Crude Oil Continues to Trade Erratically

- Continued ripples in market from drone attack

- Mixed global economic signals

- Crude oil market still has massive gap to fill

The crude oil markets continue to trade erratically as the Wednesday session was somewhat calmer than the last couple of days, due to the wait for the FOMC statement. Ultimately, though, the biggest issues facing the crude oil market have to do with the drone attack over the weekend.

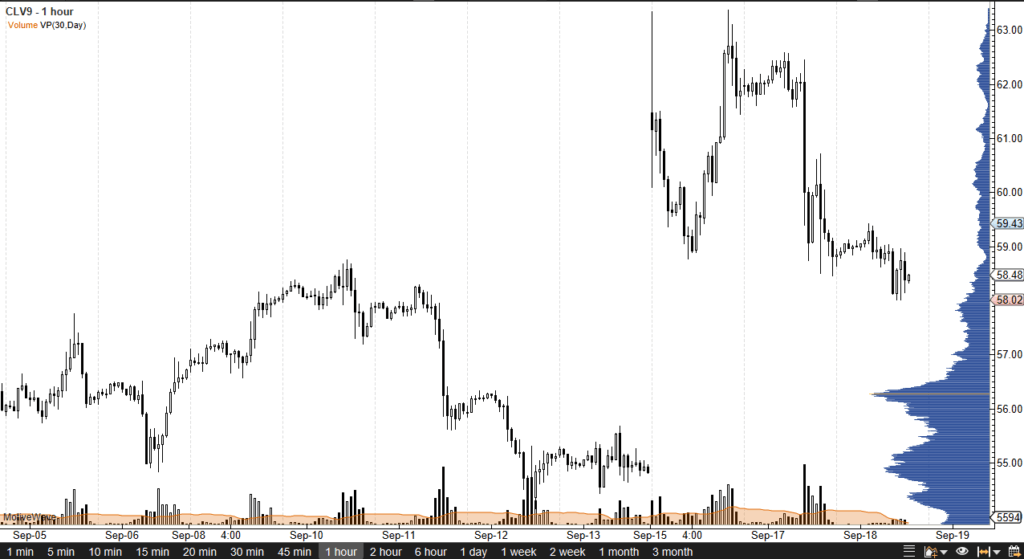

WTI crude oil daily chart

Gap higher and drone attack

The crude oil market had a massive gap higher on Monday morning, so technical traders will be looking to fill that gap. That’s especially true since the gap was anomaly, following the drone attack in Saudi Arabia. Since then, we have also seen the Saudi government suggest that production will pick back up to normal levels in the next few weeks, so the worst-case scenario wasn’t realized. Because of this, the massive shot higher doesn’t make any sense.

Economic outlook

The economic outlook for the world is mixed at best. It’s very likely that the demand for crude oil will be somewhat weak, as the European Union and the United Kingdom look to be very weak economically. While the United States is doing a bit better than so many other regions, it won’t be enough to lift the oil markets by itself. Beyond that, the Chinese economy is slowing down, and that will continue to drive down demand for petroleum from one of the largest consumers in the world.

As long as the US/China trade relations remain sour, they will continue to cause issues with crude oil demand. As such, it’s hard to imagine a scenario where crude oil shoots straight up in the air like it did after the attack.

The trade going forward

Traders don’t like erratic markets, and as a result it does tend to drive a certain amount of money out of the market. You can see that we have broken down pretty significantly since the top of the gap after initially testing the level yet again. The $63 level is massive resistance, but so is the $60 level. Below there, the $59 level also offers a lot of short-term resistance.

Looking at the 30-day volume profile on the right side of the chart, you can see just how thin the volume has been up in this area. The POC, or point of control, is just above the $56 level, so at the very least it’s likely that the market will keep trying to get down there. In the short term, it’s a matter of fading signs of exhaustion as the market is overbought. Beyond that, the inventory build of over 1 million barrels in the United States suggests that demand is not picking up.

While the market is trading erratically, that should scare a lot of big money out of it. The gap has yet to be filled, so it should give plenty of opportunity for those who are willing to wait for the right exhaustive setups at the levels above.