Bitcoin Likely to Continue Falling

- Central bank easing hasn’t helped

- Break of major uptrend line

- Below 200-day EMA

Bitcoin was very lackluster during trading on Thursday, as the market is hovering around the $8000 level. This is an area that will attract a certain amount of attention as a large, round number, but it is also an area that has seen support as recently as two weeks ago. That being said, the market has broken through some technical barriers to the downside, and it certainly looks as if it’s ready to slump lower.

A story of disappointment

While the rest of the world burned, essentially, geopolitically and as far as interest rates are concerned, Bitcoin sat still. Bitcoin has been a story of disappointment for several months. There was an initial surge higher for the crypto markets, but most of this was due to Chinese money leaving the mainland. As capital controls were put upon Chinese citizens, the wealthier and more sophisticated ones were sending money out of the country and into the Bitcoin markets. This, in hindsight, was the biggest driver of this market to higher levels.

However, central banks around the world cutting interest rates should be good for Bitcoin. After all, one of the biggest arguments for Bitcoin is that it gets you out of the fiat currency system. There are a limited amount of coins, and they cannot be “printed” like fiat currencies such as the euro, the US dollar, and the Canadian dollar. However, Bitcoin isn’t reacting to a lot of the normal catalysts, which is a very ominous sign.

You could pay the equivalent of $1000 to a vendor today, but unfortunately for them, that amount could be worth $750 in the blink of an eye. It works both ways obviously, but in that scenario, Bitcoin isn’t going to be useful as money.

Technical analysis

BTC/USD chart

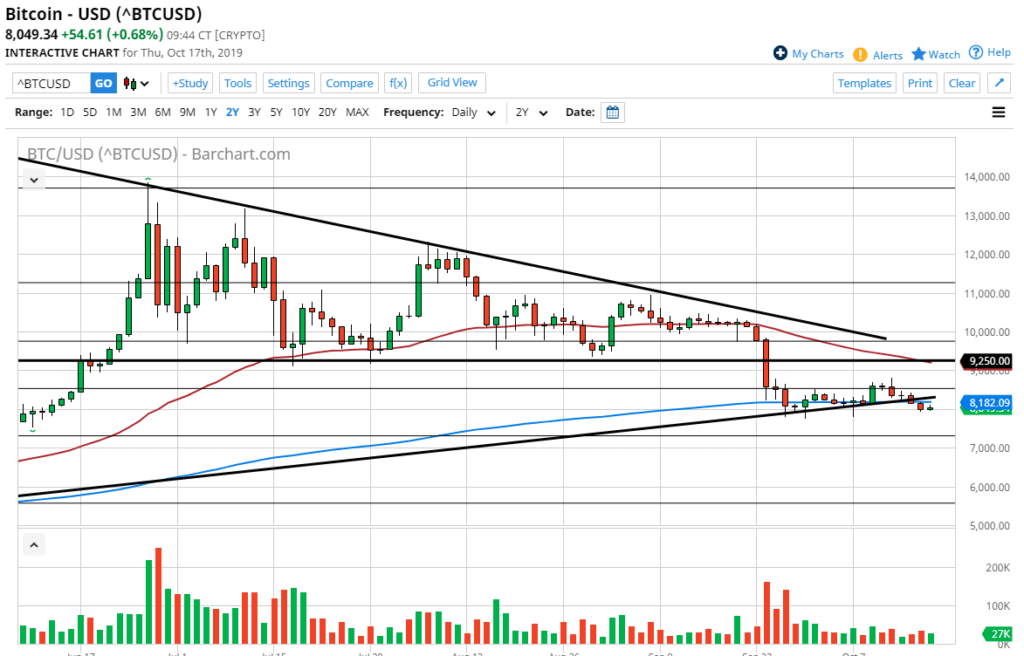

Bitcoin has broken down below the 200-day EMA, which of course is crucial. It has also broken through an uptrend line which attracts a certain amount of attention. But the most important signal on this chart is that it broke down below the bottom of a massive descending triangle that had a base at the $9250 level. As that was broken, it projects for a move down to the $4800 level. Although we’re quite far from that, market participants have seen Bitcoin make these kinds of moves in the past.

To the upside, the $9250 level will be a massive barrier if Bitcoin were to somehow get a bit of a bullish tone to it. Currently, though, fading rallies and selling fresh lows will make the most sense.