor of Japan in both a ‘run from the dollar scenario’ and a ‘run from fear scenario’ at this point.

The main take away

While it might be rather choppy in the short term, it’s very obvious that this market is in a downtrend. Because of this I’ll be looking for short-term pullbacks to take advantage of in what is an obvious longer-term downtrend. I have no interest in trying to “catch a falling knife” here, but I do recognize that in the short term we may bounce as high as the ¥108 level before finding sellers again. With that in mind I would be a seller at the first signs of exhaustion, or of course a break down below the bottom of the candle stick for the day on Tuesday.

Typically, we will go down to the 100% Fibonacci retracement level which means will be heading down to the ¥105 level or so. Because of this, it’s very likely that this will move right along with risk appetite as the stock markets starting to show the same type of nonsense. We have gotten a little overextended and a lot of risk appetite and now very unlikely that we can continue. All things being equal to very likely that this market will continue to be more of a short-term traders market with a negative bias. Keep an eye on the G 20 talks in Japan, they will more than likely disappoint and therefore send money back into the Japanese yen anyway.