Crude oil bounces during Wednesday trading

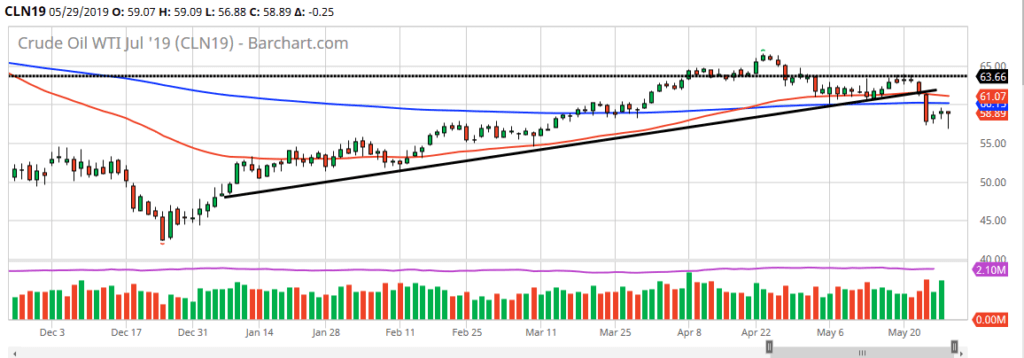

The WTI Crude Oil market spent most of the trading session on Wednesday falling rather hard. However, later that day we searched to see if I come back into the marketplace, forming a daily hammer. This is obviously a very bullish sign, but the question now is whether or not this is something that can to figure gains, or is it simply a “bear market rally?” Remember, those can be quite drastic and sudden, as the bullish traders out there cannot give up the trend so quickly.

US/China trade war

The US/China trade war is taking all of the headlines recently, which makes sense considering that those are the two largest consumers of crude oil in the world. If both of their economies start to slow down drastically, crude oil will continue to struggle gaining strength. Ultimately, that is essentially what is driving this market lower. This is simply a situation where people are worried about global demand, and that of course is always going to be bearish.

Quite frankly I don’t believe that either country is getting close to a deal, so this should continue to be a headwind. Given enough time, there will be bad news coming out that will continue to work against the value of crude oil. Beyond that, if we start to see negative economic figures coming out of the United States, that will only add more pressure.

Short-term possible strength

WTI Crude Oil

I suspect that there could be short-term possible strength in this market, but quite frankly it’s very likely that we will see enough pressure of all the market somewhat soft. That being said, one thing you should pay attention to is the fact that the hammer is so big during the trading session on Wednesday. This tells me that there are buyers underneath. Crude oil demand so far is still solid but at the end of the day there is still a general “risk off” attitude to the market is because of this five I believe the rally is probably going to be somewhat short-lived.

Essential resistance

The essential levels of resistance it should be paid attention to are found around the $61 level, perhaps even extending as high as $62. Keep in mind that there is an uptrend line that coincides with that general area so it will probably continue to offer trouble. Because of this, I believe that the next day or so could be strong, but ultimately the sellers will return given the first opportunity to take advantage of this potential bounce. However, if we get above there is a resumption of the longer-term uptrend that has recently been broken.

The main take away is that I still even selling this market, but it may take a couple of days to get the right signs of weakness to take advantage of. In the meantime, those who are short-term traders may be willing and able to take advantage of the bounce, but it certainly could turn around on it right away and with very little notice.