Constellation Brands Fizzing Over After Positive Earnings

- Earnings better than anticipated

- Constellation Brands raises outlook

- STZ testing 200-day EMA

Things are looking just fine for the beer, wine, and spirits giant as Constellation Brands Inc. released earnings premarket for the quarter on Wednesday. These showed better-than-expected profit and revenue numbers, with the company also raising its full-year outlook.

Constellation owns brands such as Robert Mondavi, Corona, and Svedka, and it is one of the largest distributors in the United States.

Earnings are bubbling over

The premarket trading on Wednesday rallied as much as 3.5% as the company revised its full-year outlook to the upside. It also produced the net income for the quarter to November 30 at $360.4 million, or $1.85 a share. This is much better than the 303.1 million, or $1.56 a share, from a year ago.

Earnings per share came to $2.14, including the loss of $0.25 a share from the company’s stake in Canopy Growth Corporation, the popular cannabis company. The consensus of $1.82 was smashed through quite easily, and therefore it’s likely that Constellation Brands will continue to see sustained growth.

Furthermore, beer sales increased 8.3% to $1.31 billion to beat the consensus of $1.30 billion. At the same time, wine and spirit sales fell 9.7% to $688.8 million, but they beat the rather low expectations of $649.4 million.

After the announcement of the numbers, the company raised its fiscal 2020 comparable EPS guidance from a range of $9.45 on the bottom, to $9.55 on the top. It had previously been guiding from $9.00 on the bottom to $9.20 on the top. While the stock (STZ) had lost 3.1% over the previous couple of months, it now looks as if it is going to play catch-up.

The play going forward

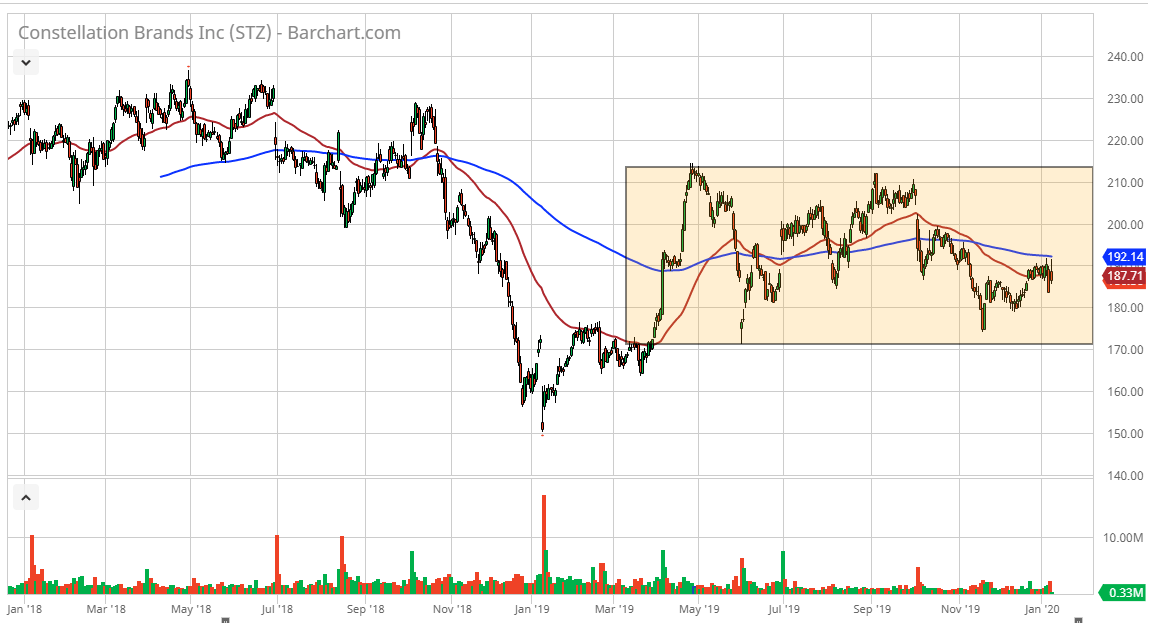

STZ chart

When it comes to Constellation Brands, it’s very likely that the market will continue to see this as a stock that offers plenty of value. In a market that is a bit overextended, signs of growth are desirable, especially as we are long in the tooth when it comes to the overall S&P 500.

Ultimately, as the S&P 500 has gained 11.9% during that same phase that Constellation Brands lost 3.1%, the catch-up play is probably going to make quite a bit of sense.

As far as trading is concerned, a break above the 200-day EMA would be a very bullish sign, which is currently at the $192.14 level. Ultimately, if the market can break above there, it’s very likely that the stock will go looking towards the $200 level. To the downside, the $180 level looks to offer support.

With earnings beating, the market may see a push higher. Not only is it approaching major moving averages, but it is also close to the bottom of an overall range. Because of this, value hunting will probably already be part of the equation.