Australian Dollar Falls Against Singapore Dollar Again

The Australian dollar continues to slide against many other currencies, and of course, the Singapore dollar isn’t going to be any different. While a lot of you won’t necessarily trade the Singapore dollar very often, it should be thought of as the “Swiss franc of Asia.” So what does this mean essentially? This is what we need to ask ourselves at this point.

Potential meaning

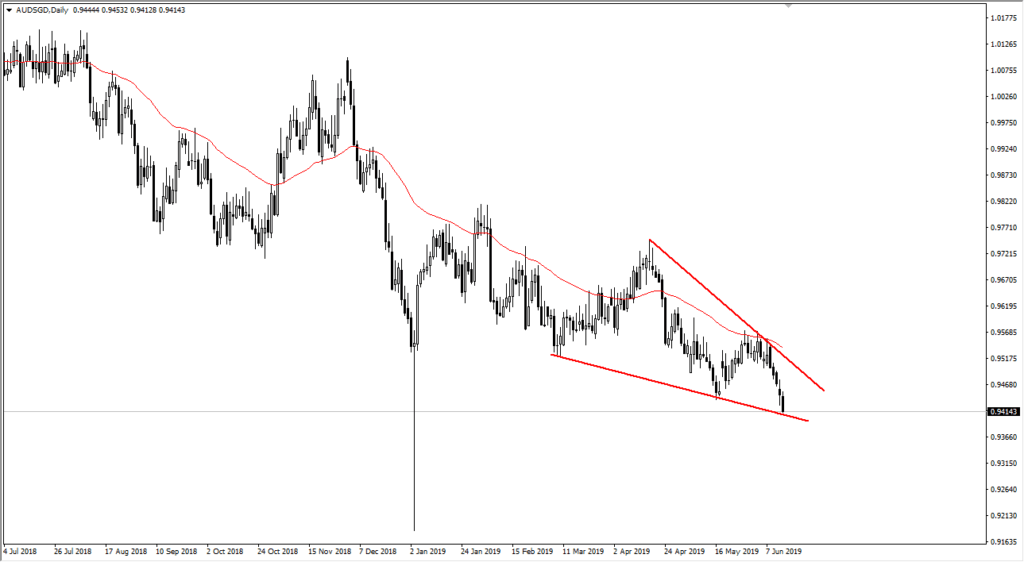

The Australian dollar initially tried to rally against the Singapore dollar during the trading session on Friday. It then broke down rather significantly. The uptrend line underneath that I have drawn on the chart shows that there is a certain amount of channeling or perhaps even a wedge that we are trying to form. However, take a moment to think about what this could mean.

The Australian dollar is of course considered to be a “risk on currency”. It is highly levered to the Chinese economy, and of course the US/China trade situation. At that point, it’s very likely that we continue to see softness in the Australian dollar against safer currencies such as the Singapore dollar. While not as popular as the Swiss franc, it certainly is treated the same way.

AUDSGD Daily Chart

Downward slope

The downward slope in this pair can’t be ignored. Now that we have cleared the most recent low, it looks as if we are going to go much lower. Perhaps reaching down towards the 0.92 level again. We are a little overextended at this point so any bounced this point could be a nice selling opportunity. The 50 day EMA sits just above the downtrend line as well, so given enough time it’s very likely that we could have more selling pressure on rallies.

However, we are closing towards the bottom of the range and that, of course, suggests that we could very easily continue this action without a bounce. The proxy for that would be a close below the 0.94 handle, which would be another clearance of potential support as it is a large, round, psychologically significant figure.

Final thoughts

While many of you have probably been paying attention to the AUD/USD pair, as it continues to slide lower, there is a lot less support underneath the SGD to keep the Australian dollar floating. After all, we have just recently heard the Federal Reserve changing its attitude overall, and therefore there could be a little bit of a floor underneath the AUD/USD pair. However, Singapore is an entirely different situation, and beyond that, it isn’t traded as heavily as the US dollar, so it’s easier to push the market lower.

I’m looking to sell short-term rallies going forward, or that break down below the 0.94 level. I suspect there are another 200 pips to the downside as we reached towards the lows again. There’s no reason to think anything is going to change soon, but if we do get a US/China trade deal, that would be very bullish for the Aussie overall, including in this market. However, there’s nothing on the horizon that suggests that’s going to happen very soon. Keep in mind that this pair does tend to grind more than run, so be patient to take advantage of a long-running trend and of course to collect profits