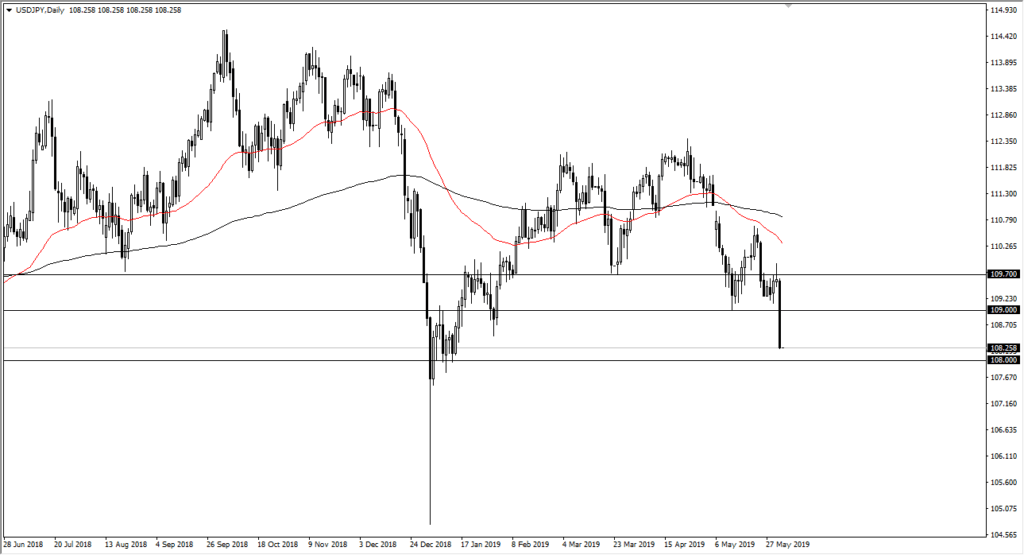

USD/JPY breaks down to test support

The US dollar got hammered during the trading session on Monday as more of a “risk off” trade took over again. After all, the US dollar will fall against the Japanese yen in times of economic concern, and with the headlines crossing the wire it’s no surprise that we fell hard.

China increases tariffs

The US dollar fell against the Japanese yen as the Chinese said that they were raising tariffs against the United States starting in June. This has people concerned about the overall global economy, and therefore people started running for shelter. The S&P 500 got absolutely crushed, as the market found plenty of reasons to sell off. With that being the case this pair followed suit as it typically does.

Potential support

The potential support at the ¥109 level has held so far, and it does significantly look like we are going to find value hunters. After all, the Americans continue to ignore on the trading floors a lot of the negativity, and as a result the S&P 500 has been rather resilient. Beyond that, we are breaking through the bottom of the Bollinger band indicator yet again, so it’s only a matter of time before we get some type of snapback.

That being said, if we break down below the ¥109 level, then we could go down to the ¥108 level next. That is an area that will also be supportive so at this point it’s probably a bit overextended to the downside to start shorting.

USD/JPY

Fickle markets

We are starting to see the markets act very fickle light, and therefore all it’s going to take is some good headline to send things back around. Beyond that, we have a major gap above at the ¥111 level, which has yet to be filled so of course there will be certain traders out there looking to fill that gap. This is typical with the Forex market, but that doesn’t necessarily mean it needs to happen today. It may take quite some time to come to fruition, and therefore some type of supportive candle stick underneath on the daily chart is what I’ll be looking at as an opportunity to place a trade.

Keep in mind that if we do rally from here to go fill the gap, it’s probably a long-term affair and therefore will take quite a while to come to pass. You will need to be very patient, but sooner or later we will turn around to try to fill that gap as markets hate them.

The main take away

The main take away is that the market will turn around eventually, and if you are patient enough you can take advantage of it. There was a bit of a “knee-jerk reaction” to kick off the week but if we see the ¥109 level stabilize the market, it’s only a matter of time before the value hunters come back and start pushing to the upside. This is a market that hasn’t moved very much on a daily basis, but at this point we could be setting up for a two handle move.