Spot Reversals with Head & Shoulders Patterns

Trading patterns are powerful tools that are used to spot trend behavior. The head-and-shoulders pattern is one of the most important of these as it indicates a potential reversal. You probably already know this fact. But do you find that something goes wrong every time you try to apply it?

Maybe you’ve stared at a gazillion charts, but you can never seem to properly identify the head-and-shoulder pattern, nor can you understand what it’s trying to tell you. Maybe it’s become ridiculously frustrating.

The good news is that this page is going to help you master this awesome pattern. You’ll learn what makes it, and more importantly, you’ll discover what it’s indicating based on how the pattern forms. We’ve also included a video and a few charts so you can see exactly what’s happening.

| Broker | Bonus | More |

|---|

If you want to truly master this pattern, though, you’re going to have to practice identifying it. A great way to do that is to use historical charts because you can see the head-and-shoulders pattern but also how price changed after it formed.

So, make sure to sign up with one of our trusted forex broker sites so you can access the historical charts necessary to help you improve your ability to identify the invaluable head-and-shoulders pattern.

Video Transcription: How to Trade the Head and Shoulders Pattern

Hello guys. We move on with our trading academy on Topratedforexbrokers.com with one of the most interesting patterns which is part of the western approach of Technical Analysis, the Head and Shoulders. Everyone knows what the Head and Shoulders is, but few know how to master this wonderful pattern.

(0.24) First of all, it is a reversal pattern, a classic reversal pattern which is part of technical analysis. You need a Bullish trend, and then the pattern, the head and shoulders, let’s take a shape from here, and then the pattern, and then the market will simply reverse after the head and shoulders.

(0.44) So, a Bullish trend, a reversal pattern, and the head and shoulders and a then Bearish trend. A head and shoulders does not always appear at the end of a Bullish trend, it can form at the end of a Bearish trend. For example, you have a Bearish trend like this one, the market forms an inverse head and shoulders pattern and then it moves to the upside.

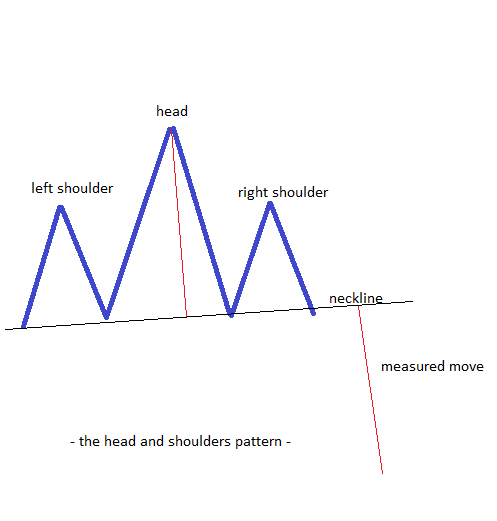

(1.08) Before anything, let me show it to you here. What a head and shoulders looks like in textbook materials and not in the Forex market. So, we have a Bullish Trend, then A bit of a consolidation starts, let me put this one here, and the market hesitates and then it consolidates for a while.

(1.31) It depends on the timeframe. The bigger the timeframe the more powerful the implications are. So, a bit of a consolidation here. It could form on the horizontal, in textbook materials you may find this on the horizontal but it’s not mandatory. And then, at this moment, as Technical traders, we don’t know how the market will form here.

(1.57) But the next move you will see is a high spike, an aggressive high spike destined to top everyone on the short side. However, only a few moments later or a few candles later, the market retraces, all the way down to the original consolidation level and it forms another consolidation.

(2.21) At this very moment when we see a spike like this, followed by a quick retracement, we know that the market forms a head and shoulders, and traders will focus on this consolidation on the right side.

(2.36) As you probably have an idea, or if you don’t, then the head and shoulders pattern, or its shape comes from the Human body. There is the head and there is the two shoulders. The head is made up of these two spikes, let’s make it a bit different. This is the head. (types head)

(3.07) And of course the two shoulders, here is the left shoulder here and the right shoulder is this one here. Basically the consolidation area represents the two shoulders and the head represents a high spike and a low spike. That is the head and shoulders pattern.

(3.32) How do you trade this one? It is very easy. The head and shoulders has one head, two shoulders and a neckline. What does a neckline mean? It means the traders take a trend line, they connect the consolidation part of the two shoulders here.

(3.53) let’s change the size and colour and here we have the neckline. Everyone waits for the neckline to be broken, here on the right. Already from here we know that we deal with a Head and Shoulders pattern, a reversal pattern. So we wait for it to be broken, and when the price breaks the neckline, that’s it. The reversal pattern ended and the market should reverse.

(4.20) Now, how about the take profit. When you enter a trade you must know your way out of it before you go in. You simply apply the Measure Move of the Head and Shoulders. The measure move goes from measuring the length from the neckline all the way to the top of the head and we paste it from the moment that the market breaks the neckline and there is the target for your trade.

(4.48) Before anything, it is orientatitve . What does that mean? It means that it is the minimum distance for the price to travel. Being a reversal pattern, it reverses the previous trend and then a new one will start. If anything at this very point when the measure move is reached, as traders we should move the stop loss and break even or trailor stop in order to profit as much as possible from the new trend.

(5.23) Most of the times, although it is not mandatory, the market, after breaking the neckline, it retest the neckline and then it moves low. Some traders wait for the neckline to be mandatory, but it’s not mandatory. Sometimes you end up waiting for the neckline to be retested only to see that the price has reached the take profit on the measure move.

(5.50) So it is a two way street and it is a risk that aggressive retail traders will take and a risk that conservative traders won’t take. Now this is the theory on how to trade the head and shoulders pattern. Let’s see in reality how it looks.

(6.07) Before going on the practical side, the more the right shoulder resembles the left shoulder in terms of distance the price travelled, the amplitude and so on for the time taken for the two shoulders, the more powerful the pattern. Keep that in mind when you search for these kind of patterns.

(6.30) This is the US Dollar and Canadian Dollar on the four hour chart and in January 2016, you remember when the oil price collapsed from over 100 dollars down to 30 dollars. It triggered a move high on the US Dollar/ Canadian Dollar. Why? Because the Canadian Dollar is strongly correlated with the oil market as the Canadian economy is an energy driven economy and therefore oil moves are reflected in the Canadian Dollar price.

(7.04) At the very top, what did the market do? It consolidated, remember, this is a four hour chart, there is no way to say or no excuse that you did not see this kind of pattern. Followed by, a sharp move high and stopping everyone.

(7.27) From 137 to 146, almost a thousand pips and coming back to almost the same area. This would be the left shoulder here. Another consolidation somewhere around here, then all you have to do is take the neckline of our Head and Shoulder (moves the neckline). Look how it was in theory, the neckline and head and shoulders is always presented at horizontal lines…

(7.57) .. but in reality it looks something like this. In the measuring move, what would be the measure move. We measure the length from the top of the head to the neckline and ideally keeping a 90 degree angle in order to make it as accurate as possible.

(8.15) Then we project the take profit for a move like this. You may say this is ok, this is an example. But it is a perfect one from the aggressive trader where the trader goes short from the moment that the neckline is broken.

(8.37) but also for the conservative broker, because if you went short here, then you had to wait for another 36-38-4 hour candle for the market to come into the neckline. The aggressive traders would add here as well.

(8.55) And then simply wait for the measure move to come. This measure move may only be orientative and it may reverse the trade. In reality the market dipped all the way to 1.24 only to come back to the same level on the measure move. It’s not like you missed something, but the idea of trading a head and shoulders pattern. The left shoulder, consolidation. A high spike followed by a low spike and another consolidation for the right shoulder, breaking the neckline and retesting it and going for the measure move.

(9.36) Ladies and gentlemen, this is how you trade the head and shoulders pattern. The FX Market is full of them, on any time frame, on any currency pair, so simply enjoy this technical pattern. Goodbye

The head and shoulders pattern is one of the most popular reversal patterns, and there is virtually no trader out there who doesn’t know what the pattern looks like. If the head and shoulders is a reversal pattern, it means that it forms at the end of a trend, whether a bullish or a bearish one. In this area in the Forex Trading Academy project we’re building here, we’re going to cover one more reversal pattern, the wedge. Compared with the head and shoulders pattern, a wedge appears more often, but, from an importance point of view, I would say both rate equally. From an Elliott Waves point of view, the head and shoulders pattern is associated with triangular formations. However, not all triangles look like a head and shoulders pattern, but only triangles considered to be of a “special type”, like the c–e and a–e ones. We know by now that a triangle moves between the b–d and a–c trend lines, but when it is not possible to draw the a–c trend line , then the triangle falls into the “special type” category. This is the point at which when Elliott Waves traders should start looking for a head and shoulders pattern.

What Makes a Head and Shoulders Pattern?

The head and shoulders pattern is made of three elements:

- The head – This is the highest spike (if the pattern follows a bullish trend) or the lowest dip (if the pattern follows a bearish trend), and it is usually a very aggressive move.

- The left and the right shoulder – These are two consolidation areas that form on the left and the right side of the head.

- The neckline – This represents a line drawn from the left to the right shoulder to mark the end of the whole pattern. As a rule of thumb, by the time the neckline is broken, the pattern is completed.

The Measured Move

Retesting the Neckline

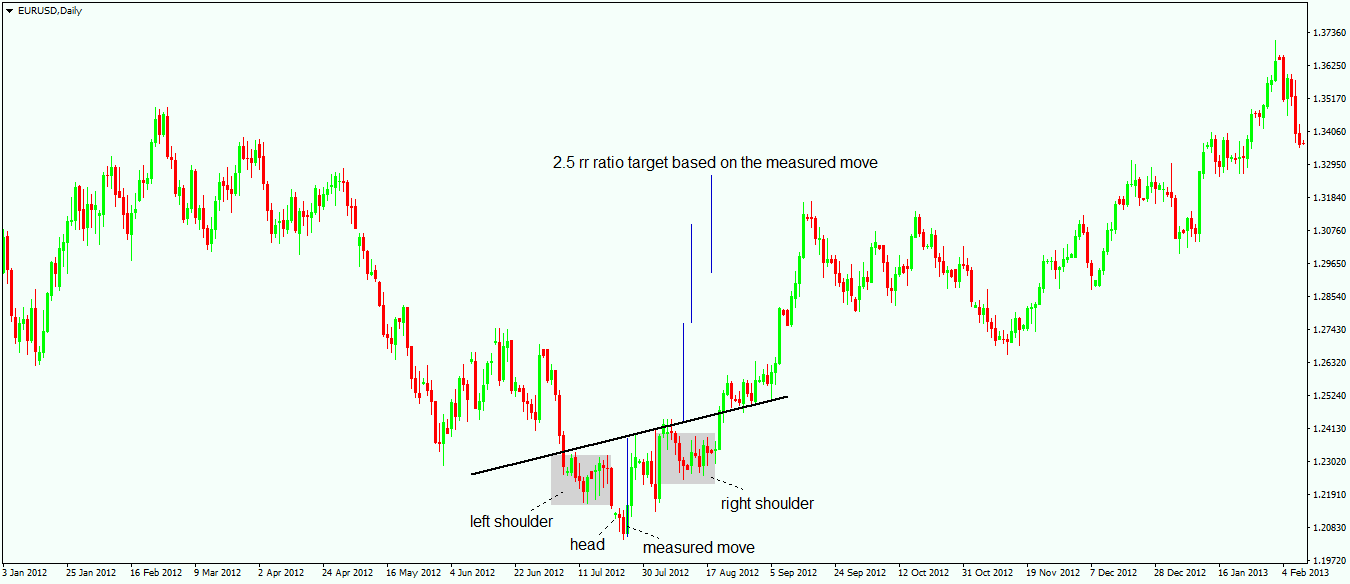

There is a saying that the neckline must be retested after it is broken, but this is not a mandatory thing to look for. As a matter of fact, if the measured move has already reached 61.8% of the whole distance to be travelled, and the neckline is not retested, then the whole pattern was probably misinterpreted, and there was no head and shoulders pattern in the first place. If the previous image in this article showed you how the head and shoulders pattern looks in theory, the reality is totally different. The chart below represents an inverted head and shoulders (this means it is formed at the end of a bearish trend) formed on the daily EUR/USD chart, and it depicts the pattern as it is most likely to be found on the Forex market: ugly, difficult to see, and ultimately rewarding.

The head of the pattern is aggressive both on the downside and the upside move, the neckline is not horizontal (as a matter of fact, you will rarely see a head and shoulders pattern on the Forex market that has a horizontal neckline), and it is retested twice. The retest of the neckline comes with almost 2 weeks of consolidation, and this is enough time to spot the pattern and to position accordingly for the move to come. The risk/reward ratio is mandatory, and the classical 2.5 r/r ratio is reached without any problem. The measured move acts here as the base for projecting the risk/reward ratio, and such a ratio should be used every time a trade is opened. In doing that, the trader is disciplined and has a trading plan, which allows for only one winning trade with every 2.5 trades to be enough to stay in the market and not lose money. In the example above, the neckline was retested, but again, this is not a mandatory thing to look for. Sometimes traders stubbornly look for the retest, and in doing so they end up on the wrong side of the market.

The head and shoulders pattern works very nicely with the Elliott Waves theory. Because of its association with triangular formations, it means that the pattern that ended with a head and shoulders is a complex correction. If you look at the articles dedicated to complex corrections here on the Forex Trading Academy, you’ll find out that complex corrections end most of the time with a triangle. Moreover, they will give us a clue regarding the move to follow, whether it is impulsive or corrective, and will have a target for it as well. What I’m trying to say here is that things have a way of correlating with each other, and understanding and applying all the things that make up the Forex Trading Academy articles will lead to successful trading. The only way to survive the Forex market’s aggressive swings is to be flexible, and correlate different trading theories and patterns.

Other educational materials

- How to Use Parabolic SAR to Buy Dips or Sell Spikes

- Bollinger Bands – Profit from One of the Best Trend Indicators

- NASDAQ

- New York Stock Exchange (NYSE)

- A Guide for Trading Rising and Falling Wedges

- How to Draw a Trendline

Recommended further readings

- “Head and shoulders: Not just a flaky pattern.” Osler, Carol L., and P. H. Chang. FRB of New York staff report 4 (1995).

- The predictive power of “head-and-shoulders” price patterns in the US stock market. Savin, G., Weller, P., & Zvingelis, J. (2007). Journal of Financial Econometrics, 5(2), 243-265.