Australian Dollar Dips on Disappointing China Results

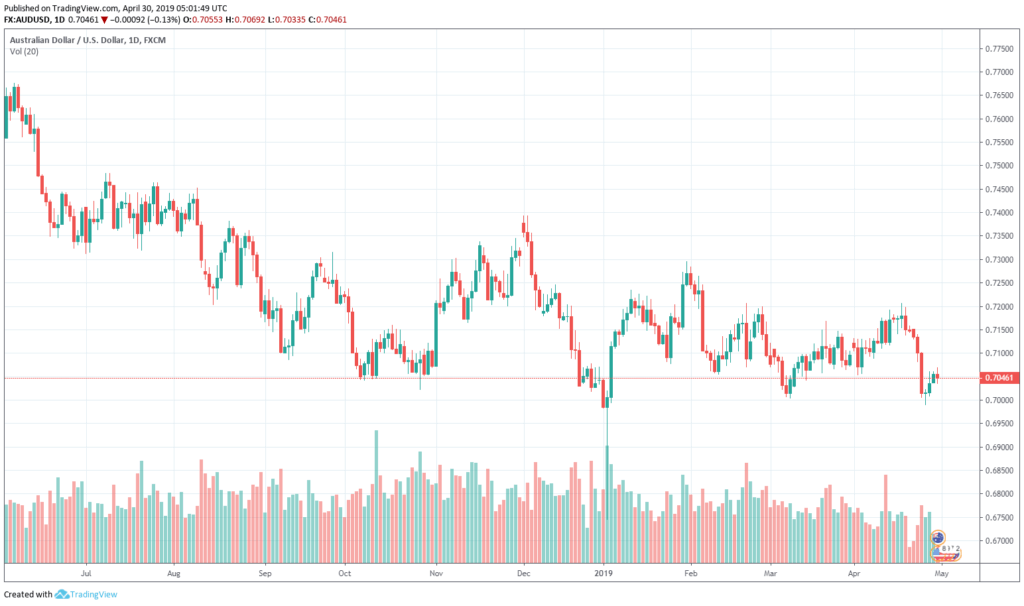

A busy day through the early Asian session on Tuesday saw slower than expected April growth for the Chinese manufacturing sector. This had a knock on impact on AUD/USD trading. This was down slightly to 0.7043 at the time of writing. It had dropped 30 pips on the initial data release.

Why the Strong Impact on Australia?

Close trading connections mean that the AUD often feels a direct impact from Chinese economic results. According to the Department of Foreign Affairs and Trade in Australia, China is their largest trading partner. This leads to the Aussie dollar frequently being used as an investment proxy for many in China.

While the PMI Index for April did fall below what analysts had projected, coming in at 50.2, when 51 had been predicted, the reading is still positive in indicating growth. This is typically one of the earliest indicators. It could point toward a difficult period coming up in China. The AUD/USD did being to pick up slightly as the news settled in the afternoon.

AUD/USD Chart – April 30th

The Wider Implications

A PMI of more than 50 is still seen as widely acceptable, and experts predict the Chinese manufacturing PMI will remain at around 50.5 in the coming months, these are some concerning signs for the markets. In turn, this could lead to further troubles for the Australian Dollar.

The non-manufacturing PMI, a very important indicator which encompasses the service sector, and more than 50% of the Chinese economy, also fell on Tuesday. This was down 0.5, to 54.3 for the month of April. These could be the early signs pointing to a slowdown.

These figures come in stark contrast to last week’s figures which reported an above estimated growth in the first quarter of 2019. This 6.4% YoY growth number has led many major banks to increase their growth forecasts for China.

With some worried we are seeing the earliest indications of trouble ahead, many more analysts urged against premature judgement based on these Purchasing Managers’ Index figures alone. They pointed out that several more months of numbers should be observed to get a truer picture. As with all things China related however, these numbers and their accuracy can be difficult to fully assess, given the levels of transparency which Beijing is known for.

Bottom Line for Traders

The AUD has shown slight signs of resilience after its early drop to a session low of 0.7037. This does not mean that AUD/USD traders are out of the woods yet. Market sentiment is still bearish. This looks likely to continue for the rest of the day at least.

Today’s missed indicators may also point to further problems in the coming months for China. This would also be bad news for the Australian Dollar, given the close trading ties which the two nations share.

In other figures released today which are relevant to AUD/USD trading, private sector credit in Australia rose by 0.3%. This was in line with forecasts.