Features of Overlapping Corrective Waves Explained

Elliott defines a five-wave structure as an impulsive wave, and a three-wave one as a corrective wave. This is what the Elliott Waves principle is, and its simplicity is actually the one thing that makes it so complicated. This is due to the fact that different waves of different degrees are coming and forming at the same time, so the trader needs to know how to differentiate between those different degrees. An impulsive wave, for example, can be only the first wave of an impulsive wave of a bigger degree, or the third wave, or the fifth one, or it can be the a-wave of a zigzag, the c-wave of a zigzag, or the c-wave of a flat pattern. All these possibilities make the whole Elliott Wave count process a difficult one, and the only way to have a clue as to where a specific count starts and ends is to interpret it from a top-down analysis point of view. This means that one should start with historical data based on the monthly charts or longer-term, then go onto the shorter timeframes, step by step, finding impulsive and corrective waves in order to come to a timeframe short enough to allow a trade to be made. One way to differentiate between the places where an impulsive wave may appear is to look at the two corrective waves (the second and fourth wave) and check whether they are overlapping. The overlapping principle, while a very simple one, differentiates between different places where an impulsive wave may or may not appear.

| Broker | Bonus | More |

|---|

Defining Overlapping

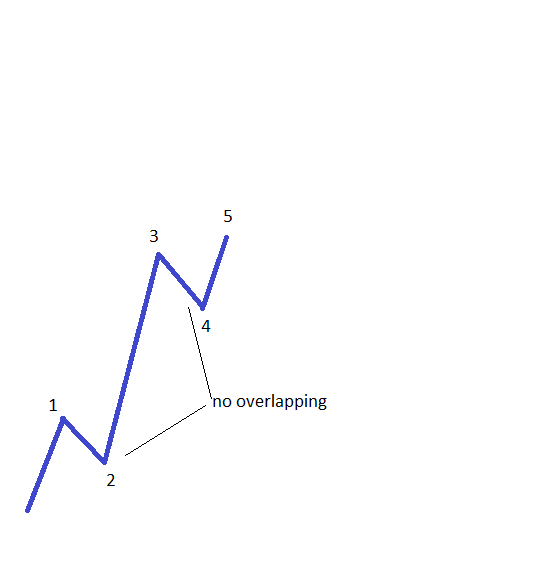

Overlapping refers only to the two corrective waves in an impulsive move, namely to the second and the fourth wave. The whole idea is that no parts of the two waves should come into the same area. If this is happens, then the whole impulsive wave is actually not impulsive, but corrective. Overlapping therefore helps traders to know whether an impulsive wave is really an impulsive wave or whether it is a corrective one. However, as with the overall Elliott Waves theory, things are not that simple, but are in fact slightly controversial. In reality, the overlapping principle opens the gates for two distinct possibilities when it comes to an impulsive wave, both of which are extremely important. One is referred to as to the classical impulsive move we mentioned earlier in our Forex Trading Academy project, and the other one is based on overlapping.

Overlapping in a Classical Impulsive Wave

Impulsive Waves that Overlap

This is one of the trickiest things in Elliott Waves theory. and it needs a clear description in order for it to be properly understood. Keep in mind that the Elliott Waves principle is basically a logical process that leaves no room for error. In other words, at one moment in time, a trader may corner a market, in the sense that based on the logical process of a top-down analysis, the market cannot possibly form anything but an impulsive wave. For example, if waves a and b of a flat or zigzag are completed, or all the previous four waves in a classical impulsive move are completed as well, then the logical thing is to expect an impulsive wave for either the c-wave of a flat or zigzag, or the fifth wave of an impulsive wave. This five-wave structure on its own can have the fourth and second waves overlapping. If this happens, Elliott found out that ALL the waves in this structure are actually corrective ones, even though, in the end, they are labelled with numbers. There are multiple names for this pattern, such as a terminal triangle, or terminal activity, etc., and this comes from the fact that, indeed, the move appears at the end of an impulsive or corrective wave.

Such a logical process can be used in reverse as well. Consider you are expecting an impulsive wave to form in one of the situations described above. However, no matter how hard you try to find a five-wave structure, the outcome shows only corrective waves. If this is the case, overlapping MUST be present, as this kind of terminal pattern must have the second and the fourth waves overlapping. If that is indeed the case, we can say the pattern is correctly identified. Rookie traders who are not familiar with in-depth Elliott Waves analysis principles have a well-known pattern that indicates terminal activity. This is the classical rising or falling wedge. A terminal pattern that overlaps in the end, looks like a wedge! It is therefore a reversal pattern, which is normal if one considers that this terminal activity forms at the end of a pattern. We all know that a rising wedge falls and a falling wedge rises, and this should be the case in this instance as well. The nature of a wedge is given by its trendlines. In a terminal pattern like the one Elliott discovered, connecting the end of the 1–3 and the 2–4 waves will result in a pattern looking like a wedge. The moment at which the 2–4 trend line is broken is considered to be the end of the pattern, and therefore the end of the overall impulsive wave.

As you can see from this whole article, a single and simple principle like the overlapping one can influence a count and change it from its core. Knowing all these tips and tricks that are part of the overall Elliott Waves theory can only help a trader to excel in finding the best set-ups to trade.

Other educational materials

- How to Trade 2nd and 4th Waves

- The All-Important B Wave Retracement

- What Are Corrective Waves?

- Trade Forex with Simple Corrections

- Complex Corrections in Elliott Waves Theory

- Types of Flat Patterns

Recommended further readings

- “A STUDY TO UNDERSTAND ELLIOTT WAVE PRINCIPLE.” Prasath, S. Naveen.

- “The security price movements with Fibonacci series numbers.” Niromand, Atefeh, and Azam Niroomand. In e-Commerce in Developing Countries: with focus on e-Tourism (ECDC), 2016 10th International Conference on, pp. 1-7. IEEE, 2016.