Bitcoin markets continue to find resistance

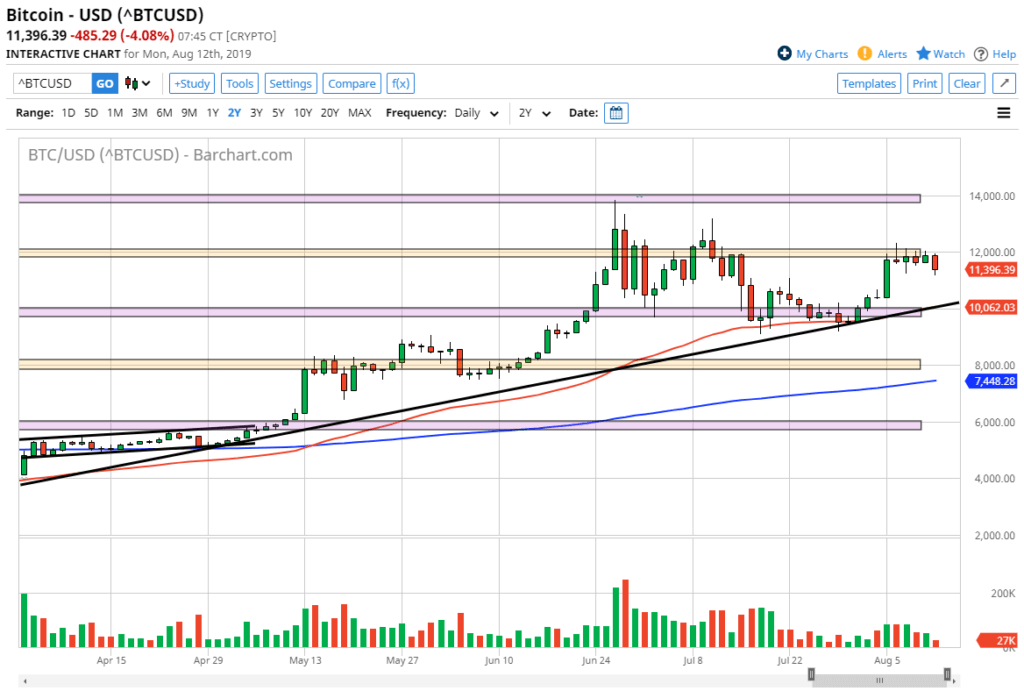

The Bitcoin market has fallen a bit during the Monday session, as the $12,000 level has offered resistance more than once. We have broken through the bottom of the last couple of trading sessions, so it is possible that we may get a little bit of follow-through here. The $12,000 level, of course, is a large, round, psychologically significant figure, and therefore it’s likely that we will continue to struggle to get above there. This doesn’t mean we can’t break above there, but it does suggest that we will have some work to do to get above that barrier.

Uptrend

The uptrend line underneath continues to offer a major support level for this market, and it has been tested a couple of times to show signs of life. The 50 day EMA also crawls right along with the uptrend line, as the 50 day EMA continues to show signs of life, it will attract a certain amount of larger institutional flow.

To the upside, we will eventually break above the $12,000 level but it will take a certain significant amount of momentum to finally clear that level, perhaps reaching towards the $13,000 level. If we were to break above the $13,000 level then has us taking the $14,000 level beyond that. That is a level that has offered a lot of resistance as well, and at this point, we will probably need to pullback occasionally to build up the necessary momentum, but eventually, that momentum will win the day.

Bitcoin Chart

Central banks

Central banks around the world continue to ease monetary policy, and that has money flowing out of fiat currencies such as the US dollar, which of course is the other side of the equation in this currency pair. Far too many crypto traders out there worry about the market not being fiat, but the reality is it functions just as a typical Forex pair. If the US dollar and other fiat currencies are starting to sell off, then Bitcoin continues to rally. Beyond that, gold has rallied quite nicely over the last several weeks, which of course gives me an opportunity to short fiat currency in not only Bitcoin but gold as well. They are starting to function on an almost one-to-one ratio.

How I’m trading

Bitcoin is a market that should be bought. I don’t have any interest in shorting Bitcoin as the $10,000 level underneath offering massive support, along with the 50 day EMA and of course the uptrend line. Ultimately, it looks as if the market is trying to build up the significant amount of pressure necessary to break through major resistance, and when it does we should do quite well to the upside. It’s obvious that there is a major back and forth situation going on, but clearly, it looks as if the market is starting to favor the upside. If we were to break down below the $9500 level, then we could go down to the $8000 level where we also have the 200 day EMA which should help as well. Buying dips continues to be an opportunity.