Australian Dollar Rallies After Philip Lowe Speech

- Philip Lowe gave speech in Sydney

- Paints the idea of 2020 being better than 2019

- Australian dollar rallies in reaction

Early on Wednesday, Gov. Philip Lowe of the reserve Bank of Australia addressed the National Press Club in Sydney. As per usual, traders were paying close attention to comments from the head of the Australian central bank, as the RBA recently held firm on rates.

In his speech, he suggested that some things over the last year have turned out as anticipated, but there have been plenty of surprises along the way. He reiterated that no doubt it will be the same going forward this year, but he would like to reiterate that the Australian economy remains resilient.

Most importantly, he suggests that the global economy outlook for the next couple of years seems reasonable and growth is expected to be a little stronger than it was during 2019. He mentioned that the IMF estimated that the global economy expanded by 2.9% last year and in its latest published forecast is predicting growth to reach 3.3% for the year, with 3.4% being the target in 2021.

He reiterated that the growth wasn’t as anticipated during the year 2019, but there were external factors that weren’t calculated in the RBA estimates. The biggest one would be the United States and China slugging it out in the trade war, slowing down demand on Australian raw materials.

He also further mentioned that the encouraging developments have made a reasonable basis to expect that the upcoming year should be better than last year. Having said that, he also reiterated that it is possible that tensions between the United States and China could flareup again, creating a bit of a wildcard in its outlook for the next year.

Many countries have unemployment at the lowest levels in decades, with the United States being at its lowest level since 1969, and the United Kingdom is at its lowest level since 1974. Having said that, inflation remains rather subdued.

The reaction to his comments

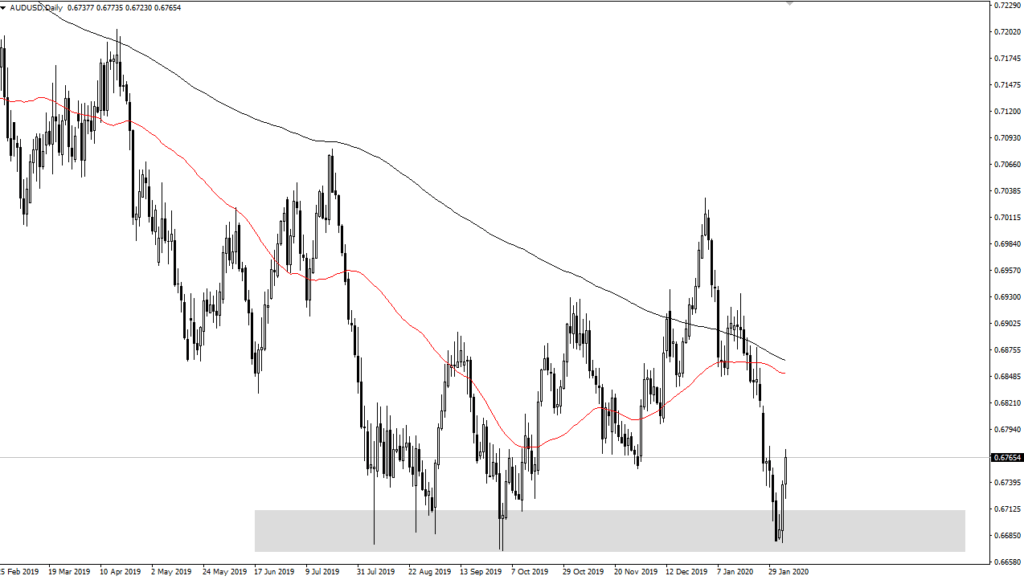

AUD/USD yearly chart

The Australian dollar has rallied against most currencies from an extremely low level. With a rosier outlook going forward, this should help get rid of some fears of owning the Aussie, and it suggests that perhaps some type of bottom is trying to be put in.

It is worth noting that just below the 0.67 level against the US dollar begins the consolidation area from the financial crisis from over a decade ago. This puts in perspective just how far down the Australian dollar has been over the last couple of years.

If it is in fact the beginning of a trend change, this will be a very noisy and erratic path higher, but it appears that the start of major long-term support could be being baked into the price.