Canadian Dollar Defended at 1.34

- Multiple attempts at 1.34 level fail

- Several hammers suggesting pressure

- Fear trade

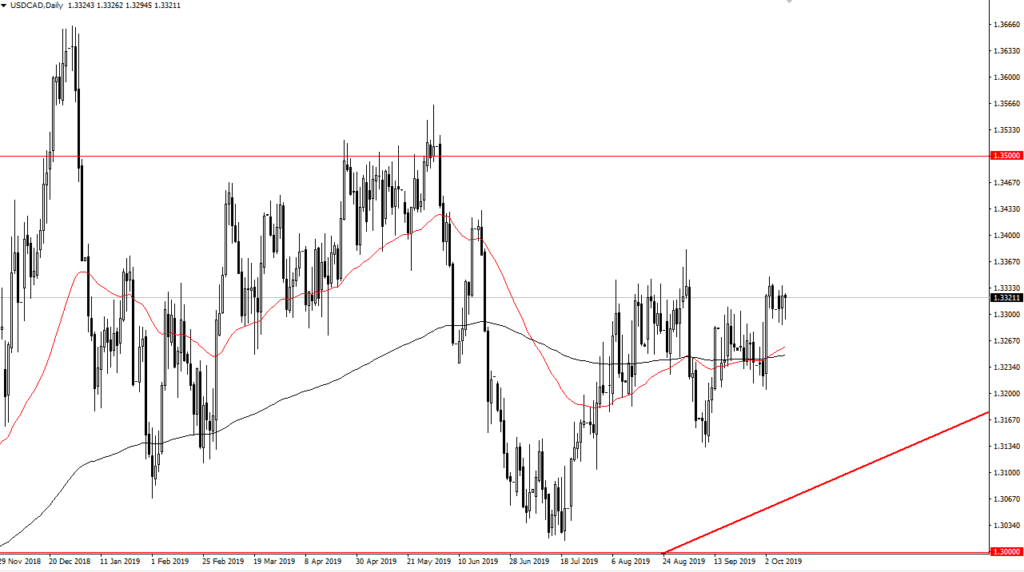

The Canadian dollar has been defended at the 1.34 level against the US dollar. The USD/CAD pair has broken down over the last couple of days, only to turn around and reach towards the 1.34 level repeatedly. This is an area that has caused resistance more than once, so it’s an area that’s worth paying attention to.

Canadian dollar and crude oil

The Canadian dollar is highly sensitive to crude oil, which has been significantly beaten down lately. The Crude Oil Inventories announcement came out much more bearish than anticipated during the trading session on Wednesday, so this suggests that perhaps the Canadian dollar will be continuing its lackluster performance.

That being said, the Canadian dollar has a benefit: the fact that it is so highly levered to the US economy. The US dollar has been strengthening against most other things, so while the CAD may lose a bit of traction against the greenback, it still should be thought of as relatively insulated against the rest of the world. After all, the rest of the world is going into recession, while the Canadians do over 80% of their trade with the Americans.

Technical analysis

USD/CAD chart

The most obvious bit of technical analysis when it comes to the USD/CAD pair is that the 1.34 level offers resistance. Looking at moving averages, the 200-day EMA has just been crossed again by the 50-day EMA, although both of those moving averages are decidedly flat. While the “golden cross” is technically a bullish sign, the reality is that markets have been very choppy and sideways lately. One would have to err on the side of caution in assuming that the 1.34 level above could continue to be a major problem.

The trade going forward

The trade going forward is to assume that the US dollar will be bought every time it dips against the Canadian dollar. That’s because, while the two economies are highly intertwined, the greenback is considered to be the “safety currency” in this market. As crude oil continues to drift lower in value and become oversupplied, the Canadian dollar will have a little bit of a head when facing that scenario. Ultimately, though, it suggests that a move above the 1.34 level opens up the floodgates to a move higher.