British pound continues to fall apart against yen

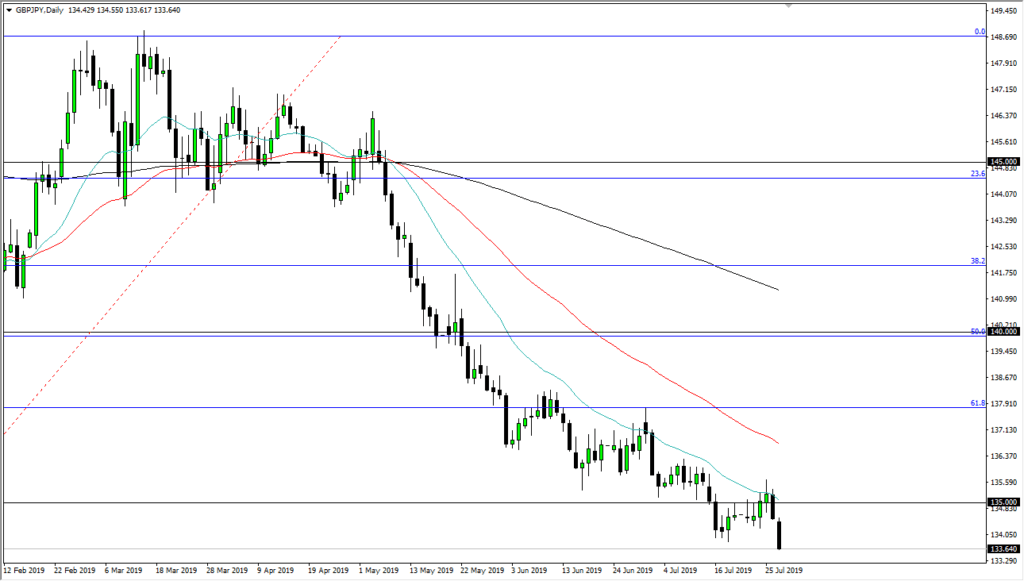

The British pound fell again to kick off the week on Monday, slicing through the ¥134 level almost immediately. We are at extreme lows and have passed several major areas to show signs of even further weakness. At this point, there is almost nothing on the chart that suggests strength going forward.

Strong downtrend

The pair have been in a stronger downtrend for quite some time, recently testing the green 20 day EMA, which of course is something that shorter-term traders tend to pay attention to catch intermediate moves. The fact that we failed there and then have fallen off a cliff immediately suggests that we are increasing to the downside. Beyond that, we obviously have the 50 and the 200 day EMA indicators above and sloping lower as well.

Breaking through the ¥135 level, of course, is a significant event, and we have now bounced towards there to start looking for resistance again. We have broken down from there, and at this point, it’s very likely that we go looking towards the next major level below, which of course would be the ¥131 level which is essentially where the 100% Fibonacci retracement level is sitting at. As a general rule, I have found that once you are below the 61.8% Fibonacci retracement level, we almost always will go looking to wipe out the entire move.

Bearish candlesticks

Bearish candlesticks over the last couple of days show just how negative this has been, and I do believe that the shallow pullback and bounce shows just how negative things really are going to be. If you look at the chart, it’s very easy to see that the longest candlesticks are all negative, and I don’t expect that to change anytime soon.

GBP/JPY Chart

Yes, it’s about the Brexit

Yes, it’s about Brexit. After all, we still have no idea how things are going to play out but they don’t look good. The fact that the United Kingdom is probably going to leave the European Union without a deal at this point, of course, has a lot of people running for shelter. It makes sense that the British pound falls in that scenario.

On the other side of the equation, it makes quite a bit of sense that the Japanese yen rallies as it is a safety currency. Ultimately, this is a pair that has been falling for good reason, and there’s not much out there to change the attitude unless of course the UK and the EU suddenly come to terms with something favorable. The European Union has no interest in trying to work things out further, and Boris Johnson has recently admitted that there need to be preparations for a “no-deal Brexit.”

Follow the trend

The best thing you can do is to simply follow the trend. Look for short-term rallies to continue to add to a longer-term position. Somewhere near the ¥131 level, we will probably see a significant bounce, but at this point there’s no reason to think we won’t at least try to get there.