DAX bullish but needs to pullback

The German index has been going higher for quite some time, as we continue to see strength in Germany. While Germany is on the verge of a recession, this is typically when value hunters come back into the stock market to pick up quality companies “on the cheap.”

€12,000

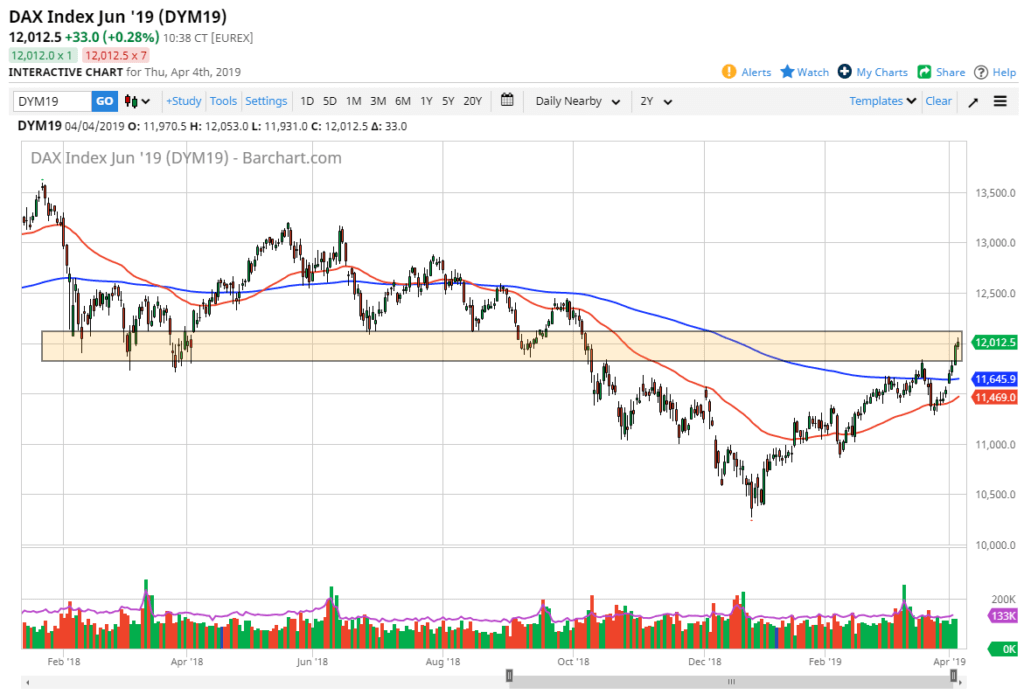

The DAX has rallied quite nicely over the last week or so, reaching towards the €12,000 level. That is a large come around, psychologically significant figure, and is also an area where we had previously seen a lot of support. That is an area that should now offer resistance in the Thursday candle does in fact suggest that we are getting a bit overextended, and if that’s going to be the case it’s very likely that the sellers will take over at this point.

After this parabolic move to the upside, it makes sense that the market needs to pullback to pick up more buyers. I do believe in the bullish case here, but recognize that we need to perhaps settle down a bit to build up positions.

Golden Cross?

DAX daily chart

Looking at the chart, you can see that the red 50 day EMA is starting to head higher and approached the 200 day EMA which is pictured in blue. At the cross, that bullish sign, known as the “golden cross” will quite often bring a lot of longer-term money into the market. At this point, if we can break above the range drawn on the chart, and we get the Golden Cross, it’s very likely that we continue to go much higher.

That hasn’t happened yet, but obviously we are approaching that, so you should keep that in mind if you are looking to trade this market. In the short term, the 200 day EMA is probably going to offer a significant amount of support.

Cheap Euro

the Euro has been trading at $1.12 recently, which is very cheap and it makes exports coming out of Germany cheaper around the world. That should help most companies, and that will be part of what traders are thinking. Beyond that, you should keep in mind that German bonds are paying negative interest rate, so quite frankly there’s nowhere else to go for domestic traders.

As long as the Euro is cheap, and it looks like it will struggle to make it above the $1.15 level anytime soon, it does make sense that German companies should benefit. Beyond that, when it comes to the European Union, Germany is the biggest game in town so therefore we will see the DAX outperform the other indices initially.

The alternate scenario

if the market breaks down below the moving averages underneath, it’s very likely that the DAX would continue to go much lower, perhaps reaching down to the €10,500 level. At this point, it’s likely that we go higher and that the alternative scenario probably has about a 10% chance of happening, but it is something that you need to keep in mind. Going forward, it looks as if the most likely scenario is going to be buyers stepping in and picking up value on dips.