Bitcoin sluggish on Friday

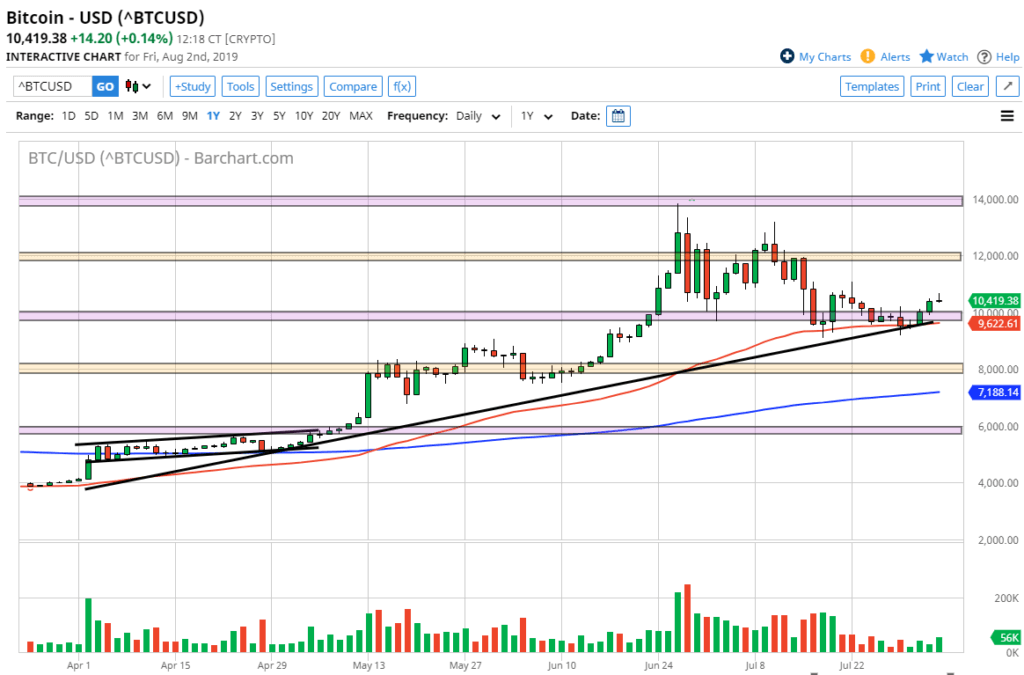

Bitcoin continues to be bullish overall, but the Friday session was of course a little bit sluggish as we are starting to form a bit of a shooting star. This is not a sell signal though; this is simply a sign where we are getting a bit sluggish. That doesn’t mean that Bitcoin is in trouble, rather it is digesting quite a bit of the gains that we had recently had.

Technical analysis

Bitcoin

The technical analysis of course is bullish still, although it has been a bit flat as of late. The uptrend line should continue to offer buying opportunities, as the market continues to show signs of strength. The 50 day EMA is just below, so that of course also offers a bit of support. Beyond that, the $10,000 level offers quite a bit of psychological importance to this level, as the Bitcoin market tends to be attracted to $2000 levels.

If we were to break above the top of the candle stick for the trading session on Friday, that would be a very bullish sign, perhaps opening up the door to $11,000 and then $12,000 after that. I recognize this as a market that continues to find plenty of buyers on dips, as people are concerned about the overall attitude of central bankers around the world. Central bankers around the world continue to cut interest rates, and therefore it’s very likely that the flow of money will be out of fiat currency and into alternate investments which of course this lines up quite nicely with.

All that being said, if we did break down below the 50 day EMA and close below there on a daily chart, then we could get a little bit more of a pullback, perhaps down to the $8000 level. Just below there, we have the 200 day EMA which of course attracts a lot of attention as well. One thing that should be noticed though is that the 50 day EMA is rarely broken in this pair.

The play going forward

The play going forward of course is to be buying Bitcoin on short-term pullbacks as it offers value. At this point, I think that the market continues to reach towards the $12,000 level over the longer-term. Short-term pullbacks should offer plenty of buying opportunities based upon value. That being said though, if we break down below the $8000 level, this market could start to struggle, but at this point it still looks bullish, even if it is a bit slow.